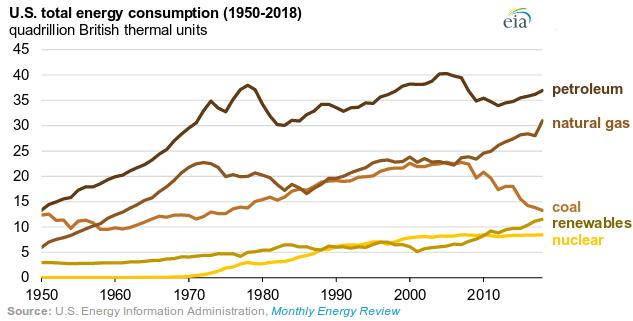

For the past several decades, energy consumption in the United States has been rapidly increasing. And in 2007, American energy demand hit an all-time high.

That was before pulling back a bit and leveling off for a decade. But last year was a turning point for U.S. energy demand.

In a recent report, the EIA says the U.S. consumed 101.3 quadrillion British thermal units (Btu) in 2018.

That was 0.3% higher than the record set in 2007 and 4% higher than the previous year.

In other words, U.S. energy demand has never been higher.

The EIA said, “The increase in 2018 was the largest increase in energy consumption, in both absolute and percentage terms, since 2010.”

And there’s really one specific segment that’s the leading force right now in growing demand: natural gas.

The EIA reported modest annual increases in both consumption of petroleum and renewable energy, a drop in coal demand, and very little change to nuclear power. But natural gas demand in the U.S. soared last year.

America’s natural gas demand hit an all-time record high totaling 31 quadrillion Btu for the year — an increase of 10% compared to 2017.

Why? The EIA says higher demand was driven by “weather-related factors that increased demand for space heating during the winter and for air conditioning during the summer.”

Despite the increase in domestic demand, however, natural gas prices remained relatively flat during 2018. For most of the year, natural gas was trading under $3 per Mcf.

Beginning around November, the price of natural gas began to move higher, briefly climbing over $4.75 per Mcf before falling all the way back to trade below $2.50 per Mcf, where it sits today.

Sharp increases in domestic natural gas supplies can be largely credited for keeping domestic prices stagnant.

For decades, U.S. natural gas production had been relatively flat. But since 2005, American output of natural gas has increased by more than 60%, with big increases starting in 2017.

Much of the increase in natural gas production can be attributed to the development of tight oil and gas sources through fracking and, just a bit more recently, the development of liquefied natural gas (LNG) technologies and infrastructure.

The United States was producing so much natural gas that it began to become a net exporter in 2017.

And it didn’t stop. Last month marks the 12th consecutive month that American natural gas exports will exceed imports.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

The last time that happened, Dwight Eisenhower was president.

Going forward we can expect continued increases in U.S. natural gas production, as the Trump administration is delivering on its promises of energy infrastructure development.

Most recently, President Trump signed an executive order to streamline the development of energy infrastructure projects. Specifically required will be analysis of coal, oil, and natural gas exports from the U.S. and the effects caused by insufficient energy infrastructure.

Energy Secretary Rick Perry said of the EO, “Under the Trump Administration, America has become the world’s top producer of energy, and the President is committed to expanding this growth into the future.”

Last week, the U.S. Department of Energy announced up to $39 million in federal funding for cost-shared research and development projects that aim to improve oil and natural gas technologies. $24 million of that is specially slated for projects that support the continued development of America’s natural gas production and infrastructure.

For us as investors, the natural gas environment couldn’t get any better right now.

Prices of natural gas have cooled off for the season. And, as mentioned, they’ve cooled off quite a bit. At last look, the cash price of natural gas was $2.49 per Mcf. But with rising natural gas demand (here and abroad), and with political will funneling money into energy infrastructure, I think we’re looking at a strong opportunity to do some bottom fishing.

Dust off those old natural gas production stocks you’ve got in your sold portfolio and give them another look. Seems like a really good time to open a new natural gas position.

Until next time,

Luke Burgess

As an editor at Energy and Capital, Luke’s analysis and market research reach hundreds of thousands of investors every day. Luke is also a contributing editor of Angel Publishing’s Bull and Bust Report newsletter. There, he helps investors in leveraging the future supply-demand imbalance that he believes could be key to a cyclical upswing in the hard asset markets. For more on Luke, go to his editor’s page.