Direct lithium extraction (DLE) is the future of low cost lithium production, and DLE stocks are starting to show it.

At the moment, there are two methods for pulling battery-grade lithium out of its natural matrix that account for the vast majority of world lithium production: hard rock mining and evaporation.

Hard rock mining is exactly what it sounds like and carries with it the costs and uncertainty of exploration, followed by the long and arduous task of drilling, blasting and processing rock to get at the minute concentrations of lithium metal.

The other option is this:

A long and slow evaporation of lithium-rich solution, which afterwards requires further processing before anything useful can be harvested.

Lithium-rich salt flats like those in Chile, Bolivia and Argentina currently account for some of the biggest deposits known to man, but the time and cost of implementing this method is prohibitive for all but to the biggest firms.

Especially with today’s lithium prices at less than one quarter where they were just two years ago.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Direct Lithium Extraction… No Exploration. No Mining

Direct lithium extraction sidesteps almost all of the cost and time-delay issues by processing liquids with known lithium concentrations through an active filtration apparatus, resulting in clean, salable lithium bicarbonate in days or weeks, instead of years.

So there is no exploration. There is no waiting. There is setup, pumping and filtering, and lithium comes out the other end.

Initiation is rapid; filtration units can be stacked, allowing for scaling, and lithium solutions with concentrations previously considered too low to be viable are now producing at economically justified prices.

So where does all this solution come from? Well, for one particular Alberta-based DLE company, the solution comes from oil fields in Western Texas’s Permian basin.

Nineteen million barrels of lithium-rich brine flow through that region every single day, and with it, hundreds of thousands of tons of lithium — all of which can be extracted at less than $3k/ton — which makes even today’s post bubble lithium prices seem cheap.

This Direct Lithium Extraction Stock Is Trading At Fractions Of Its Value

The cheapest, in fact, of all but the biggest producers in the world.

Right now, this company is at a crucial point in its development: Earlier this month, it achieved a major scaling milestone, one of the last before full-scale commercialization is possible.

Shares, which were trading at a market cap of less than $25M, jumped 50% over the next week, and continue to trade at a valuation approaching $40M.

All this during some of the laziest trading weeks of the entire year.

Of course, it's still insignificant compared to what’s possible if the company is able to achieve its next scaling goal.

Because with that much brine flowing through the southwestern United States, the balance of power in the lithium game could shift just based on this technological breakthrough.

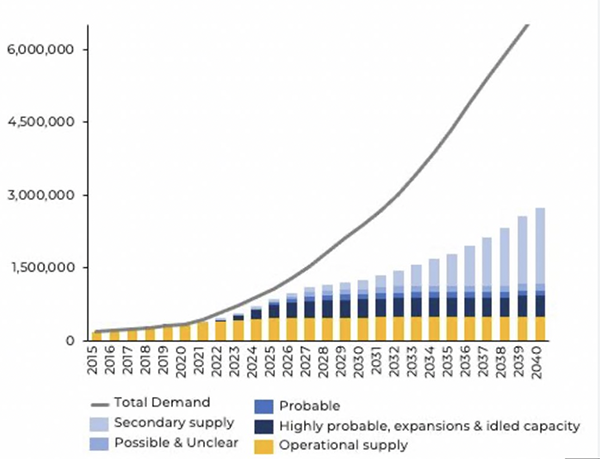

Lithium Demand Set To Outpace Production This Year

And make no mistake about it, the balance of power is a huge deal… Because even with the lithium bubble behind us, lithium demand is only set to grow for at least the next decade and likely beyond.

As long as we need cheap, high-capacity, quick-charging batteries, whether they're lithium-ion or solid state, lithium will be highly sought-after.

If history is any indicator, lithium prices could easily double as the post-bubble rationality returns.

With all these catalysts at work, it should come as no surprise that a number of major energy companies have already showed interest, with at least one collaboration already in place.

My readers were first introduced to this stock last year, and it’s true, the going hasn’t been easy with the turmoil on the lithium market.

But with this level of speed and economy, even today’s lithium prices present compelling profit potential.

Few can compete, and those that can aren’t nearly this undervalued.

Want to learn more about it before the summer buying lull comes to an end?

Check out this quick video presentation, right here, and get fully informed.

Fortune favors the bold,

Alex Koyfman

His flagship service, Microcap Insider, provides market-beating insights into some of the fastest moving, highest profit-potential companies available for public trading on the U.S. and Canadian exchanges. With more than 5 years of track record to back it up, Microcap Insider is the choice for the growth-minded investor. Alex contributes his thoughts and insights regularly to Energy and Capital. To learn more about Alex, click here.