Driving through West Texas will give you the feeling of endless nothingness. If you want to get rid of some bodies that would never be found, you could do a lot worse. After driving fast because you can, you’ll tend to slow down. It is going to last forever, so you might as well enjoy it, and besides, there is no reason to tailgate that cattle truck…

I had the chance a few years ago to drive a squishy GM rental sedan through the endless wasteland, all the while wrapped in the stale luxury of air conditioning. The land is gray, dust-covered scrub brush, which is commonly referred to as hardscrabble. The food is Mexican omelets and BBQ. The sky is as big as it gets.

I was heading to the small town of Iraan (pronounced Ira-Ann) on the Pecos River, and when I stepped out into the hot, kiln-like air, I knew I had arrived. This was the closest town to the famous Yates Oil Field of the Permian basin.

The Yates Oil Field (and the town) is named for Ira and Ann Yates who owned a ranch that was sitting on an ocean of oil just 1,000 feet below their stable. It turns out they had a hard go of it in the ranching business and couldn’t pay the taxes or their mortgage. Ira went to the nearest big city and somehow convinced Transcontinental Oil Company to drill a well.

They agreed, even though the conventional wisdom of the time said there was no oil west of the Pecos River. To make a long story short, in 1926, Transcontinental struck so much oil that they ran out of storage. The company damned a nearby canyon and created a lake of oil.

Iraan, Texas

As an aside, Iraan, Texas is also where Alley Oop was created, but that is only tangentially related to hydrocarbons…

In 1929 the Yates field peaked at an amazing total production of 41 million barrels. That same year, it also saw a blowout, which set the record for blowouts with a flow of 8,528 barrels an hour. This oil flowed into the Pecos River, which was skimmed, recovering over 3 million barrels of oil.

Marathon later owned the field and produced diminishing amounts of oil using CO2 and water injection until 2003. All in all, during the first 63 years of life, the Yates field produced 1,180,073,629 barrels of oil, which ranks it among the most prolific oilfields in the world. In the last 15 years, as far as I can tell, the field traded hands, went private, and was generally forgotten until the frack revolution made it feasible again.

In September of 2016, EOG Resources Inc. (NYSE: EOG) paid privately held Yates Petroleum Corp. $2.5 billion in stock and cash to acquire acreage in the Permian Basin.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

The Permian Basin

The Yates field is the most famous of the Permian Basin, a massive, low-cost oil field in the U.S. Some companies are pulling oil out of the scrubland at $30 a barrel.

Today the price of oil is at $52.54, and the Permian is a hot property. Production is climbing. In the first week of January, U.S. crude production rose to 8.95 million barrels a day, the highest level since April. Oil rig use expanded to 529 in the prior week, a 67% increase from the 2016 low of 316.

I’ve bought one Permian oil play for my trading service Crisis and Opportunity, and I’m waiting for a dip to buy two more.

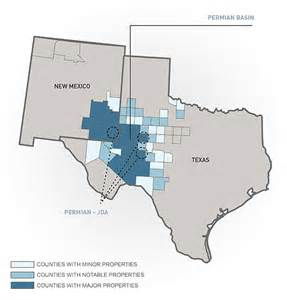

The Permian is in West Texas/New Mexico:

The Permian Basin is built like a wedding cake with multiple layers, as you can see from this handy graphic from the Wall Street Journal.

One section alone, the Wolfcamp formation, could hold up to 20 billion barrels of oil worth up to $900 billion. That is three times bigger than the Bakken formation in North Dakota, which has been acknowledged as the largest unconventional oil field ever discovered. In total, the Permian Basin could hold 75 billion barrels of shale oil, which would put it at number two in the world, right behind Saudi Arabia’s Ghawar field.

If you are looking at a Permian play, the big players in the region are Chevron (NYSE: CVX), Occidental Petroleum (NYSE: OXY), Apache (NYSE: APA), Pioneer Natural Resources (NYSE: PXD), and Concho Resources (NYSE: CXO). Many of these companies have high price-to-earnings ratios or none at all. Low oil prices destroyed the oil patch over the past two years. But that has turned around. Oil prices have climbed back. Stock prices are up…

If you are looking to buy in the Permian Basin, look to companies with plenty of cash and/or credit as well as lots of acreage. Also look at the hedge book. It is no fun if the price of oil jumps to $70 and your company sold it forward at $50. That said, finding the world’s second-largest oil field in Texas bodes well for American oil independence, as well as oil and gas exporters, manufactures, pipe builders, chemical producers, and all of the downstream oil business.

And if you are ever in Iraan, stop by the Mesquite Wood Bar-B-Q and try the ribs.

More next week…

Christian DeHaemer

Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.