Editor’s Note: To see how deep we now drill for oil, click here…

Taking cover during a hurricane in Baltimore is easier said than done.

At one point, I was forced to take refuge inside the nearest building. The first thing I noticed was how meticulously carved the stone walls were, each setting up the next intricate design. It was impossible not to be impressed.

Shaking the rain off over the next few minutes, I struck up a conversation with one of the building’s tenants.

Even after living there for years, he confessed that the place never ceased to amaze him. What he said next astonished me even more…

“It might look nice on the outside, but this place is absolutely hellish to live in sometimes,” he said, smirking.

“You might think I’m being picky,” he continued, “but the pipes are a disaster, the elevator is out of service most of the year, and don’t even get me started on the rest of the problems we’ve had here… Still, it’s nice to look at.”

It was then I realized the stark similarity between the building I’d sought shelter in and the state of our oil industry.

Drilling Deeper than Ever Before

One morning in the next few years (possibly months), we’re going to wake up and realize how fragile things are.

How many times have we been told that we’ll just drill ourselves out of Peak Oil? That’s the answer to $2-a-gallon gas, right?

Unfortunately, that’s not how it works.

By 2012, there will be more than 2,000 rigs drilling for oil and gas across the United States — more than 300 rigs compared to a year ago.

Considering that four and a half million barrels of OPEC oil is shipped to us on a daily basis, we’re trying with earnest to break ourselves from Saudi chains.

But one glance at the big picture doesn’t offer much hope that we’ll completely shake the OPEC:

Now here’s where it gets tricky. Because it’s painfully obvious to us that the cheap, easy-to-extract oil is gone.

And today, we’re drilling deeper than ever before.

Within the last sixty years, the average well depth has nearly doubled:

To say that our conventional production is in trouble is a gross understatement.

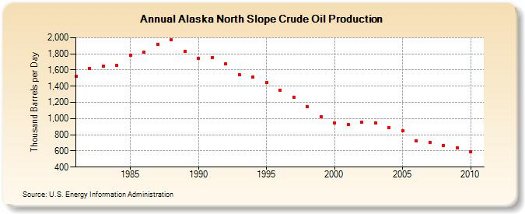

Pull up a chair, because we have a front-row seat to Alaska’s production crisis. More than 97% of the state’s oil production comes from its North Slope, and as you can see below, things are getting increasingly shaky for The Last Frontier:

There’s no saving grace here, no last-minute shot at the buzzer.

The problem isn’t how much oil is left in the ground, but rather the rate at which we can produce that oil.

And as you can tell, the deeper we drill and the farther we have to travel to set up those rigs, the more it will cost. Look, you don’t have to be an economist or even a geologist to realize where crude prices are headed.

Add to that the dismal condition the world’s oil fields are in, and the outlook becomes even more grim.

There is, however, a silver lining…

Peak Oil Opportunity

If nothing else, one simple truth has emerged over the last few years: Peak Oil presents us with the greatest investment opportunity of our lifetime.

This is a reality that my readers have taken advantage of time and again.

But keep in mind that drilling today isn’t the same as the gushers most people picture when they conjure up images of “oil profits.”

To get complete articles and information, join our daily newsletter for FREE!

Plus receive our free report, “Two Stocks to Play The Coming U.S. Oil Export Surge”Energy & Capital Members Receive:

Until next time,

Keith Kohl

Editor, Energy and Capital

P.S. Every so often, I get a few readers writing in to ask about Dr. Hubbert’s Peak Oil theory. Whether you’re a history a buff or are just curious about how the petroleum productive curve came to be, I’ve tracked down his original 1956 Peak Oil paper, which you can read here.