A lot of politicians will claim it’s about environmentalism…

But really it’s not.

Don’t get me wrong. I’m all for integrating cleaner electricity generation options into our grid, but the catalyst for the global transition away from fossil fuels has very little to do with the environment.

And yes, it is actually happening.

According to 2021 data analysis from Bloomberg, either wind or solar photovoltaics is the cheapest form of new-build electricity generation in almost all major markets, covering two-thirds of the world population.

To put that into perspective, that represents roughly 77% of global GDP and 91% of all electricity generation.

It’s also now cheaper to build new renewables from scratch than to operate existing coal and gas plants in a growing number of countries, including China, India, and much of Europe.

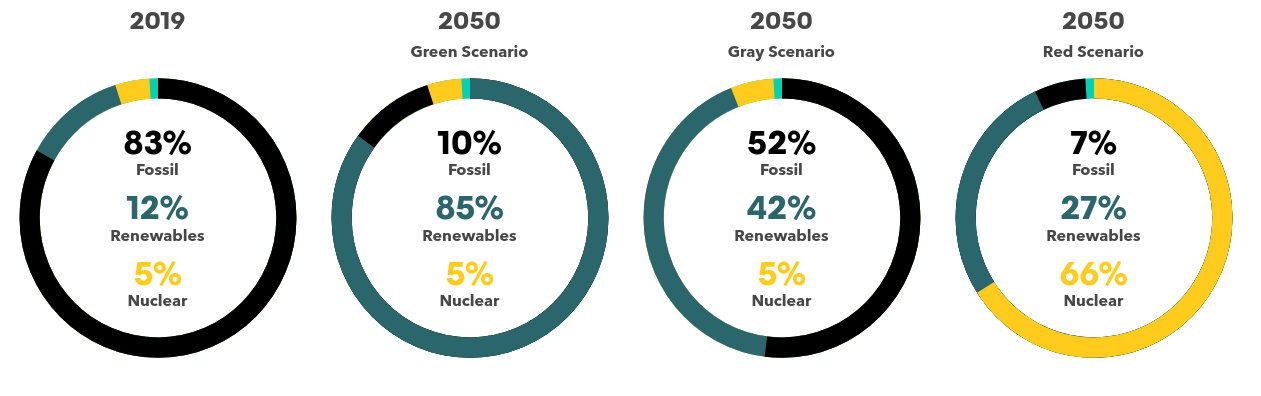

So with significant cost advantages, Bloomberg anticipates three scenarios in which fossil fuels lose market share to either renewable energy or nuclear power.

Check it out…

In the red scenario, nuclear takes the lion’s share.

But there’s a caveat to that…

Traditional nuclear power plants also have to figure into the equation costs tied to waste disposal, decommissioning, safety and security, and exceptionally high insurance rates. As such, a nuclear-dominant global energy economy can only exist with newer, more advanced nuclear technology that significantly cuts all the high-cost considerations that come with traditional nuclear power technology.

Such a technology does exist; my good friend and colleague Keith Kohl recently created an investment presentation on this technology and the only public company that’s making it commercially viable.

You can check that out here.

In the absence of that technology, I don’t see how the high costs of traditional nuclear power will be able to compete with the rapidly declining costs of renewable energy and energy storage. Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.The Best Free Investment You’ll Ever Make

Together, that combination provides what is today the most cost-effective option for electricity generation for more than half of all countries in the world.

By 2050, it will likely be the most cost-effective energy for more than 90% of the planet.

Oil and gas investors certainly don’t want to hear this and will be quick to dismiss the data.

But that is, for lack of a better word, stupid.

The data is sound, and you can still make money in fossil fuels for the foreseeable future, but if you ignore the transition that is already upon us, you risk losing out on a massive payday.

If you don’t believe me, just look at this analysis that shows exactly how investors like Elon Musk, Warren Buffett, and Jeff Bezos are already making millions by investing in new solar power projects across the globe.

They’re not doing it because they’re tree huggers.

They’re doing it because they see the same data I’m sharing with you today…

The data that shows the transition away from fossil fuels IS happening.

So unless you hate money, you’d be an absolute fool not to get in on this action.

See for yourself why the world’s biggest billionaires are betting big on solar.

To a new way of life and a new generation of wealth… Jeff Siegel Jeff is an editor of Energy and Capital as well as a contributing analyst for New World Assets. Want to hear more from Jeff? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@JeffSiegel on Twitter

@JeffSiegel on Twitter