This is probably best time in history to be investing in lithium microcaps, and it doesn’t take a financial genius to see why.

We are now well into the post-bubble period for the lithium market, as resource prices are down around 80% from the peaks of 2022.

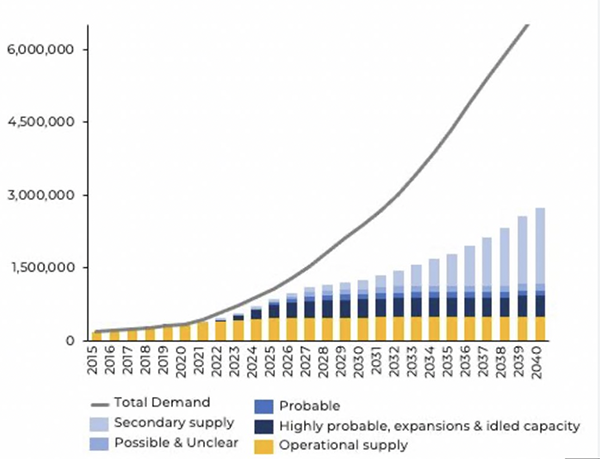

And yet, demand for lithium is at all time highs and growing every year — outpacing production as of last year.

Of all the types of investments out there providing retail investors with exposure to the lithium world, it’s the microcaps that have been hit the hardest.

Because while these stocks are best suited for steel-nerved speculators, they tend to pull in more than their share of emotional impulse buyers.

Their subsequent buyer’s remorse crushed the lithium microcap sector last year, but those losses have opened the door to some of the best buying opportunities we’ll not likely ever see again. Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.The Best Free Investment You’ll Ever Make

Here are a couple of my favorite examples:

Lithium Microcaps… Progressing At Fractions The Value

American Lithium (LI.V/AMLI) which is sitting on a $5.11B resource in Peru, is currently trading at less than ⅙ where it was at the peak of the market.

The reason?

Weak-handed investors, the very same lot which pushed the price up between 2020 and 2022, cut and ran at the first sign of disappointment — a response which spread through the retail community like a chemical chain reaction.

Anybody buying American Lithium today is buying at a market capitalization of less than $150M.

Three years ago the same company, whose principle was valued at less than ⅓ what it is today, was worth more than $1B.

Lithium Microcaps Are Often The Most Resourceful In The Field

Or how about Foremost Lithium Resources (FAT.CN/FMSTW), which specializes in high-efficiency hard-rock lithium mining. It’s a cheaper, faster, and more environmentally neutral method of refining raw material into battery-grade lithium hydroxide.

Back in early 2022, this company was trading for more than $20/share at a market cap of $100M.

Today it’s at $3.50/share with a market cap of less than $20M.

Its assets include over 55,000 acres of lithium-bearing properties in Manitoba as well as Quebec, with 5 projects across these regions.

The company recently published the results of a very promising drill test, with just one section of one of the Manitoba projects showing close to $500M worth of recoverable lithium — enough to power 400,000 EVs.

And yet shares are at close to 5 year lows — with a valuation of just 4% of the resource value of this single portion of the project.

Let Your Anxiety Be A Barometer Of Potential Upside

All of this is enough to create a lot of investor anxiety, but the reality hasn’t changed. Lithium demand has years, probably decades of steady growth ahead of it, while supply is dwindling.

A second, enduring bull market is inevitable.

So yes, this could well be the best and last days to make truly life-altering investments in small lithium firms.

The two I named earlier are excellent examples of oversold, undervalued companies that should rationally command much higher share prices, but, like the rest of the sector, have fallen victim to herd mentality.

There is a third company which I’ve been writing about to my premium subscribers for months now, and like all young companies with disruptive potential, this one takes an old theme and applies a new twist.

Lithium From Oil: The Next Step For North American Lithium Production

This company isn’t a miner, but rather a lithium-technology company.

It was started by veterans of the petrochemical industry, for the sole purpose of exploiting a long-known property of oil-field brine.

Their technology is a filtration method which cost effectively extract lithium directly from oilfield waste water — the very stuff that oil and gas companies use for their fracking operations.

Which means there is no exploration, no drilling or testing. Lithium quanitites are known beforehand. They can just come in, set up a filtration facility, and salable product is ready to ship in days to weeks.

The tech is proven, there is a pilot plant up and running, and the company just recently took on a strategic investment from a major North American fossil fuel interest, with collaborative efforts in the works.

This makes sense, because with this technology, almost any company producing oil or gas can diversify into lithium at the turn of a key.

Lag time from the start of production is just a few weeks, and when I said ‘very cost effective’, I meant it.

A recent press release revealed a 64% production cost reduction over the standard, making it among the cheapest, if not the cheapest, methods in existence.

The potential in North America, where oilfield brine is super-abundant and lithium production is sorely lacking, is impossible to ignore.

This company is currently valued at $30M (USD), but with the collaboration in place, and industry-beating numbers to boast with easy scaling, there is billion dollar potential here if we view a multi-year time horizon.

Want to learn more about it?

Here’s a video presentation to answer all of your question. Fortune favors the bold, Alex Koyfman His flagship service, Microcap Insider, provides market-beating insights into some of the fastest moving, highest profit-potential companies available for public trading on the U.S. and Canadian exchanges. With more than 5 years of track record to back it up, Microcap Insider is the choice for the growth-minded investor. Alex contributes his thoughts and insights regularly to Energy and Capital. To learn more about Alex, click here.