I don’t often get into a row with my readers.

Most of the time, we’re in lockstep together when it comes to the U.S. energy sector.

Together, we’ve uncovered the most lucrative energy investments simply by recognizing a situation long before it bears fruit.

I know my veteran readers will remember us discussing the potentially wild profits from tight oil resources in the lower 48 states years before the shale boom ignited in the Barnett and Bakken plays.

So when I found myself in a recent conversation over our future transition away from fossil fuels, I was shocked to learn that one reader wasn’t buying it.

“They’ve been saying that for decades,” he told me. He continued, “I’ll still be filling up my tank at the gas station around the corner for another 30 years… at least!”

To be fair, the world will still be using petroleum products well past 2050.

Looking at the EIA’s most recent Annual Energy Outlook 2021, the United States will still be using a massive amount of petroleum over the next few decades.

It certainly won’t experience the most growth — not by a long shot. However, petroleum products will easily remain our largest source of fuel through 2050.

Take a look for yourself:

You see, what he failed to realize is that while our oil consumption isn’t abating anytime soon, there’s another shift in the U.S. energy paradigm well underway right now, and it’ll be complete sooner than you think.

The Holy Grail for Energy Investors

Mark my words, the holy grail for energy investors today is in electrical generation.

Yet I’m talking about more than the sheer growth in how much power we use down the road — I’m referring to WHERE we get that electrical power from.

It’s no secret that the coal industry has been dying over the last 15 years.

Clean or dirty, coal is dead.

It was a slow death, to be sure.

However, the deck was stacked against it. And nowhere else would the the impact be felt more than in the electric power sector.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

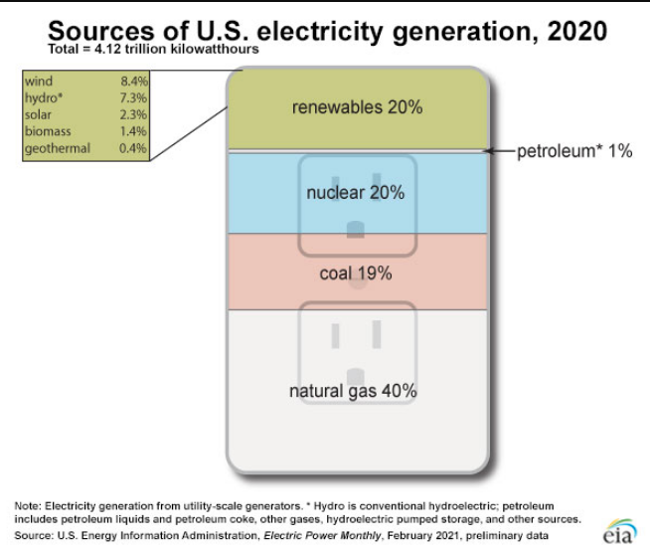

In 2011, coal accounted for roughly 45% of U.S. power generation. At the time, natural gas’ share was less than 25%, and renewable energy made up just 5% of our electrical generation.

Oh, how the times have changed, dear reader.

Here’s a look at how that dynamic was last year:

Not only have renewable sources — specifically solar and wind — greatly helped make up for declining coal power generation, but this gap will only grow from here on out.

The interesting part for us is that there doesn’t need to be any wild hype over renewable energy for that to occur.

The simple fact is that our nation’s coal plants are getting too old. Nearly three-quarters of U.S. coal plants are over three decades old, with the average plant age being 40. Keep in mind that 40 years is the average life span of these plants.

Considering we’re not adding any new coal capacity right now means that by 2050, the average coal plant will be 70 years old!

Like I said before, the transition toward more natural gas, wind, and solar is well underway.

And the best part is this transition is about to accelerate under President Biden’s new plan.

Look, we discussed the implications of Biden’s $2 trillion proposal to radically transform our energy infrastructure, especially the aggressive push toward electric vehicles.

However, his goal of a carbon-free electrical grid is not forgotten.

The 10-year, $2 trillion proposal would set a target for the U.S. to produce 100% clean power by 2035. And to help set that plan in motion, Biden’s allocating more than $100 billion toward it.

Trust me, it’s an upgrade that is long overdue.

So I can’t help but ask, “Have you prepared for THAT energy transition yet?”

Next week, we’ll delve a little deeper into one stock that stands to deliver a fortune to shareholders as Biden’s ambitious infrastructure plans roll out.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.