It happens every year without fail.

That moment when you wake up shivering one morning and it hits you that summer is gone and the cool days of autumn are quickly turning bitter cold.

You get up, and for the first time in a long while, you click the switch on your thermostat and put the heat on.

Most people trudge back under the covers without much thought.

Yet for some reason, the first time I click on that switch, all I can think about is one thing…

Pennsylvania.

Why, you ask? I’ll get to that in just a second.

Despite the fact that I lived in the Keystone State for most of my life, there’s another reason that first trip to the thermostat makes my mind drift back to PA.

Actually, there are 6.2 trillion reasons why…

Natural gas.

Whenever winter weather starts to settle in, natural gas investors breathe a slight sigh of relief; record-cold temps have gripped the central, eastern, and southern parts of the country.

Front month contracts of natural gas at the Henry Hub have jumped nearly 20% higher as heating demand for natural gas increased.

We’re expecting prices to climb even higher over the short term as winter weather slams into parts of the U.S. It’s barely into November, and parts of New England are expected to be hammered with snowstorms.

Make no mistake; this is incredibly bullish for natural gas investors.

So, what’s our outlook going forward?

Natural Gas Forecast 2020

Last week we talked about how investors can lock up LNG profits in 2020.

The fact that U.S. natural gas exports during the first half of 2019 more than doubled that of the first half of 2018 speaks volumes.

Although exports have been driving profits for natural gas investors, it was still a painful year for the rest of the market.

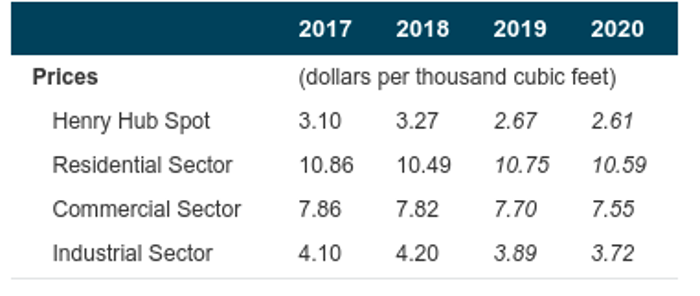

The EIA expects natural gas prices at the Henry Hub will average about $2.67/Mcf this year. If true, it would mean prices dropped 18% year over year.

And they’re projecting even weaker prices ahead, too.

When the EIA released its latest Short Term Energy Outlook last month, it projected Henry Hub spot prices to decline another 2.2% and average $2.61/Mcf in 2020.

In fact, natural gas prices in each sector are expected to fall next year.

Take a look for yourself:

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

6.2 Trillion Reasons to Love Pennsylvania

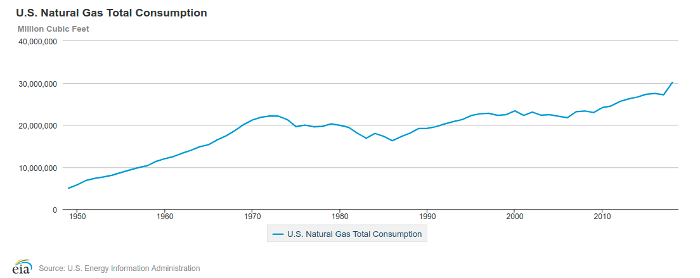

Look, we certainly can’t blame the demand side of the equation for weaker prices. As you can see below, U.S. natural gas consumption has been steadily growing for the last 33 years:

Last year, we used an eye-popping 30 TRILLION CUBIC FEET of natural gas!

Natural gas accounted for more than 35% of our electrical generation in 2018 — well over coal’s falling share and more than double that from renewables.

To put a little perspective on that, the electric power sector makes up almost 37% of the United States’ total energy consumption.

And as President Trump recently announced our official withdrawal from the Paris Climate Accord, I can’t help but think natural gas is the biggest reason U.S. greenhouse gas emissions are falling.

With all this bullish news for natural gas, you have to wonder by now what’s keeping a lid on prices.

Well, that brings us full circle to Pennsylvania.

I know this doesn’t come as a surprise to anyone in our investment community. We’ve been tracking Marcellus shale boom since Range Resources drilled its first exploratory wells in the play.

And we’ve come quite far since those early days.

Here’s a quick look at natural gas production in the Appalachia region:

Last month, an estimated 33.1 billion cubic feet of natural gas was extracted from the Marcellus play.

In 2018, Pennsylvania produced 17% of all the natural gas extracted on U.S. soil — a total of 6.2 trillion cubic feet of it!

In 2020, the EIA projects that U.S. marketed natural gas production will average 100.74 billion cubic feet per day.

More than a decade after the Marcellus shale boom was sparked, and the U.S. is still awash in natural gas.

Next week, I’m going to show you exactly where all that gas will end up.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.