There’s a fire sale taking place, but I’ll bet it’s not the one you’re thinking of.

Right now, America’s largest banks smell blood… and they're circling. JPMorgan, Citigroup, Bank of America, and Wells Fargo are all eyeing up a sale that would give them First Republic's corpse for pennies on the dollar.

But that’s not the fire sale you should be watching.

Last week, I told you to buy oil and thank me later. Well, it turns out I was a week early, as the latest panic on banking failures caused a sharp drop in WTI crude prices.

Within a few days, WTI prices dropped like a stone, falling below $66 per barrel on Wednesday. Granted, the recent drop this week was part of a sell-off that has been taking place in the oil sector since mid-February.

Mark my words now: This might be the only chance you’ll get to buy oil stocks this cheap in 2023.

The only question is where to look.

I know we’ve been hammering the EIA’s data recently — even the EIA itself was calling its own methodologies into question as far back as November.

I’m specifically talking about the wild monthly adjustments that could have resulted from a number of things, from misreported or misclassified data to crude oil production not being counted in the EIA’s survey to even the EIA underestimating daily output.

Remember, it’s not the EIA that’s providing those weekly numbers but rather the Census Bureau.

Some numbers are much easier to track, such as the amount of crude oil that is shipped globally.

And this past week, we got an eye-popping glimpse into what lies ahead in 2023.

It’s no secret that within a few short years, the United States went from being incredibly dependent on foreign oil back in 2006 to becoming the world’s largest oil producer.

But we can thank the tight oil boom for that another time.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Within the course of just 10 years, we went from having to import 10.1 million barrels of crude oil per day to lifting restrictions on companies exporting oil!

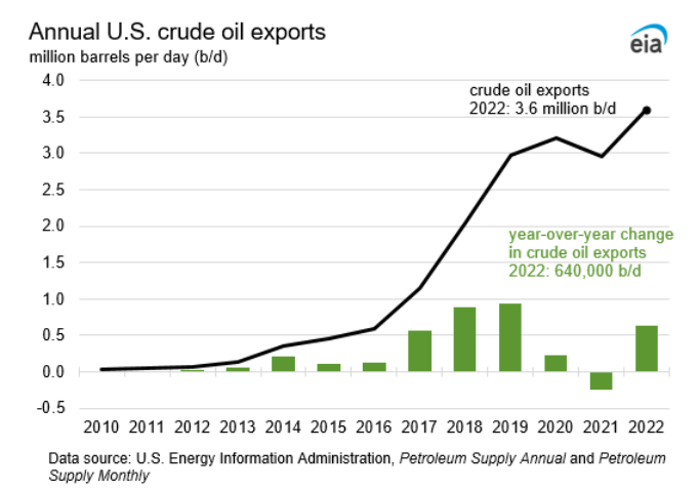

And when those restrictions were out of the way, we became a leading oil exporter in a matter of a few years.

Take a look for yourself:

What’s more interesting than simply the growth of our oil exports is WHERE our oil is heading.

Ask yourself: “Who’s buying up our oil?”

Right now, more than half of our oil exports are destined for just one of six places: South Korea, the Netherlands, the U.K., Canada, India, and Singapore. Those six countries account for more than 55% of U.S. oil exports.

Conspicuously absent from our top six oil customers is China.

That may change very soon.

A few days ago, OPEC painted a very tight supply picture as China’s economy builds more steam throughout 2023. In fact, the group believes that China’s oil demand will rocket higher this year by 710,000 barrels per day to reach 15.5 million barrels per day.

Even though Russia has diverted its oil exports away from everyone but China and India, global demand growth will ensure that every drop of oil extracted from U.S. fields will find a buyer.

And the key to unlocking our true export potential lies buried in the U.S. oil companies that will ultimately be responsible for returning our domestic production to record highs.

I highly recommend you take a few minutes out of your day to check out my latest investment presentation, which will tell you not only where those future export barrels will come from but also the three must-buy oil stocks that will lead the charge.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.