Big Meeting With OPEC Today

Six OPEC and non-OPEC ministers are in Saint Petersburg today to talk about the future of the oil market and compliance with the oil cuts.

The Saudi energy minister has stated that the key goal is to drive the reserves down to the five-year average. He went on to say that Saudi Arabia is leading by example on supply cuts and is “forcefully” demanding conformity to the agreement. The Russians are on board, saying that compliance is running at 98%.

We all know OPEC and the Russians say a whole lot of things about a whole lot of subjects. But in this case, it appears to be true.

Reuters is reporting that Saudi Arabia is drawing down its crude stockpiles:

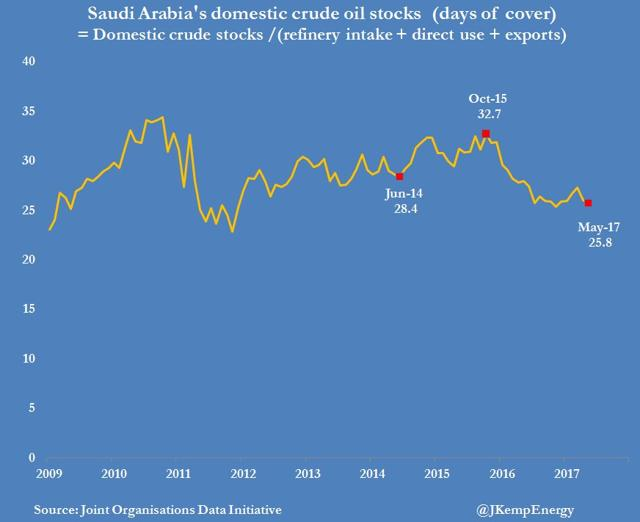

Saudi Arabia’s domestic crude stocks declined in 16 of the 19 months between November 2015 and May 2017 according to government data reported to the Joint Organisations Data Initiative (tmsnrt.rs/2uIi9dC).

Domestic stocks fell to just 259 million barrels at the end of May 2017, which was the lowest level since January 2012, according to updated figures published on Tuesday.

Stocks were down by 30 million barrels compared with the same month a year earlier and are now down by 71 million barrels from their peak in October 2015 (tmsnrt.rs/2ua1nmg).

Saudis’ Lowest Oil Stocks Since January 2012

Most traders only pay attention to the U.S. EIA data while ignoring the reduction in Saudi Arabian crude oil stocks. But these days, the U.S. is a global oil exporter, and oil is a fungible market, which means supply disruption in the Middle East will affect us all.

U.S. Drawdown

Meanwhile, back in the U.S., the American Petroleum Institute (API) reported a huge draw of 8.133 million barrels in United States crude oil inventories, compared to analysts’ expectations of a much more modest draw of 2.99 million barrels for the week ending July 7.

That’s a big drawdown.

In other news, the rig count dropped by two, which isn’t much but a reversal of trend. China’s oil imports for the first half of 2017 were up 13.8% over last year. And the EIA revised its forecast to say the U.S. would produce 9.9 million barrels of oil daily in 2018, down from its previous forecast of 10 million bpd.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Technical View

If you look at the technical view, we are in a bearish channel and have been since the start of 2017. This is a consolidation pattern after bouncing off the lows of 2016.

There is plenty of support at $42.50, which should keep the WTI price bouncing around $45 for the next two months, at which point the OPEC oil cuts will hit and drive the price higher.

With the exception of retail, hydrocarbon equities are the most hated sector in the market right now. It won’t take much for sentiment to change and oil prices to lurch higher. Right now is the time to lay some contrarian bets on select oil companies.

I’ve found two expert frackers that trade for less than a dollar. They aim to frack what has never been fracked before… in the newly liberated oil fields of Mexico! Click here now.

Christian DeHaemer

Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.