In the wake of COVID-19, gold has soared in popularity as an investment asset.

According to the World Gold Council, gold-back ETFs realized record annual inflow during the first half of 2020. Meanwhile, some traders see gold penny stocks as the next big Robinhood user fad. Crescat Capital’s global macro analyst Otavio Costa says, “Wait until the Robinhood traders learn about the gold and silver penny stocks, that’s where we’re long.”

Bank of America says gold will smash through all-time highs within the next six months. Goldman Sachs believes gold will reach $2,000 an ounce in a year. Others are already calling for $10,000 gold.

Everyone loves gold. To learn more about why everyone thinks gold is set to break records, click here.

But what about silver?

In certain circles, the debate over gold and silver is more heated than politics. Friends have been lost and enemies have been made.

But at the end of the day, to compare gold and silver is to compare apples and oranges — though not exactly as the idiom implies. Apples and oranges can be compared: They’re both fruits. In the same way, gold and silver can be compared: They’re both precious metals. Thing is, one is more precious than the other.

There’s no doubt gold and silver are physically related. The two metals are chemically similar to each other –– more similar to each other than to most other elements. They even sit right next to each other on the periodic table. In fact, all four precious metals are lumped together:

Gold and silver are similar, but they are not equal. Just looking at the two metals would tell you that.

Aside from the obvious though, gold and silver have different physical properties. For example, gold will never oxidize –– aka rust. Silver, on the other hand, will turn black with oxidation over time.

Another example: Gold is a good electrical conductor. But silver is a better electrical conductor than gold.

Gold is also much rarer than silver. Some estimates put silver at over 60 times more abundant than gold in the Earth’s crust.

The abundance of above-the-ground gold and silver supplies, however, is a different story. Because gold is recycled at a much higher rate than silver, there is more gold above ground than silver. Some estimate gold is five to seven times more abundant above ground than silver.

For investors considering precious metals, however, the most important difference between gold and silver is demand.

Very broadly speaking, people buy gold and silver for two reasons:

- To hold them as a monetary asset.

- To use them as an added-value component.

Those who buy gold and silver as monetary assets do so through bullion investment, either with an ETF or physical coins and bars. Typically, investors hold gold and silver as wealth storage vehicles or as a hedge against some kind of monetary problem, whether it’s inflation, interest rates, or something else.

But I’d also argue people buy gold and silver as monetary assets with jewelry purchases. That’s because jewelry is, most certainly, a way to show off wealth.

Those who buy gold and silver to use them as an added-value component, on the other hand, generally use them in some industrial applications – mostly for electrical and electronics.

So when you break it down, after gold and silver are pulled out of the ground, they’re used in either one of two ways: as a monetary asset or as an industrial metal.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to is join our Energy and Capital investment community and sign up for the daily newsletter below.

But their end use is not equal.

And here’s the most important part for investors…

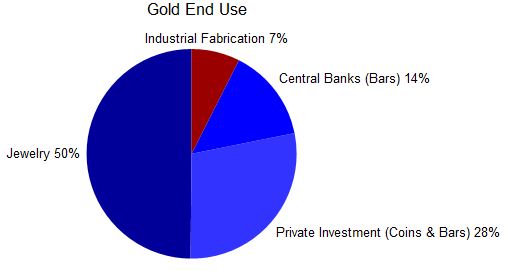

Over 90% of gold demand comes from the jewelry industry or as some kind of investment, either from retail consumers, institutional investors, or central banks. So nine out of every 10 ounces of gold is held as a monetary asset, including jewelry. Here’s how gold’s end use breaks down.

Silver, on the other hand, is a much more industrial metal. According to the World Silver Institute, 56% of silver demand comes from industrial fabrication, which includes electrical, electronics, brazing alloys, solders, photovoltaic, and other industrial applications. These rest comes from jewelry, investment, and silverware, which I also consider very similar to jewelry. Here’s how silver’s end use breaks down.

Considering gold and silver’s end use is important because what’s good for one metal isn’t always good for the other. During a recession, financial uncertainty might push the demand for gold and silver as a monetary asset higher. At the same time, the accompanying drop in consumer spending during a recession might also lead to lower demand for the metals as industrial components. That reduction in industrial demand would affect silver’s overall demand more than gold’s.

At the end of the day, I think about gold and silver like this…

Gold is about 90% precious metal and about 10% industrial metal.

Silver is about 50% precious metal and about 50% industrial metal.

But of course, that could always change.

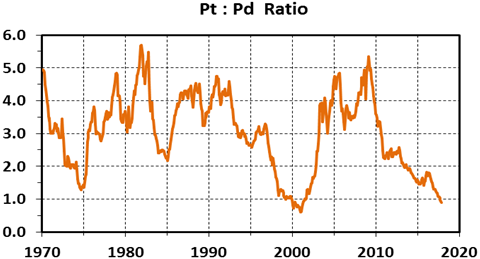

Gold and silver demand isn’t set in stone. Silver prices could increase so much that manufacturers begin to use cheaper alternatives –– thus lowering silver’s industrial demand and raising its status as more of a precious metal. In fact, that sort of thing happens quite frequently in the auto industry.

The number one application by a wide margin for both platinum and palladium is in autocatalysts. Approximately 85% of all the platinum and palladium mined and recycled right now ends up being used in a single application: catalytic converters.

As catalyst materials, platinum and palladium work well to absorb harmful hydrogen and carbon emissions –– so autocatalyst makers can use either as the main catalyst material in their products. And they do, use both. But not at the same time.

To save on manufacturing costs, autocatalyst makers will choose the less expensive between palladium and platinum to use in their products. If one gets too pricey, they just switch to the other. This is very clearly reflected in a long-term inverse price relationship between palladium and platinum.

So it’s not that silver can’t be gold. Silver could be just as much of a precious metal as gold, even if it’s much more naturally abundant and has different chemical and physical properties that make it naturally less intrinsically valuable. But for now, that’s only what could be.

For now, I think gold is still king. Certainly, silver has more upside. Between 2011 and 2013, silver traded for over $30 an ounce, peaking in 2011 at almost $50 an ounce.

With silver trading at just $19 an ounce right now, a move to only $30 an ounce would result in a 50% gain. For gold to gain 50% from today’s prices, it would need to increase to $2,700 an ounce. And in the short term, at least, the former might seem like an easier move.

Here’s the best part though: You don’t have to choose.

You can own both gold and silver. In fact, it’s advisable to do so.

Whether you want to own one metal more than the other is up to you. But a good precious metal portfolio includes both gold and silver. For more on exactly why we believe gold and silver are headed much higher, click here.

Until next time,

Luke Burgess

As an editor at Energy and Capital, Luke’s analysis and market research reach hundreds of thousands of investors every day. Luke is also a contributing editor of Angel Publishing’s Bull and Bust Report newsletter. There, he helps investors in leveraging the future supply-demand imbalance that he believes could be key to a cyclical upswing in the hard asset markets. For more on Luke, go to his editor’s page.