Welcome to the Energy and Capital Weekend Edition — our insights from the week in investing and links to our most-read Energy and Capital and sister publication articles.

The Macondo saga continues…

Even after BP finally managed to stop oil from spewing into the Gulf of Mexico, the company still can’t catch a break.

This time, another threat has moved into the area: tropical storm Bonnie.

The good news is that BP received permission to leave the well capped during the storm.

The bad news is that BP’s relief well efforts have been delayed again.

When Bonnie formed late Thursday, BP made the decision to move its drilling ships.

As you know, once the relief well is completed, BP will be able to pump the Macondo well full of mud and cement, permanently plugging it. Now, the threat of Bonnie has moved the completion date back to late August.

Although we don’t know for certain what Bonnie’s impact will be, remember that storms during June pushed a huge amount of oil onshore. And don’t forget that the delay until late August assumes no other interruptions take place.

Do you think BP’s luck will prevail?

An industry under siege

Every oil and gas investor has taken a look at the offshore industry at least once since the Deepwater Horizon disaster.

If they say they haven’t, they’re lying to you.

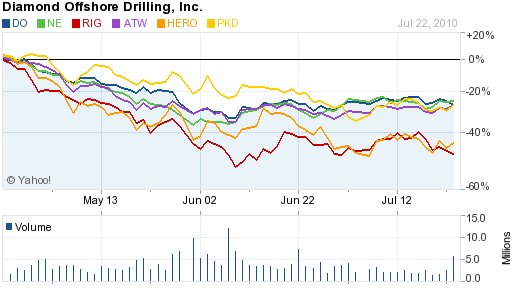

Make no mistake — the last three months have been brutal for those offshore drillers:

Once the relief wells are completed — and if all goes well — then BP will have turned a major corner in this disaster.

I don’t believe it’s a matter of if drilling will resume in the deepwater Gulf of Mexico…

Eventually, the market is going to take full advantage of those beaten down offshore stocks.

At what point do you see a huge buying opportunity?

Stay tuned, because I’ll have my answer for you next week.

Enjoy your weekend,

Keith Kohl

P.S. In case your work week was nearly as hectic as mine, I’ve included some of the top stories to cross my desk recently.

Oil’s Game-Changer: The Aftermath of the Deepwater Horizon Disaster

April 20, 2010, will go down in the record books as the day the oil industry changed forever. The disaster has become a living nightmare to BP and other offshore drillers. But there’s no denying the game-changing profits that investors will make as the enormity of the situation comes to light. Continue reading to learn more…

The Russian Oil Blunder: Mongolia’s Drilling Horde

When the Soviet government failed to develop the massive oil field they discovered in Mongolia, a veritable wealth of crude was lost to the history books — until now. Now one tiny company is now sitting on $51 billion of Stalin’s lost oil fields. Read our latest report to find out how investors are taking advantage of Mongolia’s newfound oil wealth.

China’s Silent War for Canadian Energy: Is it Time to Buy the Oil Sands?

Editor Keith Kohl explains why China’s grab for Canada’s oil sands may have been a huge mistake.

Tiny Nuclear Company Leads American Resurgence: The Nuclear Story Fox News Isn’t Telling You

Energy and Capital Editor Nick Hodge shares with readers details on a little-known nuclear company that’s set to explode on certain hidden news…

The World’s Hottest Region for Gold Exploration: Two Small Gold Stocks

Wealth Daily Editor Luke Burgess discusses the investment highlights of investing in junior gold stocks with exposure to major gold trends in Nevada, including the Carlin and Cortez Trends.

Approaching Solar Earnings Season: Big Banks on Solar Stocks

Green Chip‘s Nick Hodge talks about big banks warming up to the solar sector, and how you can turn a quick profit as earnings season.

China’s Energy Future: 1.3 Billion Chinese Can’t Be Stopped

Wealth Daily Editor Steve Christ takes a look at China’s energy future and explains what it means for the price of oil.

Smart Grid Reaching Critical Mass: Smart Grid Saves Energy, Makes Money

Energy & Capital Editor Nick Hodge discusses the coming-of-age of the smart grid via a Kohl’s case study.

How to Front-run the Chinese, Legally: Investing Secrets for an Empire’s Life Cycle

Publisher Brian Hicks explains the seven stages of an empire’s life cycle and how they pertain to the United States, China, and most of all, your portfolio.