Our favorite eccentric billionaire just announced what could be his most lucrative venture to date.

Tesla is reportedly planning a historic first for North America. As early as the fourth quarter of 2022, the company will begin construction of a battery-grade lithium hydroxide refinery.

It’s the only logical next step for a company hell-bent on conquering the EV industry.

Tesla has already gifted the world a new generation of battery cells. BMW is reportedly forking over billions of dollars to add the new Tesla 4860 cell into its upcoming Neue Klasse EVs.

The new refinery is slated to enter commercialization by the end of 2024 — an ambitious timeline if I’ve ever heard one. At that point, Tesla will control the only local supply on the continent.

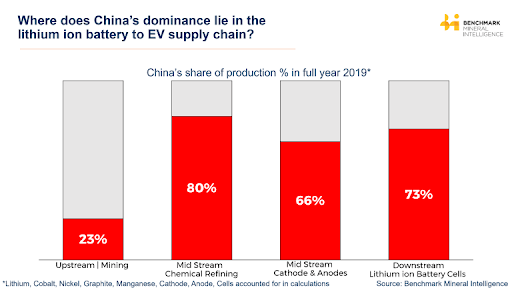

Unsurprisingly, China currently dominates the lithium refinery market. More than 75% of all battery-grade lithium hydroxide is processed in CCP-controlled facilities.

But transporting millions of tons of lithium back and forth across the planet is expensive, and shipping prices have been unacceptably volatile in the past few years.

As lithium prices surge, it’s getting less and less profitable to send raw lithium on weeklong journeys into hostile territory. That’s where Tesla comes in.

If all regulatory hurdles are properly cleared, the new facility will be located in Texas near the Gulf of Mexico. It’s a stone's throw from South America’s famed Lithium Triangle, home to 58% of the planet’s raw lithium mining.

From a supplier’s standpoint, that decision becomes incredibly easy: pay a fortune to ship raw lithium to China, or send it a few hundred miles to Texas?

Like Musk told investors in a recent financial report, this new facility is Tesla’s license to print money.

Behold, Your Tax Dollars at Work

His wording couldn't have been more accurate. Musk was most likely referring to the tried-and-true method of “printing” money: siphoning it from taxpayers.

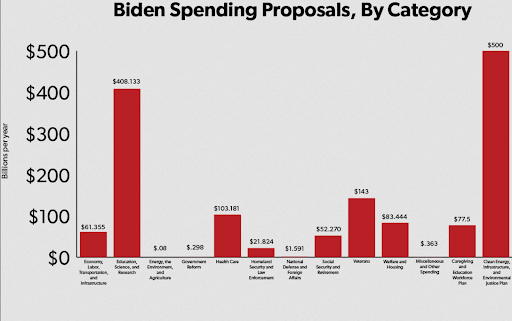

Biden’s new Inflation Reduction Act has billions of dollars earmarked for building up critical industries. If he really believes that every American will be driving electric cars in the next decade or two, lithium refining is an obvious choice.

I genuinely can’t overstate how big this is not just for Tesla but for the entire lithium industry.

The U.S. makes enormous amounts of money from refining oil into all its various derivatives: gasoline, diesel, plastics, Vaseline, asphalt, and dozens more.

On the other hand, the U.S. lithium economy is practically nonexistent.

U.S. companies design batteries and occasionally put them in cars, but there’s hardly a single functioning mine to speak of. The closest refineries are either Chinese-controlled operations in Chile or newly built facilities in Europe.

EV usage is expected to skyrocket in the next few years. According to just about every market analyst on Earth, that’s practically a guarantee.

If the U.S. doesn't start getting ready to grab a piece of it, all that money is going straight to China. Biden is essentially dangling a billion-dollar carrot, and Tesla is more than happy to chase it.

Despite how it may sound, the takeaway from this isn't to go buy TSLA shares — though this is an incredibly bullish situation for the company.

No, the real moneymaking opportunity hidden here is with the tiny companies that are the face of the blossoming U.S. lithium industry.

It’s not a mining company, nor is it a competitor to Tesla’s refinery business. It’s something arguably far more important.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

We never spam! View our Privacy Policy

You’ll also get our free report, “3 Blue Chip Dividend Stocks to Double.”

The Current U.S. Lithium King Doesn’t Even Make Lithium

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Producing battery-grade lithium requires a few simple steps.

First, raw lithium is extracted from metal-rich brine and evaporated in large pools. The resulting lithium salt contains close to 18% of the precious elemental lithium.

To refine the material into pure, battery-grade lithium hydroxide, it is combined with sulfuric acid and sodium hydroxide in industrial mixers. Electrochemical processing then removes any stray chemicals from the silvery-white powder.

The process can be incredibly energy-intensive and environmentally destructive, but it’s one of the only ways to get high-quality lithium.

At least, it was the only way… until a U.S.-based company figured out how to completely recycle nearly 99% of all lithium content in spent batteries.

It’s a patented process that even Tesla can’t touch. But why would it want to? The lithium recycling industry is a perfect complement to Tesla’s business model.

All that funding has to go somewhere. Where do you think Biden’s billions will go?

To your wealth, Luke Sweeney Luke’s technical know-how combined with an insatiable scientific curiosity has helped uncover some of our most promising leads in the tech sector. He has a knack for breaking down complicated scientific concepts into an easy-to-digest format, while still keeping a sharp focus on the core information. His role at Angel is simple: transform piles of obscure data into profitable investment leads. When following our recommendations, rest assured that a truly exhaustive amount of research goes on behind the scenes..

Contributor, Energy and Capital