Hedge funds had another miserable year in 2015, and so far they are trailing the S&P 500 this year.

While the S&P 500 index was up 7.6% through July 2016, the average hedge fund return is less than 3% — and this was on top of several years of sub-par performance!

The S&P 500 has now outperformed its hedge fund rival for 10 straight years with the exception of 2008, when both fell sharply.

A simple-minded investment portfolio (60% of it in stock shares and the rest in sovereign bonds) has delivered returns of more than 90% over the last decade!

Compare that to the meager 17% that hedge funds would’ve given you… after fees, of course.

You would think that rational investors would come to their senses and invest in a low-cost index fund instead of paying high fees for poor performance.

Unfortunately, that wasn’t the case…

Buffett vs. Hedge Funds

Why do professional investors increase their investments in hedge funds while “alternative” investments such as low-cost index funds continue to outperform them?

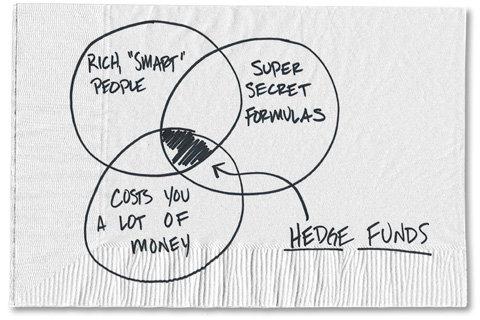

In addition to charging high fees — 2% management fees and 20% of profits — hedge funds offer something that whets most investors’ appetites: complexity and exclusivity.

Warren Buffett attempted to address why one easy investment approach was not more widely followed.

His reasoning? It’s just too simple:

Most professionals and academicians talk of efficient markets, dynamic hedging and betas. Their interest in such matters is understandable, since techniques shrouded in mystery clearly have value to the purveyor of investment advice. After all, what witch doctor has ever achieved fame and fortune by simply advising, “Take two aspirins”?

And Buffett decided to put his money where his mouth is…

About eight years ago, he made a $1 million bet against two funds of funds managers, with the winnings going to charity.

Buffett bet that funds that invest in hedge funds for their clients would not beat the S&P 500 over 10 years.

The managers assembled a portfolio of five hedge funds that they hoped would outperform the S&P 500 index. So far, halfway through the bet, Buffett is winning. After eight years, the S&P 500 is smashing the hedge funds. The S&P 500 is +66%, while Protégé’s funds of funds are up, on average, less than 22%.

{$custom_solar_2}

Filter Out the Noise

While the approach we use to select financially sound stocks trading at attractive valuations sounds simple, it’s not easy.

There are far too many distractions that get in the way of executing such an approach.

First, we need to filter out all the noise from the markets (e.g., headlines, company press releases, economic news, etc.).

Once we do that, it’s simply a matter of focusing on finding companies that are unloved and unwanted on Wall Street.

It’s crucial when picking those stocks to have the proper temperament and not get swayed by an erratic market swing.

In other words, it’s easier for investors to buy a stock that rises in value rather than get one that is falling.

Moreover, the stocks we select are usually trading well off their highs and are trading lower due to an event or news… and THIS is where most investors part company with my investment approach. (I’m giving a free live webinar on this very topic later this week. Just click here for all of the details, and pre-register for this event.)

You see, most investors love to talk about buying stocks when they are trading at their lows, but they never seem to pull the trigger.

Look, it’s not about using secret algorithms cooked up to select stocks. And it’s not about using complicated formulas to look at a company’s balance sheet.

No, the approach my readers and I use — the same one that helped Buffett build his billion-dollar fortune — is as transparent as a fish tank.

After seeing what I have over the last 30 years on Wall Street’s trading floor, I’m flabbergasted that the average investor hasn’t caught on yet.

And so far, our approach is working remarkably well.

It’s led to my readers and me producing 107 winning trades out of only 141 stock picks — with over half raking in 50% gains or more!

And the best part is that even though we don’t know what the markets will do in the next five years (or in the next five weeks, for that matter!), we’re confident that the same investment approach pioneered by the likes of Ben Graham and Warren Buffett will remain rock-solid in the long term — for as long as you have buyers and sellers in the market.

With that said, I want to remind you that I’ll be conducting a live webinar later this week. Remember that as a subscriber to Energy and Capital, you’ll be able to sit in on the webinar at absolutely no cost to you.

And the time you take to learn about this investment approach could be invaluable to securing your family’s financial future.

Again, you can find all the details right here, and even pick which time slot is most convenient for your schedule.

All my best, Charles Mizrahi Twitter: @IWPeditor Charles cut his chops on the trading floor of the New York Futures Exchange before moving on to become a wildly successful money manager on Wall Street. And with more than 35 years of recommending stocks under his belt, Charles has knocked the cover off the ball, compiling an amazing record of success and posting gain after gain for his loyal readers. He is the editor of Park Avenue Investment Club and the Insider Alert newsletters. Charles is also the author of the highly acclaimed book, Getting Started in Value Investing.