Demand for gold investments has gone through the roof amid the COVID-19 panic.

According to the World Gold Council, gold-backed ETFs saw a net inflow of $23 billion the January to March 2020 quarter — the highest quarterly amount ever!

Meanwhile there was essentially a run on physical gold back in February with bullion dealers actually selling out of inventories.

The renewed interest in gold as a safe haven asset has also extended to mining stocks. As a result, many gold mining stocks have weathered the coronavirus pandemic much better than the rest of the market. Gold majors like Newmont (NYSE: NEM), Barrick (NYSE: GOLD), and Kinross (NYSE: KGC) have gains of 30% to 40% year-to-date, while major indices sag.

Renewed interest in gold revives old questions. Over the past several weeks I’ve fielded dozens of questions about the best gold mining stocks on the market. Specifically, people want to know the best “pure play” gold stocks.

Pure Play Gold Stocks

Pure play stocks are not specific to gold or the mining market. However, when it comes to gold or precious metals, pure play stocks do carry a premium for investors.

A pure play gold company is typically thought of as one that derives all revenue from sales of gold or concentrate it has mined and processed.

A company could also earn revenue through gold mining royalties and streaming deals and still be considered a pure play. However, when most people are talking about pure play gold stocks, they’re talking about mining.

Here’s the thing about pure play gold stocks though: There really aren’t many gold mining companies that derive all revenue from sales of gold — meaning there really aren’t many technical pure play gold stocks. More often than not, a gold mining company is really one that just that primarily mines gold.

However, many times gold sales make up so much of a company’s revenue, they may as well just be considered “pure plays.”

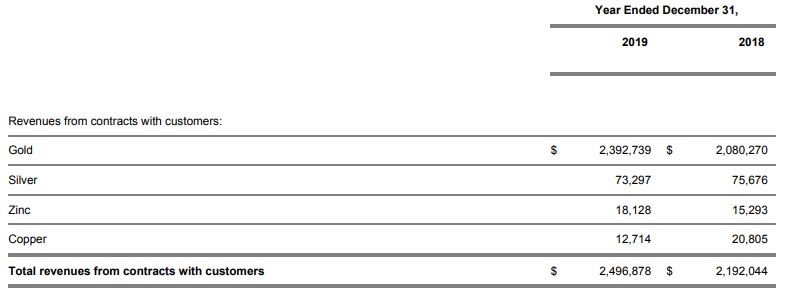

Let’s take Agnico-Eagle (NYSE: AEM) for example. Agnico-Eagle mines and sells gold, silver, zinc, and copper products. But for all intents and purposes, it’s a gold company.

In 2019, Agnico-Eagle generated $2,497 billion in revenue from sales contracts. About $2,393 billion (or about 96%) of that was derived from gold contracts.

Or look at Newmont. In 2019, Newmont generated $9.74 billion in total sales revenue. $9.05 billion (or 93%) of that revenue was derived from gold sales.

Even though these companies don’t generate 100% of their revenue through gold sales, we can consider them very pure gold plays.

There are a number of reasons why companies like Agnico-Eagle and Newmont don’t focus their efforts 100% on selling gold. Firstly, mining companies mostly expand through the acquisition of other mining companies. As that happens, the dynamic of production changes. Gold Company A buys Gold and Silver Company B, and overnight Gold Company A becomes partly a silver producer.

Gold majors like Newmont and Barrick operate and hold positions in multiple different mining operations around the world. Their corporate structures form a highly complicated web of ownership. Here’s a total picture of all of Barrick Gold’s mines, projects, related operating subsidiaries, and other significant subsidiaries:

Did ya get that? Because there’s a test later on.

In short, gold mining companies can become less pure through acquisition. Sometimes companies will sell or spin-off unrelated assets. Other times, they’ll just add it to their portfolio.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Moreover like all major businesses, many major mining companies have income from other investments, which may or may not be gold-related including royalty and interest payments.

All this decreases gold’s share within a company’s revenue stream.

The biggest reason, however, that many gold companies don’t exclusively produce gold is perhaps because pure gold mines don’t really exist.

Gold is extracted from different types of ores. Sometimes this ore contains native gold as seen in the photo below. But that gold is almost always amalgamated with other valuable metals such as silver. Other times ore contains disseminated gold as well as other valuable metals like copper, lead, and zinc.

It can cost hundreds of millions of dollars and take up to 20 years to take a piece of property from cow pasture to operating mine. So when mining for gold, there’s no reason not to isolate and sell any other valuable minerals present in a deposit. This is what miners call a co-product or by-product.

Newmont Mining says, “Generally if a metal expected to be mined represents more than 10 to 20% of the life of mine sales value of all the metal expected to be mined, the metal is considered a co-product.”

Companies like Agnico-Eagle and Newmont produce silver and copper as co-product.

Sometimes, however, gold concentrations are high enough in a deposit that a miner might not even bother with co-products. Kirkland Lake Gold (NYSE: KL) for example operates several high-grade gold mines in Canada and Australia. The concentrations of gold in the company’s deposits are so high, and concentrations of by-products so low, there’s no reason to process anything but gold.

Companies like Freeport-McMoRan (NYSE: FCX) will sometimes make their way onto a list of 10 largest gold miners. It’s true that FCX does mine gold, which makes up a significant amount of the companies revenue. And it’s true they are one of the world’s largest gold mining companies by market cap. But Freeport is mostly a copper company.

Gold only accounted for about 11% of the company’s consolidated revenues for 2019. Meanwhile, copper sales accounted for 79% of Freeport’s revenue. Most of the rest is the result of molybdenum sales.

So Freeport is certainly not a pure play gold company. But really, if four-fifths of the company’s revenue doesn’t come from gold, should they even be considered as a gold company? I don’t know. Best I can say is Freeport-McMoRan is a company that produces gold.

To summarize: Most gold mining companies aren’t 100% leveraged for gold. They aren’t 100% pure, although many can be considered pure enough.

But if you’re looking to buy gold mining stocks, and actually want leverage on gold, make sure the miners you’re looking have the lion’s share of their revenue coming from gold sales.

Until next time,

Luke Burgess

As an editor at Energy and Capital, Luke’s analysis and market research reach hundreds of thousands of investors every day. Luke is also a contributing editor of Angel Publishing’s Bull and Bust Report newsletter. There, he helps investors in leveraging the future supply-demand imbalance that he believes could be key to a cyclical upswing in the hard asset markets. For more on Luke, go to his editor’s page.