Mornings are usually quiet around here.

You know the kind of peacefulness I’m talking about. In the wee hours of the morning, when hardly a soul is around and it’s just you and your thoughts.

Granted, I say usually because mine was interrupted nearly right away.

It was a gruff voice from across the room that cracked the silence: “Where’s oil going to be a year from today, $40 or $100?”

Now, my veteran readers know that I’ve gotten into a row or two with my colleague Christian DeHaemer in the past. Sometimes we just don’t see eye to eye on the same situation.

This time was different, however.

I knew he was on my side of the fence on this one.

In fact, you might even remember back in early May, when Chris gave you 10 reasons why the oil bull was back. (I’d argue that the bull actually started in 2016, but I wasn’t going to poke the bear this time.)

Whether or not WTI makes the ultimate run to $100 per barrel remains to be seen.

Is it possible? Absolutely.

There are too many factors that could give us triple-digit crude prices. That’s simply the nature of the oil markets, given the undeniable powder keg that is Middle East geopolitics. All it takes is one of those fuses to be lit, and we’ll be on our way.

But here’s the important part for individual investors like us who are looking to capitalize on higher oil prices…

Oil doesn’t need to hit $100 for you to find some great investments in the sector.

Capturing an Oil Crown

Look, I know it’s far more interesting to dream up the black swan events that would massively disrupt global oil markets today.

That kind of chaos and devastation would be extraordinary.

But again, it doesn’t need to happen for you to cash out at the end of this oil boom.

And it IS a boom, dear reader.

The United States’ tight oil drillers are responsible, particularly those in the Permian Basin in West Texas.

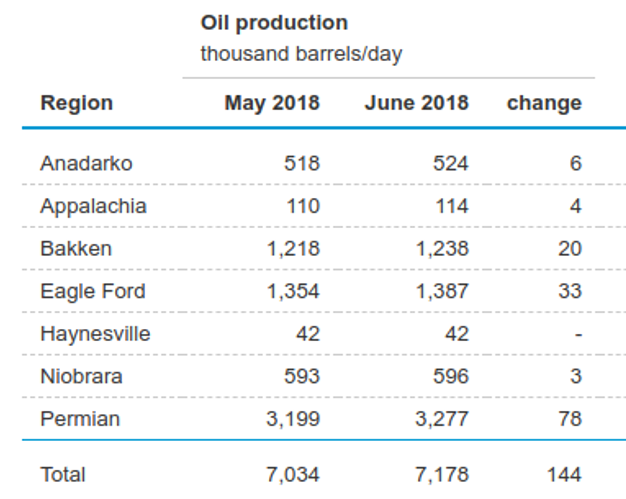

In the Permian alone, companies are extracting 3.2 million barrels of oil every day from underneath the Texas soil.

To put a little perspective on that, more oil is extracted from West Texas than the next three largest oil-producing regions: the Bakken, Eagle Ford, and Niobrara.

Of course, the fact that these Permian drillers are so close to the Gulf of Mexico will help push U.S. oil exports to new heights going forward.

It was just a month ago that the Nave Quasar, a VLCC capable of carrying 2 million barrels of oil, arrived at one port along the Gulf.

This was the first time a tanker of this size has reached a Gulf oil terminal… but it won’t be the last.

With everything seemingly going right for the U.S. oil industry, you have to wonder if there is anything that can put a damper on this boom.

There is.

And it’s on these opportunities that we need to be ahead of the investment herd.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

One Way to You Can Cash Out of This Oil Boom Now

Believe it or not, the strong production growth in the United States comes with its own complications. And during this period of high oil prices, there are a number of stocks that stand out from the crowd.

One of those winners will be oilfield service companies.

That should make some sense, right? After all, higher commodity prices mean they can charge their clients more for their services and products.

Take Halliburton (NYSE: HAL), for example. Halliburton is one of the largest oil service companies on the planet. The company’s year-over-year earnings in 2018 are projected to nearly double, and over the next two years, they’re expected to grow by 178%.

Now, Halliburton also happens to be a huge company, commanding a market cap of about $42 billion.

In other words, we aren’t the only ones who would get a piece of the action.

No, we can do better than that, can’t we?

You don’t want to simply join the herd; you want beat them to the punch.

Over the next few weeks, we’ll delve into some of these undiscovered investment gems that Wall Street has yet to catch wind of.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.