I was planning on sending out an article today talking about investing in precious gemstones — red diamonds, padparadscha sapphires, Burmese rubies, old mine emeralds, and the like.

But a precipitous drop in oil prices last night demands that I address a bad buy call on crude last Friday.

The price of crude oil plummeted in overnight trading after an apparent breakdown of the OPEC+ alliance, which has ostensibly sparked an all-out price war between Saudi Arabia and Russia.

Brent oil for May delivery fell by over 22% to a low of $35.21 per barrel (bbl), the second-largest drop in the market’s history, and WTI for front-month delivery dropped by over 33% to a low of $27.34/bbl, its lowest levels in 17 years.

Source: Barchart.com

Source: Barchart.com

What happened?

On Friday, Saudi Arabia failed to convince Russia to an additional production cut planned for this year. The Saudis were looking for OPEC+ to curb an additional 1.5 million barrels per day (bpd), bringing the total OPEC+ cuts for 2020 to 3.6 million bpd. That’s about 3.6% of global supply. But Russia wasn’t having any of it.

Russian Energy Minister Alexander Novak said on Friday, “As from 1 April we are starting to work without minding the quotas, or reductions which were in place earlier but this does not mean that each country would not monitor and analyze market developments.”

So in retaliation, Saudi Arabia slashed its crude prices for buyers by nearly 10% over the weekend, in what everyone is calling the beginning of an oil price war between Riyadh and Moscow, which would no doubt have deep economic and geopolitical implications.

Saudi Arabia’s price cut added to an already uncertain global market roiled by coronavirus fears. Australian stocks plunged 7.3% in overnight trading while Japan’s Nikkei fell by over 5%. Meanwhile, U.S. futures reacted, triggering stop limits for the S&P 500.

Meanwhile, yours truly called oil a “screaming buy” on Friday…

I’m not going to try to defend my very poorly timed call too much. Of course, I could blame the Saudis or the Russians for making moves that no one could have predicted. But instead, I’ll own the mistake: I was wrong… very, very wrong.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Thing is, no matter who you are, no matter how long you’ve been doing something, and no matter how good you are at it, everyone makes mistakes in their professional career. Everyone makes bad calls. And every investor loses money from time to time. Show me the investor who says he’s never lost any money, and I’ll show you a liar.

This job — analyzing and writing publicly about financial markets — is very much like being a weather forecaster: Everyone remembers the bad forecasts. And people love to call you out when you’re wrong. This is exasperated when you’re a person like me who likes to gloat (albeit jokingly) when they’re right.

The harder you pound your chest when you’re right, the harder people will attack you when you’re wrong. And sooner or later, you will be wrong. That’s just the nature of the beast.

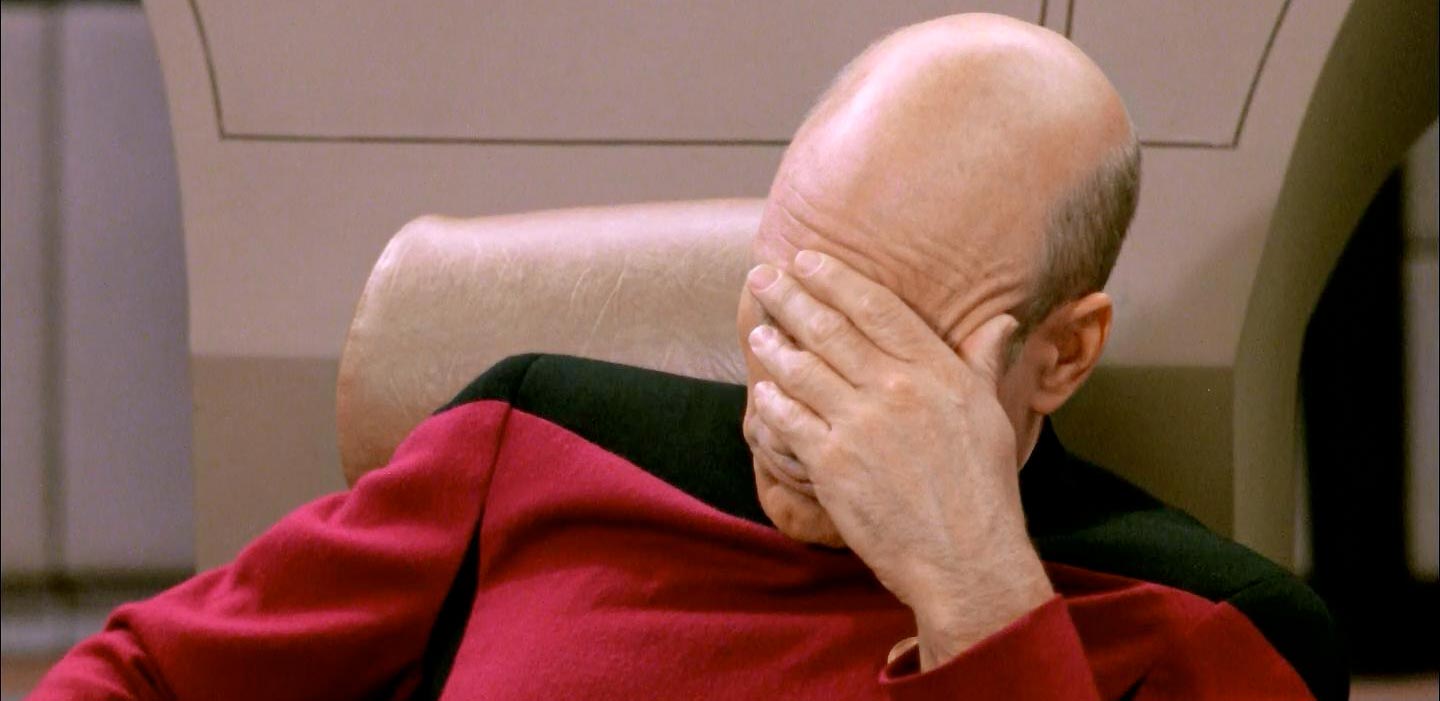

I’ve already been hit with a barrage of personal messages calling me out. The best so far came in an in-house Slack message:

The fact is, folks you win some and you lose some — hopefully more of the former than the latter. And I have plenty of winning calls to make up for this single bad one.

I’ll leave you today with what I believe to be a very apt quote from the immortal Theodore Roosevelt wrote:

“The only man who never makes mistakes is the man who never does anything.”

Until next time,

Luke Burgess

As an editor at Energy and Capital, Luke’s analysis and market research reach hundreds of thousands of investors every day. Luke is also a contributing editor of Angel Publishing’s Bull and Bust Report newsletter. There, he helps investors in leveraging the future supply-demand imbalance that he believes could be key to a cyclical upswing in the hard asset markets. For more on Luke, go to his editor’s page.