Let’s call it like it is: The majority of the resistance against alternative energy comes from the political right.

But let’s not be too quick to pass judgment. Fact is, it’s totally understandable why conservatives would be hesitant regarding alternative energy.

The left would have you believe the conservative thinking is, “If it’s new, it’s bad.” But that’s not necessarily the case. From what I gather, the conservative perspective is, “If it’s new, it involves risk. And that could be bad.”

And that’s totally understandable.

The fact is change costs. Change costs money, resources, and time. And it involves a substantial amount of risk. Consider that for every technological success story, there are a thousand stories of failure.

To be a true angel investor requires a very high risk tolerance. Some folks want no or only very limited risk. They don’t want to experiment. That’s not something we should condemn them for.

Of course, higher risk means (hopefully) getting the highest possible returns. But again, many folks aren’t always swinging for home runs.

Real success in investing is the result of a long-term series of multiple successes. Only the extremely lucky become wealthy after only one or two investments. And at the same time, there are also those who win the lottery.

The best way to maximize investment returns has been proven to be through a balance of risk and safety. So I’m not surprised many conservative investors would be hesitant at first to invest in technologies like electric vehicles.

As such, I’m not surprised they were very hesitant over Bitcoin and cryptocurrency… and the internet… and personal computers… and space travel… and television… and radio… and the automobile… etc.

This is not something to judge but instead just to be expected.

An individual’s risk tolerance is a broad gray scale. It’s not as cut and dry as high risk and low risk. Just consider your own risk tolerance. If I were to ask you to rate it on a scale of 0 to 100 (0 being no risk and 100 being the absolute most risky), where would you put it?

It probably wouldn’t be all or nothing.

Everyone else is the same. Some people are just a little more hesitant of risk than others. That’s just the way it is.

Point is, I understand the conservative perspective of being hesitant about green energy. But here’s the thing…

Industries like electric vehicles have moved out of the experimental stage. What was once a dream is becoming a reality.

A few years ago, electric vehicles were what the future could be. Now, they are what will be.

Massive sales growth over the past few years has proven that the industry is viable. And now that it’s moved on, there’s no good reason conservative investors shouldn’t take part.

Ignoring the industry is leaving money on the table.

As noted in a recent Bloomberg article, it’s pretty clear investors favor green energy. Shares of green energy ETFs are much more popular these days than conventional fossil fuel ETFs.

And this isn’t a fad. Green energy isn’t bell-bottoms or fidget spinners. At some point, it’s not even about the environment. It’s about costs.

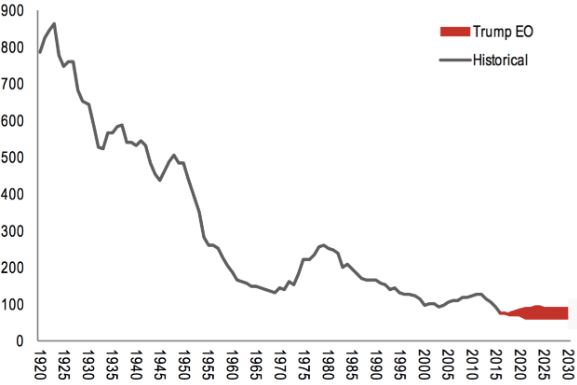

President Trump has a lot of rhetoric about the travesty of declining coal jobs in America. And he’s not wrong, actually. Coal mining jobs in the United States are disappearing. But he’s not telling the whole story.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Coal mining peaked in the United States almost 100 years ago. The number of American coal mining jobs peaked in 1923.

Coal Mining Employment in America

Of course, much of the cause of the job decline can be attributed to automation and innovation. But as of late, Trump would have you believe a liberal ideology has suppressed the industry.

Well, there’s no doubt liberal ideologies are generally environmentally conscience. And there’s no doubt many liberals push an environmental agenda. (But can you blame them? Dangling low-hanging fruit is an easy way to gain support.)

But the liberal agenda has had much less of an effect (if any) on the coal mining industry. Wanna know why there are fewer coal mines and coal power plants in America today?

It’s not because a bunch of hemp-wearing, patchouli-smelling hippies protested with peace signs and love-ins. There are fewer coal mines and fewer coal power plants in America because we found a cheaper alternative: natural gas.

For decades, coal was the cheapest natural resource to use for mass electricity and other energy production. But that’s simply not the case any more. In 2017, natural gas became a cheaper fuel stock for mass electricity and other energy generation.

In addition to being cheaper, natural gas has the added benefit of being cleaner than coal. And this whole dynamic is used by politicians on the left to show they are making progress and on the right to show the folly of liberal ideology.

But at the end of the day, these politicians are just full of shit. The reason the U.S. energy industry is using less coal is simply because there’s a cheaper alternative. Think about it: Energy companies have to hear the complaints of the environmentalists, but they ultimately have to answer to their shareholders, who are only interested in maximizing profit.

If maximizing profit means using natural gas instead of coal (with the added bonus of getting the environmentalists off your balls for a bit), which are you going to build? A coal-fired power plant? Or a natural gas plant? Now, did your decision have anything to do at all with politics? (I hope not.)

In the same way, the green energy revolution is, no doubt, being rhetorically spearheaded by the left. But the market will do as it always has: follow the money.

I recommend you do the same.

Until next time,

Luke Burgess

As an editor at Energy and Capital, Luke’s analysis and market research reach hundreds of thousands of investors every day. Luke is also a contributing editor of Angel Publishing’s Bull and Bust Report newsletter. There, he helps investors in leveraging the future supply-demand imbalance that he believes could be key to a cyclical upswing in the hard asset markets. For more on Luke, go to his editor’s page.