I’d hate to be accused of feeding into the hype cycle, but I’ve been utterly blown away by the potential of AI recently.

If you haven't experienced it firsthand, I recommend trying your hand at (or at least checking out some examples of) the more famous and publicly accessible programs: ChatGPT and DALL-E.

Both are made by OpenAI, the breakout star of the new generative AI industry, and both are capable of artistic feats that have been reserved for humans until now.

ChatGPT can create shockingly lifelike dialogue, poems, jokes, or even a bizarre combination of all three. The only input needed is a few descriptive sentences:

DALL-E requires the same input, except it returns an impressively detailed image. For example, here’s a needlessly creepy image of Homer Simpson as Jack Torrance in The Shining:

Based on the examples I’ve seen of both programs, the only limit is the user’s imagination, however bizarre it may be.

I could talk for hours about how this is going to impact the art and entertainment industries. Stock photography in particular could potentially collapse in on itself by the end of this year.

But that’s far from the full impact of this technology. It’s hardly even the tip of this looming AI iceberg.

There’s a good reason that two of the world’s top tech firms are battling for supremacy over this stuff.

One of the major money-wasting problems AI can solve today represents an industry currently valued at about $21 billion, mostly because of the highly paid experts who keep it running.

And anytime this massive industry fails — like it did during the COVID pandemic — it will drag the global economy back to the Stone Age.

I’m talking about supply chains, the backbone of just about every business on the planet.

AI Will Turbocharge Logistics and Supply Chain Management

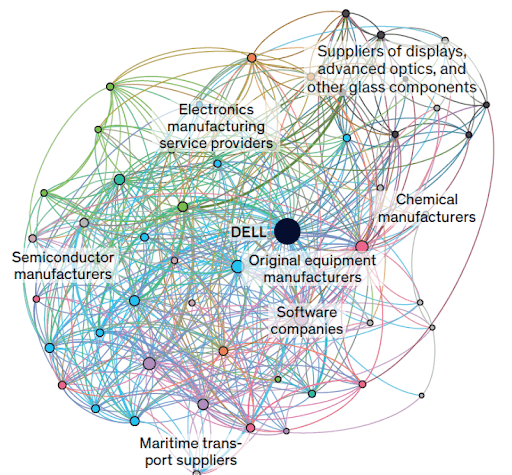

Learning a new language or making beautiful digital art is complex, I’ll admit, but have you ever looked at a diagram of a modern corporation’s supply chain?

It's a baffling web of highly detailed interconnectivity, and if even one link in the chain fails, due to anything from missed quotas to tyrannical warfare, the logistics required to get things back on track can be staggeringly difficult.

Here’s a simplified version of the supply chain for Dell, a top-tier tech company (but by no means the largest or most complex):

Now, take a quick look at that and let me know if you can pick out the most optimal path between all points.

Are there any redundancies that stick out? Or how about any simple mistakes that could cause delays as materials move from suppliers to the customer?

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

As another average human, I’ll agree I couldn't do it even if you gave me a few hours.

But for an AI program specifically programmed to dig through this vast web? It wouldn't take more than a few seconds to find even the tiniest inefficiencies.

When you ship 40 million computers per year like Dell does, even a 0.001% boost in efficiency can amount to millions of dollars in savings.

And the best part? AI isn't promising to save fractions of a percent.

According to McKinsey Research, a slightly optimistic but overall reputable research firm, adding these programs to a company’s workflow could potentially slash logistics costs by 15%, inventory levels by 35%, and service levels by 65%.

It wouldn't even require an expensive computer expert on staff — though I'm sure Dell has plenty.

In fact, it could be as simple as logging into your email. It’s an amazing equalizer between small businesses and massive corporations.

But perhaps the most critical aspect of an AI-powered supply chain system is its ability to adapt at a moment’s notice.

If there’s anything we’ve learned over the past few years, it’s that supply chains are incredibly fragile. They're made of promises and prayers instead of the usual steel.

Aside from saving companies money that was previously being left on the table, AI is smart enough to predict and respond to the type of disasters that throw humans for a loop.

From a business perspective, pandemics, world powers invading their neighbors, and the resulting shortages are all variables that can be more or less accounted for.

AI certainly can’t see the future, but it can react to the present a heck of a lot faster than even the most seasoned supply chain manager.

Don’t Worry, You’re Still in Charge — for Now

My point here isn’t to terrify readers about the upcoming AI takeover.

There will still be many years before these programs can operate in a vacuum. Smart as they may seem, today’s AI is still a slave to its human master.

But until that day comes, there’s an enormous amount of money to be made in the development phase. The valuations that these companies are getting are frankly insane.

Stability AI, for example, was valued at $1 billion while hardly posting any revenue from its free, open-source platforms.

The main driving force in this market is confidence in the technology.

AI stocks have already banked incredible returns since the start of 2022, and I don’t just mean the novelty acts that haven't realized their full potential yet.

While the rest of the industry finds its footing, we are instead focusing on the industries that stand to benefit the most from this tech.

One of the world’s most important supply chains was effectively taken offline by Russia’s invasion of Ukraine. The world is scrambling to fill in the gaps, with many turning to AI as the crystal ball.

The only solution here is a massive reorganization of the world’s supply chain.

That’s rough for the struggling industry back in Ukraine, but it’s a massive boost for this tiny U.S.-based team that is hoping to become the next top dog.

It’s a relatively small company that is set to to benefit from this massive shift in demand. Its major competitors like Samsung and Texas Instruments can’t move forward without a supply of this critical gas, but our current pick had already solved that problem before it began.

There’s much more to be said than I can include here. To get the full story, check out this free research report by our resident market expert Keith Kohl.

The information is incredibly time-sensitive, so don’t wait until tomorrow. We’re not sure how long it will take for the rest of the media to hop on the bandwagon.

To your wealth,

Luke Sweeney

Contributor, Energy and Capital

Luke’s technical know-how combined with an insatiable scientific curiosity has helped uncover some of our most promising leads in the tech sector. He has a knack for breaking down complicated scientific concepts into an easy-to-digest format, while still keeping a sharp focus on the core information. His role at Angel is simple: transform piles of obscure data into profitable investment leads. When following our recommendations, rest assured that a truly exhaustive amount of research goes on behind the scenes..