Our wealth of natural gas is the worst-kept secret in the U.S. energy sector today.

I also can’t think of a more beaten-down commodity over the last decade.

Just think, natural gas on the Henry Hub was trading for a staggering $12.69 per mmBtu (million British thermal units) in June 2008.

Mind you, this was four years after a little-known company named Range Resources completed its Renz 1 well.

It drilled its vertical well into the Marcellus formation in western Pennsylvania.

Prior to that, companies were having wild success combining horizontal drilling with hydraulic fracturing techniques down in Texas’ Barnett Shale.

Why not try it here?

That was the beginning of the end of our dependence on foreign natural gas.

However, there have also been severe consequences at home.

As our annual natural gas output swelled over the last decade to over 40 trillion cubic feet in 2019, it took a devastating toll on prices.

Last June, the spot price for natural gas on the Henry Hub averaged $1.77 per mmbtu.

Yet for the first time in recent memory, some natural gas bulls are sharpening their horns.

And you may not want to sleep on natural gas much longer.

Natural Gas Bull in a China Shop

A week ago, we saw just how much the U.S. relies on its vast natural gas resources.

During an intense period of hot weather, gas was the savior for many of us as our electricity demand for it soared to a record 47.2 Bcf (billion cubic feet) on July 27.

If you ever feel frustrated by your monthly power bill, just close your eyes, take a deep breath, and imagine how much you would’ve paid when gas prices on the Henry Hub were still $12.69/mmbtu.

Globally, however, demand for natural gas took a 4% haircut due to COVID.

And the future looks much, much brighter.

The International Energy Agency (IEA) gave investors a road map to help them take advantage of a natural gas bull over the next five years.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

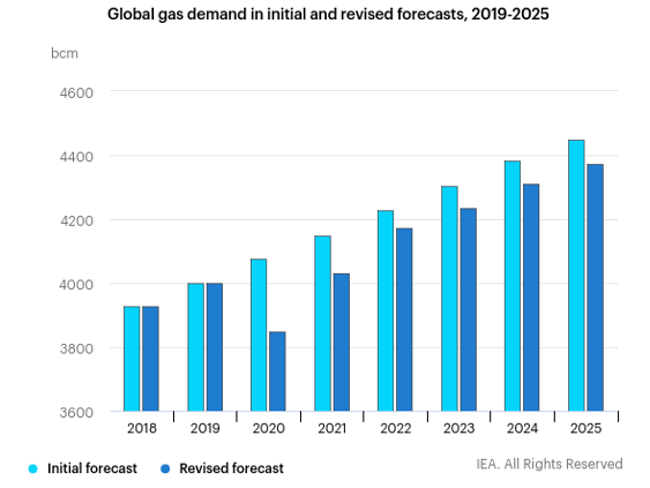

Though COVID had its impact on short-term demand, the outlook heading through 2025 paints a bullish picture.

According to the IEA, global gas demand is expected to not only recover in 2021 but experience steady growth through 2025:

So where is your edge as an investor?

Well, consider that this natural gas bull is poised to rage through a china shop.

One thing that has become clear as we move toward a post-COVID life is that Asia will be a major catalyst for future demand growth.

In fact, the Asia-Pacific region will be responsible for more than half of incremental demand over the next five years.

We are, of course, referring mostly to China.

Moreover, it’s natural gas’s use in the industrial sector that will make up the largest amount of that growth.

Right now, it’s a matter of how soon the fundamentals tighten. According to the IEA, upstream spending by shale gas companies is expected to be cut in half this year compared with 2019.

Remember, it’s not just oil drillers that are taking their rigs out of the field.

As of last week, only 72 rigs in the United States were actively drilling for natural gas.

That’s 90 fewer rigs than a year ago.

Last week, we ended with the notion that U.S. liquefied natural gas (LNG) has been one shining light in the natural gas markets for individual investors like us.

Our oil and LNG exports to China have already spiked higher this year thanks to the trade deal.

During the first six months of 2020, China bought around $300 million worth of U.S. LNG.

That may not be as much as some were hoping, but exporters are finally getting their foot back in the door.

Mark my words, this is just the beginning.

Don’t sleep on natural gas.

Until next time, Keith Kohl A true insider in the technology and energy

markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new

technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the

Managing Editor of Energy & Capital, as well as the

investment director of Angel Publishing’s

Energy Investor and Technology and

Opportunity. For nearly two decades, Keith has been providing in-depth coverage of the hottest

investment trends before

they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution

currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on

key advancements in robotics and AI technology. Keith’s keen trading acumen and investment research also extend all the way into

the complex biotech sector,

where he and his readers take advantage of the newest and most groundbreaking medical therapies being

developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s

to lab scientists grinding out the latest medical technology and treatments. You can join his vast

investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.