Although few want to admit it, health insurance companies are not in business to make you feel safe and secure.

Insurance companies exist to make money.

I don’t say this to be negative. In fact, it’s not really a criticism — more like an observation. Because the bottom line is that if an insurance company can’t make money, it can’t exist.

Pharmaceuticals, MRIs, doctor visits — this stuff ain’t cheap. So I’m never surprised when I hear that a health insurance company is looking for new ways to make a buck.

One of the more interesting that recently came across my desk was a new policy that would allow patients to get insurance coverage for medical marijuana.

This is just in Canada, of course, because here in the U.S., we’re not quite ready to relinquish the drug war that continues to make politicians, law enforcement unions, and private prison companies billions of dollars every year.

But in Canada, more and more folks are embracing the opportunity to treat their illnesses with marijuana, now that Canada has adjusted its regulations following a Supreme Court decision that allows citizens to consume marijuana as oils and edibles. Until recently, only the dried flower could be consumed.

Despite the absurdity of such a rule, this decision has paved the way for two very important things:

- Canadian citizens can now consume medical marijuana without having to actually smoke it — which is not so great on your lungs and definitely makes it difficult for folks who simply find it hard to smoke in general.

- Insurance companies may soon start to cover medical marijuana users, which could actually result in new revenue streams for insurers.

Fantastic News

Here’s the deal…

In Canada, insurers won’t typically cover a drug unless the government assigns it a drug identification number (DIN). A spokesperson for Canadian Life and Health Insurance recently told reporters that if medical marijuana could be issued a DIN, it’s very likely insurance companies would cover it.

Again, the absurdity of these types of regulatory hoops is mind numbing. Still, for the sake of users and marijuana investors, a DIN for medical marijuana would be a huge positive.

It certainly would be easier and cheaper for patients to get their medicine, and it would also send a signal to the market that Canada is serious about legalization — a signal that could instigate a huge influx of capital into the space.

As an investor and someone who thinks it’s absolutely unethical to deny a sick person medicine, I think this is fantastic news.

A Very Big Deal

Of course, there’s something in this for the insurance companies, too.

According to Khurram Malik, an analyst at Jacob Securities, medical marijuana doesn’t currently have a DIN due to a lack of clinical research on its efficacy. However, Malik is bullish that this is about to change. And based on the Supreme Court’s recent decision, I agree.

The groundwork has now been laid, and it’s time to move forward — with full support of the health insurance industry. After all, as Malik noted:

From a dollars and cents standpoint, if marijuana is the same thing as a narcotic opiate, they would much rather cover marijuana because they’re in the business to make money.

The number of medical marijuana users continues to grow by the day, and I would bet that more than half would be willing to pony up for insurance that covered their cannabis treatments. As well, consider the number of folks who would likely be more willing to try medical marijuana if their insurance companies covered it.

This is a very big deal, and it should not be taken lightly. In fact, if insurance companies do begin to cover medical marijuana, the entire industry could get a massive boost in business.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Ripe for Gains

While significant investment risk still exists in the space, the medical marijuana industry is ripe for gains. It’s just a matter of sifting through all the clutter of sketchy penny stocks and snake oil salesmen — of which there are many.

And that’s what I’ve been doing for the past two years.

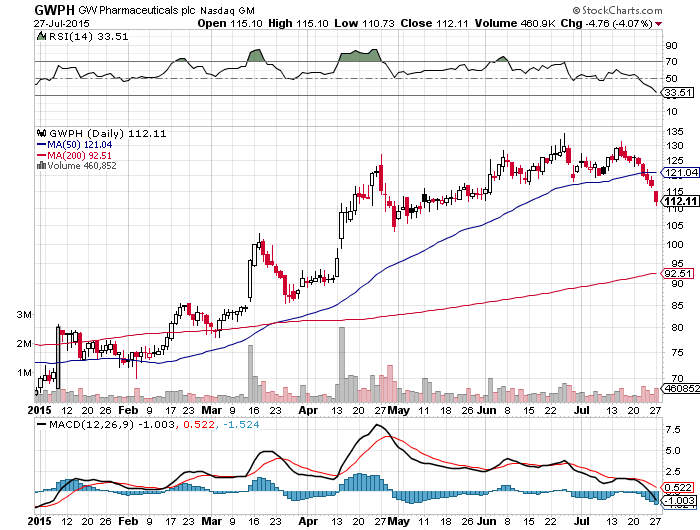

There are about two or three stocks that I really like in this space right now. GW Pharmaceuticals (NASDAQ: GWPH) is one, and there are two more Canadian plays that I’m writing up right now.

Here’s how GWPH has worked out so far this year…

I suspect my next two picks will perform just as well, if not better.

The first one should be ready for you to check out next month.

To a new way of life and a new generation of wealth…

Jeff Siegel

Jeff is an editor of Energy and Capital as well as a contributing analyst for New World Assets.

Want to hear more from Jeff? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@JeffSiegel on Twitter

@JeffSiegel on Twitter