Remember back in the simpler days of the 2010s when electric vehicles (EVs) were almost nonexistent? Back then, driving past a Tesla merited a call home.

I think it’s safe to say those days are over.

Every major automaker has either released a solid competitor to Tesla or has one in the works. I've started playing a little game called "EV Bingo" every time I spot a new one in the wild.

This week's new sighting looks and acts like a regular truck, but the missing tailpipe and suspiciously futuristic taillights are a dead giveaway.

The Ford F-150 Lightning has officially been on the road since January, but it's the first time I've spotted it outside of dealership lots — or perhaps the first time I've noticed it wasn't just a regular F-150.

Aside from the crisp LED light bar and dead-silent motor, the Lightning resembles any other new truck on the road. There are no wheel covers, excessive aerodynamics, or other futuristic adornments to speak of.

That’s the most interesting factor of this new wave of EV designs. They're no longer modeled after TRON-style spaceships with smooth curves and quirky add-ons, like BMW’s adorable yet slightly goofy i3.

Instead, they now blend seamlessly with their respective company’s signature style. The Volkswagen ID.5, for example, has almost the same design as its gas-powered cousins — plus a few more curves.

Or take the Honda Prologue, the long-awaited EV crossover from one of the world’s top consumer car brands. Its admittedly sterile design almost resembles a stretched-out version of the CR-V.

As someone who personally had a soft spot for the sci-fi designs of yesteryear, I can't help but think one thing: These new EVs are BORING!

Of Course, I Mean That in the Best of Ways

The reasoning behind this is simple: Regular people are buying EVs, not just avid environmentalists or EV enthusiasts. And your average driver isn’t looking for something out of Speed Racer.

Back when the BMW i3 was one of the few EVs on the road, its range was only around 80 miles on a good day. Public charging was practically nonexistent, so the average driver was hardly likely to switch over to electric. Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.The Best Free Investment You’ll Ever Make

And who could blame them? Running out of juice on the roadside means an automatic call to a tow truck rather than a quick hitchhike to the nearest gas station.

Repairs and maintenance are another factor. If the battery pack goes up in flames, who can replace it? Tesla owners have recently hit the news with horror stories about absurd repair and replacement costs.

Today, the average EV range is well above 200 miles, charging stations are cheaper and more abundant, and batteries are getting cheaper every day. Yet millions of drivers are still anxious about giving up the convenience of their gas vehicles.

I’ll admit I underestimate how attached some drivers are to their cars, but it goes deeper than just the car itself.

It’s the Gas Devil You Know Versus the Electric Devil You Don’t

Changing to a new type of vehicle comes with changed habits and behavior. Some drivers out there have potentially been filling up the same car at the same gas station for decades.

Entrenched behavior like that doesn't go away overnight. For some, a new EV will need to drive itself, pour drinks, and assemble sandwiches before the diehards will ditch their internal combustion engines (ICEs).

But for many others, the differences between EVs and ICEs are becoming more tolerable.

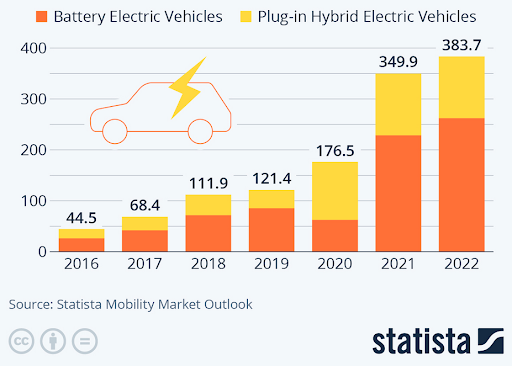

Sales in the U.S. almost doubled between 2021 and 2022, and experts forecast a nearly 800% increase by the end of the decade.

The total market is currently valued at $380 billion. By the end of the decade, that could swell into the trillions.

The tide is turning, and the standard boringness of the most recent EV models is a telltale sign. Automakers are preparing to shift their target demographic to everyone.

It’s going to be a beast of a transition, but the real winner is the army of suppliers needed to overhaul one of the biggest supply chains on Earth.

Some components are the same regardless of the car — aluminum, steel, plastic, etc. are still needed in about the same quantities. But other materials are entirely unique to EVs.

Lithium is the obvious example. ICEs usually have a few small batteries here and there but nowhere near the amount needed for an EV battery.

EV makers have been focusing so hard on securing a lithium supply that they neglected some equally important materials.

In many ways, the “lithium rush” pales in comparison to the “Imperial Metals” rush.

These elements aren't used in batteries. Instead, they power the other half of the equation: the motor.

Without these "Imperial Metals," not a single electric motor on the planet would turn. That kills not only EVs but just about every power generation turbine, which is nothing but an electric motor in reverse.

Think about that — EVs would be off the table, and we wouldn't have a way to generate electricity to power them anyway.

We’re tracking a company that thinks it has solved the problem in a bizarrely creative way. It’s a unique solution to the next great metals crisis that doesn’t involve China, the current leader in "Imperial Metals."

This transition is coming. Make sure your investments are squared away before these stocks go through the roof.

To your wealth, Luke Sweeney Luke’s technical know-how combined with an insatiable scientific curiosity has helped uncover some of our most promising leads in the tech sector. He has a knack for breaking down complicated scientific concepts into an easy-to-digest format, while still keeping a sharp focus on the core information. His role at Angel is simple: transform piles of obscure data into profitable investment leads. When following our recommendations, rest assured that a truly exhaustive amount of research goes on behind the scenes..

Contributor, Energy and Capital