Petrobras (NYSE: PBR) is officially screwed. Exposed. And is about as corrupt as a Russian traffic stop.

Petrobras (NYSE: PBR) is officially screwed. Exposed. And is about as corrupt as a Russian traffic stop.

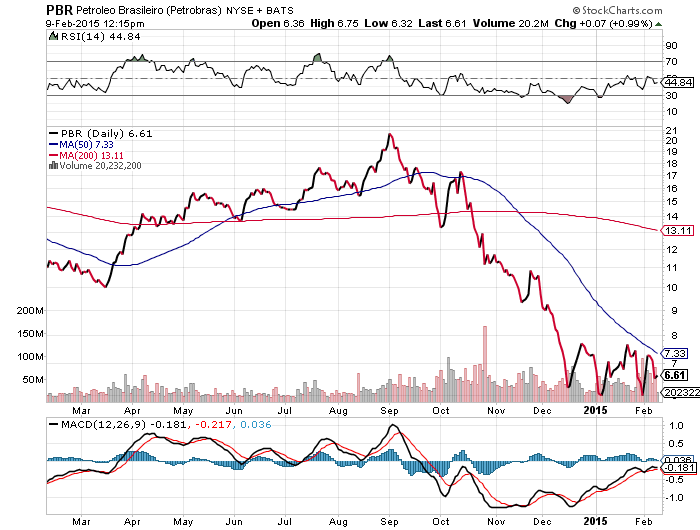

You might have seen the headlines about bond holders losing $4 billion since November. But that’s only the beginning of the nation’s largest graft probe. A scandal that could cost bond holders another $32 billion over the coming weeks.

It’s a pretty big sucker-punch to investors, considering that the state-owned oil giant is the largest company in the entire southern hemisphere, by market cap, and it’s played a major role in many high-performance mutual funds and retirement accounts over the past decade.

I just double checked my own holdings to make sure I’m clear of this mess, at least until the smoke has cleared. Considering so many growth investors, young bucks, and big swingers have at least SOME of their holdings in Latin American bonds or Emerging Markets, I think pulling out right now is obviously the safest move.

With all of the oil and gas discoveries in the US and OPEC unable to suppress prices for much longer, more domestic investments aren’t only safer these days, but also much more lucrative.

After all, we’re finally starting to see the South American giant for the sham that it is, rife with what the federal police are calling “strong evidence” that builders formed a cartel in the country to control public contracts.

I know it’s still just the early stages of this mess, but we’re already finding – as I suspect of many “fast growing” Latin American companies – that it’s also overvalued by more than 88 billion reais… that’s around $31 billion in US currency.

To put that into perspective, Petrobras bond losses are so-far greater than the bailouts the Fed paid to Bank of America, Morgan Stanley, and Goldman Sachs Group Inc, COMBINED.

And like I said, all the details aren’t even in yet.

That’s why you’ll soon find this company on the official chopping block, as it falls from the largest company south of the equator, with a Baa1 rating down to “junk”. Trash. Tarnished.

Adeus Petrobras!