If you haven't started panicking already, now might be a good time. A huge portion of the economy is digging itself into a hole that it will never climb out of.

While the world’s leaders are busy boosting morale with their green energy promises, they are conveniently ignoring the trillion-ton elephant in the room: Carbon-free power and gasoline-free transportation cannot exist without mining an absurd amount of lithium.

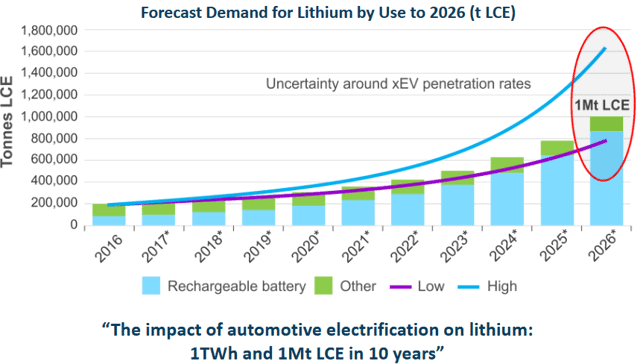

Right now, production is not even close to keeping up. We simply aren’t pulling enough lithium out of the ground to match the projected demand.

While digging deeper into the market, I noticed that one of Biden’s decisions is a perfect metaphor for the world’s entire attitude toward green energy.

To keep environmentalists at bay, the president promised to close off a minimum of 30% of all federal land for conservation. At the same time, Biden wants to stop relying so much on Chinese lithium imports.

Are you starting to see the problem here?

I'm all for wishful thinking, but those two plans cannot coexist if the country is serious about transitioning to electric vehicles. It’s a classic case of Biden wanting to have his cake and eat it too.

Don't get me wrong — the U.S. has never really been invested in its own rare earth mining business. But then again, why would it be?

Digging out even a modestly sized mine can run more than half a billion dollars — and that's not including endless environmental regulations. The fact that the USA’s only active rare earth mine is in red tape-infested California is a fantastic piece of irony.

For reasons I think we are all aware of, China is the undisputed leader in cheap raw materials like this. In contrast, even though the U.S. could have some of the highest lithium reserves on the planet, the nation’s single active mine only produces a measly 5,000 tons per year.

At this point, the government is caught at a crossroads: Do we continue to depend on China’s cheap lithium, or do we take the safe route and dig up our own?

If we are lucky, Biden will grace us with an answer to that question before he leaves office. The future of the world’s lithium market could depend on it.

Going Forward, the Market Is Looking White-Hot

Pretty much everything takes a battery these days, but lithium has a few other uses than just batteries.

Heavy industries use lithium as a flux additive to iron and steel, and lithium carbonate can even be prescribed by doctors as a mood stabilizer. Certain oxides of lithium can be used to purify the air, and lithium fluoride in particular is used in high-end telescopes.

But let's not kid ourselves. The real moneymaker here is batteries — more specifically, EV batteries. Pretty soon, just about every driveway in the world will have a few hundred pounds of lithium sitting in it.

In 2020, the world mined a combined total of 82,000 tons of the precious white metal. At $8,000 per ton, that's a sizable market even during the height of the pandemic.

Now that demand is shooting up every day, some analysts think a buyer’s market is on the horizon. The supply side is already expanding as fast as possible, but demand is outpacing it 10-fold. Price increases for 2022 are all but guaranteed at this point.

EVs will undoubtedly be the biggest lithium hog in the industry. Progress is being made on other battery types, but so far none can touch the supremacy of the lithium-ion cell. I’m confident it will remain the standard for much longer than the industry expects.

Around the world, EV sales are booming. More than 2.9 million passenger vehicles hit the road in 2020, and nearly every regional market saw some type of growth.

Europe was voted “most improved” after ramping up EV sales more than 44% in a single year, while China asserted dominance with a whopping 1.3 million sales on its own.

Even with the pandemic steamrolling the world’s economy, EV sales kept moving steadily upward. Global sales shot up 41% from 2019 into 2020, pleasantly surprising more than a few investors.

The general consensus among just about every analyst and market researcher in the business is this: EV sales are going to keep increasing. Some forecasts expect sales to top 4 million by the end of the decade.

If that's the case, lithium producers need to get their collective asses in gear if they want to stay above water. The industry is already growing at a CAGR of 7.0% and expected to reach just under $2 billion by this time next year.

But it won't be enough. In fact, it might not even be halfway there.

Just to clarify, the world has more than enough lithium in the ground than we could ever hope to need. But whether that lithium will make it through the red tape and find its way into a battery is a totally different story.

Right now, a few major players are expanding into the famed lithium triangle’s Salar De Antofalla, a project that contains practically unheard-of concentrations of raw lithium. At 350 milligrams of lithium per liter of water, sources like this give the world a fighting chance to catch up with future demand.

Argentina Lithium & Energy Corp. (OTCMKTS: PNXLF) and Albemarle Corp. (NYSE: ALB) are both dominating the Antofalla project, which stretches over almost 100 miles of prime Argentinian real estate.

Going forward, expect more and more companies to start scrambling for the world’s coveted lithium reserves. With Biden’s infrastructure bill still up in the air, we could potentially see a renewed interest in lithium mining right here in the U.S.

At this point, every little bit counts.

To your wealth, Luke Sweeney Luke’s technical know-how combined with an insatiable scientific curiosity has helped uncover some of our most promising leads in the tech sector. He has a knack for breaking down complicated scientific concepts into an easy-to-digest format, while still keeping a sharp focus on the core information. His role at Angel is simple: transform piles of obscure data into profitable investment leads. When following our recommendations, rest assured that a truly exhaustive amount of research goes on behind the scenes..

Contributor, Energy and Capital