Mexico faces a hurdle that’s bigger than any wall Donald Trump could ever build…

Our southern neighbors have a gas problem — a natural gas problem, to be exact.

It’s pretty simple: Mexico already consumes much more natural gas than the country can possibly produce. And it’s gonna need much more of the fossil fuel over the next several decades.

Anyone can see the dilemma. But while Mexico has the problem, America has the solution.

Let me back up for a minute…

Mexico was once one of the world’s largest oil producers. But after over 10 years of falling production, Mexico’s crude output doesn’t even rank among the top 10 producing nations.

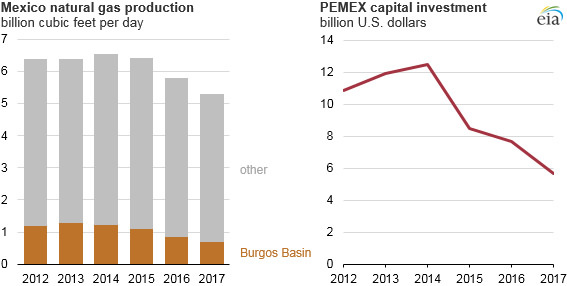

And as a result, the nation’s natural gas production has also dropped. Over the past decade, Mexico’s natural gas output has declined by 28%.

|

|

Some of the decline in oil and natural gas production can be blamed on lower energy prices.

The price of oil was on the rise for much of the beginning of the 21st century. That was, of course, until around 2013, when the bottom fell out for fossil fuel prices, which really threw a wrench into the clockwork.

When energy prices decline, as they did back then, spending to develop new oil and/or gas production naturally gets cut. Why spend money on something that’s providing declining ROI?

What that means for supply, however, is that current and future production remains stagnant or, more often, declines.

And that’s exactly what happened in Mexico.

In the past five years, Mexico’s national energy company PEMEX has cut its capital expenditures by nearly 75%… 75%! This has contributed significantly to the decline in Mexican oil and gas production.

And here’s the thing…

Mexico can’t just start spending money again to develop new projects and expect a windfall of natural gas resources. It’s not that easy.

You see, Mexico does have a significant amount of oil. It sits at 18th on the list of the world’s largest oil reserves. But its proven natural gas reserves leave the country lacking.

Mexico’s natural gas resources rank way down at number 40 on the list of nations with highest reserves. So while Mexico has plenty of oil, it doesn’t have a lot of natural gas.

In short, Mexico’s domestic natural gas production is tanking. And it has no way of significantly increasing it.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Now, that wouldn’t be much of a problem if the demand for natural gas were declining, too.

But it’s not.

Just the opposite, in fact.

The Mexican government says it expects domestic demand for natural gas to increase 26.8% over the 15-year period between 2016 and 2031.

That’s a CAGR of about 1.6%.

So at the end of the day, Mexico desperately needs to import natural gas.

That’s where America steps in…

You see, the Land of the Free and Home of the Brave is also home to the world’s fourth-largest natural gas resources.

It’s also the world’s #1 producer of the fossil gas.

That’s why the Mexican government also recently said it should continue to depend on imported natural gas via pipeline from the U.S. to meet local demand.

As we can see in the chart below, Mexico has relied on U.S. natural gas for a while.

The Mexican government really has no choice for the time being other than to continue buying U.S. gas… meaning this is a trend that’s expected to continue: more demand for U.S. natural gas from Mexico.

And that, dear reader, could mean another boom time for U.S. natural gas producers.

We will be taking a look at several U.S. natural gas producers to bring you more soon on this developing story.

Until next time,

Luke Burgess

As an editor at Energy and Capital, Luke’s analysis and market research reach hundreds of thousands of investors every day. Luke is also a contributing editor of Angel Publishing’s Bull and Bust Report newsletter. There, he helps investors in leveraging the future supply-demand imbalance that he believes could be key to a cyclical upswing in the hard asset markets. For more on Luke, go to his editor’s page.