On Saturday, I stopped by Royal Farms to grab a cup of coffee.

The guy standing in line ahead of me was there to get change after pumping gasoline.

I overheard him tell the cashier, “I’ve got change on pump seven. I can’t believe gas is only $2.25. I thought $20 would fill it.”

Turns out he’s not the only one surprised by lower gas prices.

Social media was buzzing over the weekend with posts about cheap gasoline prices. Some people were even posting photos of local gas prices under $2 a gallon.

AAA reports gasoline prices currently average $2.55 per gallon nationally, which is a $0.30 decline over the past month.

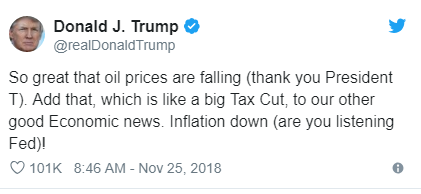

President Trump was quick to take credit for falling gas prices over the Thanksgiving weekend, congratulating himself on Twitter writing, “thank you President T.”

In the next couple weeks ahead, we can probably expect gasoline prices to remain low as oil prices dig deeper into bearish territory.

Crude oil for January delivery fell to as low as $50 per barrel in overnight trading before slightly rebounding this morning.

It’s still quite possible for oil to continue heading even lower. But I don’t think oil prices will fall much lower from here.

Fact is, OPEC just won’t let them.

As I mentioned to you a few weeks ago, crude oil is perhaps the most manipulated market on the planet.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

And OPEC is the main culprit.

Any time the price of oil gets too low, OPEC just comes out and says it has to decrease production for one reason or another. Then oil prices quickly turn around. We’ve seen this many times before. And I expect to see it again soon.

It seems OPEC wants oil prices to be in a specific range: somewhere between $70 and $80 per barrel.

Why does it seem that way?

Well, because that’s when OPEC is the most quiet.

When oil prices get too low for its comfort, OPEC announces supply decreases. And when prices get too high, it announces supply increases.

But in the $70 to $80 range, OPEC is quiet. And I think its silence speaks volumes.

So I wouldn’t expect to see $50 oil or lower for very long. OPEC is just not going to have it.

As a result, I think it’s a good time to start looking to buy high-quality oil stocks. But only look for now…

With oil prices so low right now, one major hurdle oil producers are going to face is their fourth quarter earnings. What I mean is this…

Even if the price of oil works its way back to $70 over the next few weeks, fourth quarter earnings for oil producers are likely going to disappoint. And since fourth quarter and full year 2018 data will be released at the same time, a rocky fourth quarter for oil producers might significantly affect investor sentiment. It has before.

So right now, I just want to be a window shopper… a looky-loo.

Patience and wisdom are key to investment success, just as they are in life.

Patience and wisdom…

Until next time,

Luke Burgess

As an editor at Energy and Capital, Luke’s analysis and market research reach hundreds of thousands of investors every day. Luke is also a contributing editor of Angel Publishing’s Bull and Bust Report newsletter. There, he helps investors in leveraging the future supply-demand imbalance that he believes could be key to a cyclical upswing in the hard asset markets. For more on Luke, go to his editor’s page.