Gold is trading at $1,263.04/oz. Silver is at $17.62/oz. Platinum is at $934/oz. Palladium is at $624/oz.

But there is a fifth precious metal that very few people talk about and even fewer trade. It’s called rhodium, and it is now trading at $680.00/oz., down from more than $10,000/oz. just a few years ago.

Since the start of the Great Recession in 2009, gold and silver have more than doubled. But rhodium is now trading at multi-decade lows.

And due to a new set of circumstances, this could be the buy of a generation in a precious metal you’ve never heard of.

First, a little background… Rhodium is a silver-white metallic element that is highly resistant to corrosion and is extremely reflective. It is used as a finish for jewelry, mirrors, and searchlights. It is also used in electric connections and is alloyed with platinum for aircraft turbine engines. Furthermore, rhodium is necessary in the manufacture of nitric acid and in hydrogenation of organic compounds.

That said, 80% of rhodium goes to the catalyst applications in automobiles, where it is used together with platinum and palladium to control exhaust emissions.

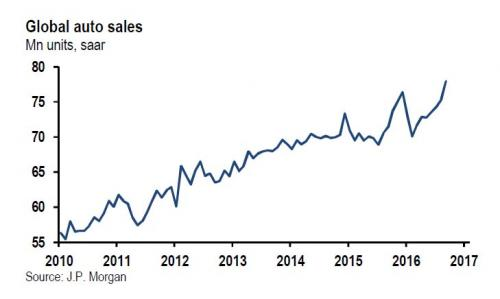

And business is good. With a surplus of oil and cheap gasoline, global auto sales are on fire…

But what you many not know is that rhodium is one of the most exotic metals in the world. It is 100 times rarer than gold and 150 times more expensive than silver. There are no pure rhodium mines in existence; rhodium is produced entirely as a byproduct of platinum and/or nickel mining.

This means global rhodium supplies cannot respond to changes in demand. So if the supply of rhodium is short, prices will rise drastically — and fall just as fast if demand eases off. There are fewer than 10 significant rhodium-producing mines in the world, most of which are located in South Africa. The country supplies over 80% of the world’s demand for rhodium.

Two years ago, strikes in South Africa forced mining companies to decrease — and sometimes even completely halt — rhodium production.

The annual rhodium production is already extremely limited. Only about 25 tons of rhodium is mined each year. Compare that to the 2,500 tonnes of gold mined in 2015, or the 220 tons of platinum mined each year…

When the strikes ended, production increased, forcing prices down again. Prices are now at a point not seen in 14 years. Adjusting for inflation, they haven’t been this low since 1970.

But rhodium prices have a tendency to launch unexpectedly.

In 2003, rhodium averaged $530 an ounce, but rapidly increasing demand and supply deficits over the next five years skyrocketed rhodium prices to over $10,000 an ounce.

To get complete articles and information, join our daily newsletter for FREE!

Plus receive our new free report, How to Play Rare Earth Today

Boom and Bust

As you can tell from the price spike in the chart above, rhodium tracks car sales, as its principal application is in automotive catalytic converters.

You may remember the early 2000s — everyone seemed to own a new car. But the sharp decline of the global automobile industry in 2008 sent rhodium prices tumbling. After reaching a high of $10,010 per ounce, rhodium prices collapsed more than 90% to a low of $760 per ounce in just a few months.

But now, eight years later, the global automobile industry is selling record cars — more than 82.8 million sold last year, and I’m betting rhodium hasn’t kept up with its stockpiles.

It should be noted that rhodium is a marginal cost to auto production, but they must have it at any cost. So when shortages occur, the price is paid.

Furthermore, emerging market countries like India and China are enacting catalytic converter regulations in an effort to decrease smog. So now you get a chance to buy rhodium at record lows when demand is at record highs.

Buy Some

You can buy blocks of the stuff. The Cohen Mint produced the first grade .999 rhodium bullion coins and bars in April 2009. The main downside to investing in this rhodium bullion, however, is that the premium for bars and coins is outrageously high. They are currently selling for $785 for a one-ounce bar.

The Cohens might have some competition soon. I have recently learned that the huge PAMP precious metal refinery is about to launch investment-grade rhodium bars. The retail market for rhodium bars could be massive. There is only around 800,000 oz. of global rhodium production! And it is so dense that you can carry a million dollars’ worth in your backpack.

If you don’t want to own physical rhodium, may I suggest the Physical Rhodium ETC (LSE: XRH0). The ETF is 100% backed by physical rhodium and is designed to track the U.S. dollar spot price less fees. This ETF allows investors to directly access rhodium spot returns in a “simple, secure and liquid manner.”

Granted, it may take time, but when the next uptick in rhodium occurs in this illiquid market, XRH0 will see a surge in share price. From 2004 to 2008, the price went up 22 times! This is a nice speculation on a metal no one is thinking about.

All the best,

Christian DeHaemer

Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.

P.S. I first wrote about rhodium in Bubble and Bust Report. This week, it has started to move higher on zero news. If you’d like to join us in profiting from this opportunity and others, check out my free gold hoax report.