Get ready to be confused… and maybe even question your entire reality.

We already know LIBOR was being manipulated. That’s the rate every single interest rate in the world is derived from: municipal bonds, money markets, your credit card — everything.

And it was all smoke and mirrors.

The rates being set at whatever level was needed for fat-cat bankers to make even more money.

We also learned HSBC (NYSE: HBC), a $165 billion bank, voluntarily laundered billions for terrorists and drug cartels.

So basically, in the past few weeks we’ve learned what most suspected: Wall Street is a Machiavellian Wild West where only those in charge know what’s happening.

These stories are getting no Main Street traction.

And that’s a shame, because they gnaw at the root of many of today’s problems for the middle class.

But I digress.

I also have energy shenanigans to tell you about…

The U.S. Energy Information Administration (EIA) is out with oil demand forecasts for the rest of this year and next.

In its view, the world will need 88.64 million barrels of oil per day (BPD) for the rest of this year. Next year we’ll need 89.37 million bpd.

The International Energy Agency (IEA) was also out with its 2013 oil demand forecast. It says we’ll need 90.9 million barrels per day next year.

So the IEA is a bit more bullish, but the numbers are pretty close.

But here’s the thing: The world doesn’t produce that much oil.

It never has.

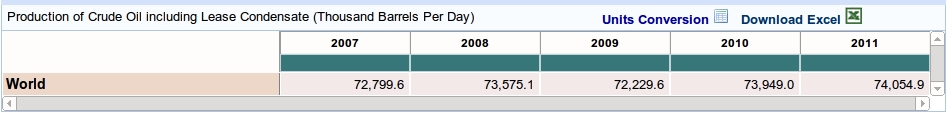

Look at this info taken right from the EIA’s website. It shows total world crude oil production for the last four years (click to enlarge):

The most oil the world has ever pumped is 74.05 million barrels per day.

That’s about 16 million barrels per day shy of what we’ll need next year.

We’ve been making up the difference with natural gas plant liquids (NGPLs) and other liquids.

Look what happens when we include them in total world production:

Still, the most “oil” (that word is in quotes because it’s not oil — it’s total liquid fuel — and calling it oil is a lie and a cover-up) the world has ever produced is 84.7 million barrels per day.

And even that’s over five million barrels per day short of what we’ll need next year.

Saying there’s plenty of oil is like saying the integrity of LIBOR is fine.

In the coming years, we’ll need every BTU of oil, coal, natural gas, nuclear, solar, and wind that we can find.

As I’ve said before, it isn’t either/or; it’s and/when.

That’s reality. Start living in it.

Call it like you see it,

![]()

Nick Hodge

Editor, Energy and Capital

Three Natural Gas Stocks: 2012 Natural Gas Investments

Three natural gas stocks investors should consider while prices are dirt cheap.

Election Year Investing: Should You Trust the Government?

It’s time to make your independent self successful — no matter who’s in office.

A Perfect Storm for Biotech in 2012?: These Stocks Are Up 40% for the Year

Once in a long while, the perfect set of conditions all come together at the same point in time and space… and bring us bull markets that forever change the landscape of the sectors they affect.

Saudis’ Secret Oil Dilemma: Crisis Strikes Riyadh

Editor Keith Kohl explains why the world’s largest oil producer is desperately trying to avoid an energy crisis.

Platinum Cheaper than Gold: The White Metal Reaches a Tipping Point

The Hammer talks about the wacky world of platinum and why it is priced below gold. A tipping point is looming. Here’s why.

Solar Bottom: Second Half Could Shine

The downside is solar prices have fallen extremely fast, making it hard for panel makers to generate a profit… at least in the short term. The upside is falling prices have led to record installations and investment.

Global Deflation: Prepare for More Printing with Gold

Greg McCoach explains why the junior mining share market has been hit to the downside yet again.

American Energy Investing: OPEC Is Done!

American energy is increasing thanks to oil production, the coming boom in natural gas-powered vehicles (which will be fueled solely by domestic natural gas), and alternative transportation fuels.

Silver and Gold, Silver and Gold: What Does Velocity Have to Do With It?

The Hammer talks about a new bull market in gold and silver.

Record Growth in Solar: Prices Falling, Stocks to Rise

Even though the solar industry posted record growth last year, it’s only the beginning of a massive turnaround. Acting now will ensure the biggest gains for your account.