The era of the internal combustion engine is ending.

It’s not over yet.

But it is ending.

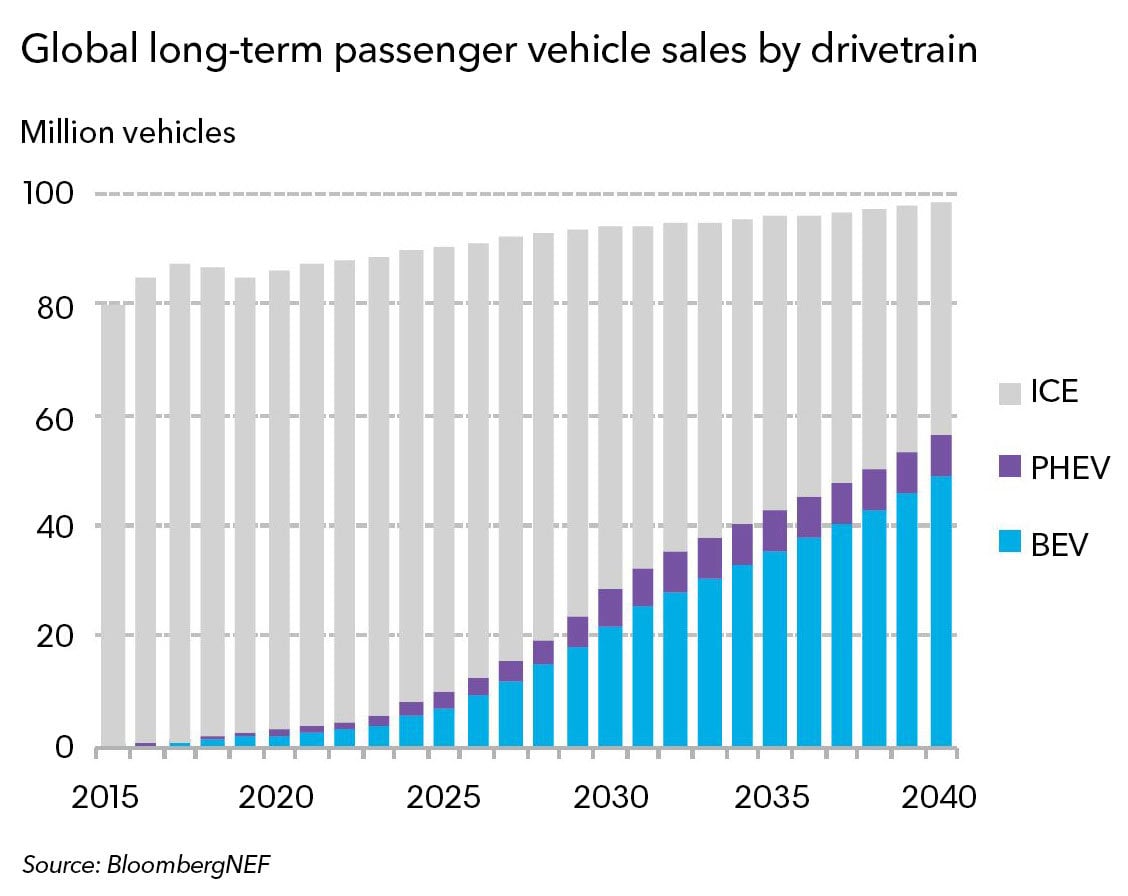

By every estimate, sales of internal combustion engine (ICE) vehicles are set to continue increasing for the next decade or so.

That’s due to the general increase in global energy demand driven by a growing world population, increased urbanization, and economic development in second- and third-world nations.

But by around 2030, ICE vehicle sales are forecast to peak and then rapidly decline, as new environmental regulations and competitive pricing put more consumers behind the wheel of a new electric vehicle.

According to a new report from Bloomberg New Energy Finance, 57% of all passenger vehicle sales will be electric by 2040.

BloombergNEF’s recent Electric Vehicle Outlook reports, “Over 2 million electric vehicles were sold in 2018, up from just a few thousand in 2010, and there is no sign of slowing down.”

And they mean it…

Right now the IEA estimates there are a little over 5 million light-duty electric vehicles on the road globally. By 2040, BloombergNEF’s report projects there will be more than 500 million passenger EVs and over 40 million commercial EVs around the world — 100 times more than today.

Powering future EV sales will likely be lower prices — specifically lower battery prices.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Twenty years ago, much of the cost of building an electric vehicle came from the price of batteries, leaving builders with one of two options:

- Pass the costs onto consumers

- Lose money

But that’s not so much the case anymore.

The price of EV batteries has dropped over 80% just since 2010. And EV battery prices are expected to continue falling over the next decade.

As a result of the decline in battery prices over the past few years, BloombergNEF says, “We expect price parity between EVs and internal combustion vehicles by the mid-2020s in most segments.”

Price parity is a huge deal for EV makers and their investors. It marks the stage where EV manufacturers can really begin to compete with the gasoline and diesel engine market.

And if automakers keep their promises, a 2020 forecast of price parity between EVs and ICE vehicles could be spot on.

Volkswagen CEO Herbert Diess recently told investors that the company’s new ID.3 electric vehicle will be 40% cheaper to manufacture than its e-Golf, the electric version of the Golf model. Reuters reported:

The battery in the new ID.3 can be used to add structural rigidity to the body and the modular layout of the battery allows for advantages in packaging and economies of scale.

This cost reduction is one of the reasons that Volkswagen is confident it can shift from making combustion-engined to electric cars without eroding the company’s profit margin, VW said.

Despite an impressive growth in sales over the past few years, EVs still represent less than 0.5% of the global vehicle fleet. That means the market is still almost completely wide open for electric vehicles. And forecasts like 100 times growth in global stock by 2040 aren’t unrealistic at all.

Investors should have at least some long-term exposure to the electric vehicle market.

Until next time,

Luke Burgess

As an editor at Energy and Capital, Luke’s analysis and market research reach hundreds of thousands of investors every day. Luke is also a contributing editor of Angel Publishing’s Bull and Bust Report newsletter. There, he helps investors in leveraging the future supply-demand imbalance that he believes could be key to a cyclical upswing in the hard asset markets. For more on Luke, go to his editor’s page.