According to the wealth of historical market data we have at our disposal, September is typically one of the worst-performing months of the year for the stock market.

Investors call it the “September swoon.”

The September downtrend was first identified in a book called The Stock Trader’s Almanac, authored by Jeffrey Hirsch and Christopher Mistal. If you don’t own a copy, I highly suggest picking one up. It’s a great tool for easily finding market trends with data that’s been backtested all the way through 1950.

According to the almanac, since then, the Dow Jones Industrial Average (DJIA) has averaged a decline of 0.8% during the month of September, while the S&P 500 has averaged a 0.5% decline. Over the past 20 years, these losses were even more acute, averaging roughly 6% across all major indexes.

This means it’s a good time to start prepping some dry powder.

The market is set up for an acute correction this September, and while the pain of this drawdown may not be widespread throughout the entire market, some sectors will get hammered, and by much more than 6%.

Here’s Why

Throughout August, the S&P 500 and Nasdaq notched numerous new highs. Almost every week, we heard news of a record-breaking close. In fact, we had another record breaker for the Nasdaq this past Wednesday.

I find this worrisome. The frequency of these record-breaking events is increasing too quickly. There’s simply nowhere else for this bull to run. We’re almost at the crescendo.

Further exacerbating things is the continued threat of COVID-19 and its various mutations. Political opinions aside, it’s irresponsible as investors to ignore the fact that the world is starting to lock down again and employment numbers are not where they need to be. In fact, more disappointing news was released this week with the Bureau of Labor reporting that the amount of actual open and unfulfilled jobs dwarfed August estimates. Moreover, we’re still dealing with the unintended consequences of unprecedented money printing and real inflation.

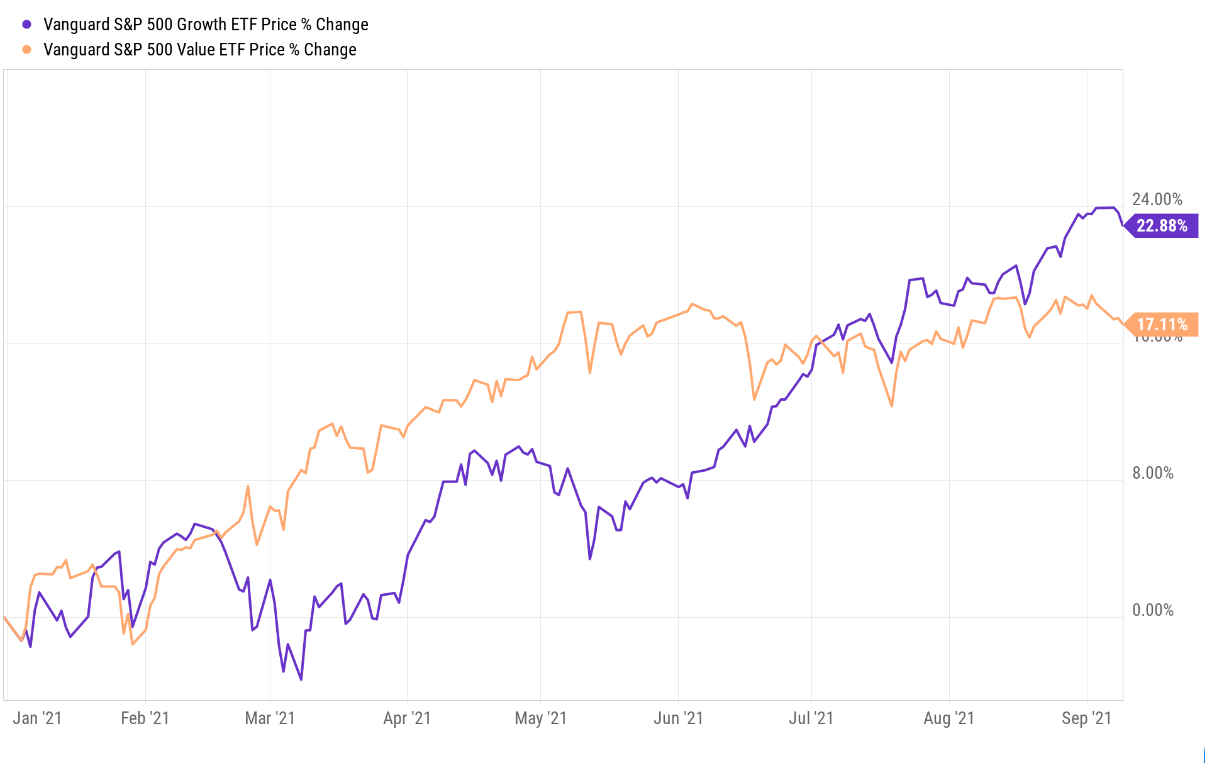

Additionally, we’re seeing the market move back toward its tech-heavy tendencies. Mega-cap tech is once again leading the way as the year’s early rotation into value grinds to a halt. We can see this change in investor sentiment by looking at two prominent growth and value ETFs — the Vanguard S&P 500 Growth ETF (purple line) and the Vanguard S&P 500 Value ETF (orange line).

To prepare for this change in market leadership and to reposition ourselves for big gains come the expected seasonal recovery in October, it’s time to cash in our winners, jettison our losers, and get that extra capital ready for the October–December seasonal rally.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Identifying Profitable Trends and Recommending Stocks — It’s What We Do

Here at the Energy and Capital office, I spend most of my time analyzing markets. I spend hours upon hours, days, and even weeks to find lucrative market opportunities.

Sure, not every trade works out in my favor, but the majority of them do. And you can use the information I share to make real investments that will help you grow your income a lot faster than your 401(k), mutual fund, or high-yield savings account.

In fact, since the beginning of the year, I’ve recommended 23 stocks in total. Of those 23, 18 are in the green! That’s an open win rate of nearly 80%! And many of those positions have easily beaten the S&P’s, DJIA’s, and Nasdaq’s total returns on the year to boot.

I hope you had the opportunity to take advantage of these trades. If not, don’t worry. I’ll share plenty more trades in the future.

For today, if you acted on my recommendations to buy any of these stocks earlier in the year, I want you to sell your positions today.

Looking at the charts and trends, I think we have maximized our profits for the following names:

- Carrier Global Corp. (NYSE: CARR) — Recommended on December 9, 2020. Sell today for approximately a 52% gain.

- Dell Technologies Inc (NYSE: DELL) — Recommended on January 1, 2021. Sell today for approximately a 30% gain.

- Caesars Entertainment Inc. (NASDAQ: CZR) — Recommended on February 5, 2021. Sell today for approximately a 30% gain.

- MGM Resorts International (NYSE: MGM) — Recommended on February 5, 2021. Sell today for approximately a 26% gain.

Lastly, I have an update and sell recommendation for our last call option — the Dell Technologies Inc. (NYSE: DELL) September 2021 $105.00 call(s) that expire September 17, 2021.

Unfortunately, unexpected pressures from rising interest rates, plus what I suspect is profit taking post-earnings, have worked against us on this trade. Next week we will more than likely be forced to sell at a loss or, at the very worst, watch our contracts expire worthless.

We may still see a flash reversal next week, but the range between the underlying stock’s current price as of Wednesday ($94) and where we need it to be by next Friday ($105) is quite large. However, if we see an upswing to close out this week’s trading and shares can reach a price point of $100 by Monday, September 13, I still like our chances to pull off this trade for a profit.

In this scenario, our action to take is to sell our DELL call(s) on Thursday, September 16, for a profit.

UNLESS…

If by Monday DELL shares are still below our coveted $100 price point, we will cut our losses immediately and see if we can’t offload our contracts for a little cash to offset the loss on our original premium of $136.

The good news is if you pair this potential loss with the gains you could take today from my many other recommendations this year, you’re still beating the pants off the major stock indexes regarding total returns in 2021.

And it’s only going to get better from here once the “September swoon” ends.

To your wealth,

Sean McCloskey

Editor, Energy and Capital

After spending 10 years in the consumer tech reporting and educational publishing industries, Sean has since redevoted himself to one of his original passions: identifying and cashing in on the most lucrative opportunities the market has to offer. As the former managing editor of multiple investment newsletters, he's covered virtually every sector of the market, ranging from energy and tech to gold and cannabis. Over the years, Sean has offered his followers the chance to score numerous triple-digit gains, and today he continues his mission to deliver followers the best chance to score big wins on Wall Street and beyond as an editor for Energy and Capital.

@TheRL_McCloskey on Twitter

@TheRL_McCloskey on Twitter