Well, I think we can say it officially happened…

The price of gold increased to $2,000 an ounce for the first time in history.

And despite hitting its head on the ceiling, all signs are still pointing to higher prices from here.

Shaking off profit-taking in the Western markets yesterday, gold for December delivery (the most active futures contract) increased to $2,005.40 per ounce last night.

As I mentioned on Monday, a significant jump in gold prices following the Fed’s interest rate meeting could be the spark on the fuse that skyrockets gold prices. And I think that’s exactly what $2,000 gold right now is telling us.

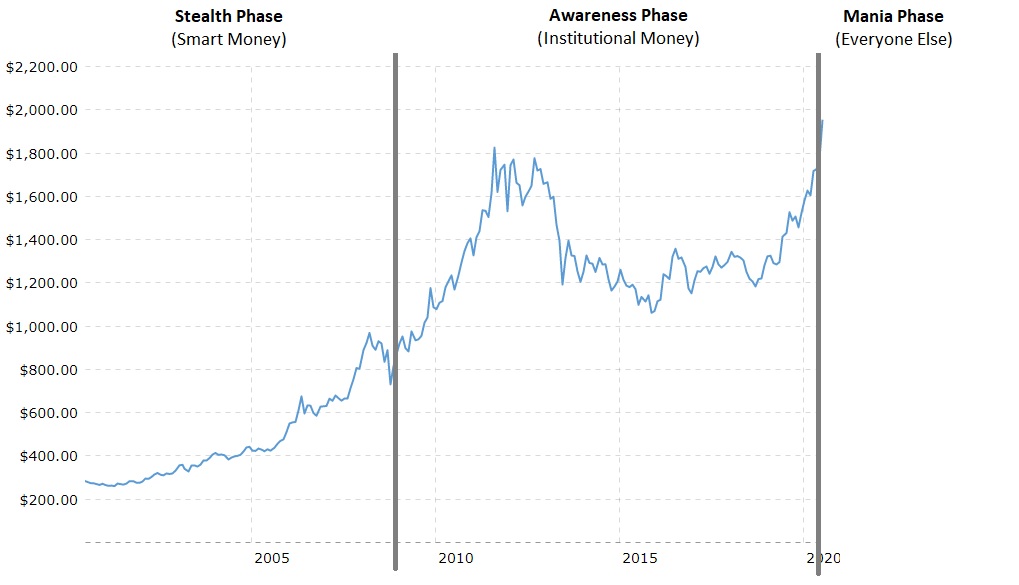

What most people don’t understand about gold bull markets is they’ll typically unfold in stages. And looking at the market’s path through these stages makes gold more predictable than many other assets.

The first stage is long and mostly boring. In this stage, a very small group of investors working independently around the world begins to notice fundamental forces that could drive gold prices higher. Those forces could be the threat of inflation, the next recession, competitive currency devaluation, or any number of social or economic issues.

This is the best time to be a gold buyer… if you have the patience to wait it out. But that doesn’t really matter now. Because we’re way past the first stage of the gold bull market at this point.

In the next stage, the world’s central banks and institutional money realize, Gee-whiz, those nutty gold bugs were right, and begin buying gold themselves.

We have been watching central banks grow their gold stockpiles for years now. And we just saw a major run to gold by fund mangers following the COVID-19 outbreak. The commodity desks of almost every major financial institution have predicted gold over $2,000. And some, like Goldman Sachs, are now revising their projections higher.

Right now that stage is just wrapping up. But it really isn’t until the third and final stage of a gold bull market that things get crazy. That’s when everyone else is buying gold.

And we’re just now starting to see that happening!

Scrolling thorough the news this morning, I found an article by local Fox affiliate KVVU-TV in Las Vegas titled “Precious Metal Dealers Struggle to Keep Silver, Gold in Stock.” In the article, Mr. John Jankowski, owner of Las Vegas Coin Company, is quoted saying:

I can’t keep enough material in stock… Now you have middle-class America realizing, “You know, my money may not be worth anything in just a very short period of time”… Eighty percent of our buyers are now first-time buyers or second-time buyers versus the clients that have been coming to us for years.

What Mr. Jankowski is seeing is the beginning of everyone else buying gold — the beginning of the mania stage.

The demand for safe-haven gold swells like a wave throughout the entire run of the bull market starting with a small group of smart investors, then growing in both size and influence with central banks and institutional money, and then finally with the rest of the public.

That’s when gold prices skyrocket.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

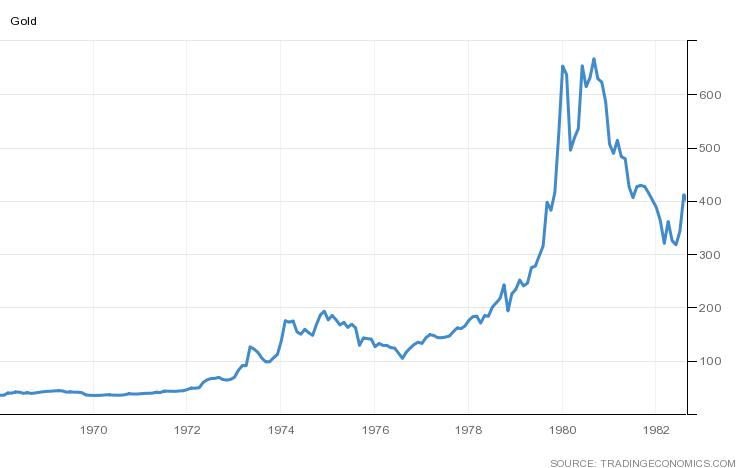

During the final stage of the great gold bull market of the 1970s, the average monthly gold price increased over 500% from its low in August 1976 to an inflation-adjusted peak of nearly $3,000 in January 1980.

1970s Gold Bull Market

An equivalent increase from gold prices starting December 2015 — gold’s lowest price in over a decade — would take the yellow metal to almost $6,500 an ounce.

Gold Price 2000–Present

Will gold really go to $6,500?!

Well, it’s certainly not out of the realm of possibility. Some are now predicting up to $15,000 an ounce. But there are a few things that are important to remember when talking about such lofty gold prices.

First is the fact that the world’s most powerful organizations are (and have been for decades) working against private gold ownership. And that’s simply because gold is a competitor to their product: fiat currency.

Of course, central banks don’t mind owning gold themselves. But they most definitely don’t want you to hold a competing product as much as Coke doesn’t want you to buy Pepsi. And they’ll do whatever it takes to discourage private gold ownership — including manipulating gold’s price lower.

And there’s the rub.

Gold and silver price manipulation is real. Back in 2016 the German Deutsche Bank was accused of manipulating gold prices and agreed to pay $60 million in a settlement with investors. More recently, the U.S. Department of Justice began to build a criminal case against JPMorgan for rigging precious-metals futures with employees already pleading guilty.

Manipulating gold prices down or flat will work to discourage demand. Central banks knows this. And if they really want to discourage private gold ownership (and they do), market manipulation is one of many tools in their chest to accomplish that.

That leads into the next most important thing to remember about lofty prices…

Skyrocketing prices of any asset are usually followed by a crash. Think of Bitcoin, real estate, dot-com… anything really.

Wait… am I saying gold prices will be a bubble?!

Sure, whatever works for you.

There are a lot of negative associations with the term “market bubble.” My only guess is that’s because the last thing you generally hear about a market bubble in the media is from the “I told ya so” crowd. Nevertheless, timed correctly, market bubbles make millionaires.

Point is, don’t get greedy. If you’re a gold owner and are sitting on a big profit, take it. Chances are gold prices in the several thousand dollars won’t last long. That’s not only because there are powerful forces working against gold but also because there’s always someone else taking his profits first. And if you wait too long, there’s not going to be any meat left on the bone.

We saw this happen following the great gold bull market of the 1970s. The price of gold crashed just as fast as it peaked. And then gold sat flat for the next three decades.

Gold Price 1970–Present

We believe gold prices are just on the cusp of taking off right now. But take your profits when you have them, folks.

Until next time,

Luke Burgess

As an editor at Energy and Capital, Luke’s analysis and market research reach hundreds of thousands of investors every day. Luke is also a contributing editor of Angel Publishing’s Bull and Bust Report newsletter. There, he helps investors in leveraging the future supply-demand imbalance that he believes could be key to a cyclical upswing in the hard asset markets. For more on Luke, go to his editor’s page.