Let me introduce you to Mr. Henry Jackson Morton (1836–1902)…

Mr. Morton was the son of a reverend who became a scientist. And he’s remembered for two things:

- He was the first president of the Stevens Institute of Technology.

- He made one of the worst scientific and market predictions in history.

In 1879, when Thomas Edison invented the first successful electric light bulb, it was surprisingly met with a lot of professional criticism.

And Mr. Morton was among Edison’s biggest critics.

Refusing to accept this newfangled doodad, Mr. Morton wrote in December 1880 that Edison’s electric light bulb was “a conspicuous failure, trumpeted as a wonderful success… a fraud upon the public.”

He called the light bulb a fraud.

Fortunately for Edison and the rest of the world, the light bulb was backed by smart investors like J.P. Morgan and William Vanderbilt.

Today, there is similar criticism about electric vehicles, Elon Musk, and Tesla. In fact, the CEO of Murray Energy, the largest coal miner in America, even said on CNBC, “Tesla is a fraud.” But sales of electric vehicles suggest the market believes otherwise.

Here in America, sales of electric vehicles have grown at a 32% compound annual growth rate (CAGR) over the past four years.

And globally, growth has been even stronger. Since 2013, global EV sales have increased about 400%!

But the electric car revolution is only getting started.

Fueled by a decline in production costs, increasing public demand, zero-emission regulations, and government incentives, the global EV market is expected to grow at a CAGR of close to 23% through 2021. The IEA says:

Assessments of country targets, original equipment manufacturer (OEM) announcements and scenarios on electric car deployment seem to confirm these positive signals, indicating a good chance that the electric car stock will range between 9 million and 20 million by 2020 and between 40 million and 70 million by 2025.

Is Elon Musk the 21st Century Thomas Edison?

It’s a bit ironic to compare Elon Musk to Edison.

Thomas Edison’s primary rival was inventor and electric pioneer Nikola Tesla, after whom Mr. Musk’s company is named. But, irony aside, there really are some strong similarities between the electric vehicle and light bulb revolutions. Consider this…

Before the light bulb, the main source of lighting was fire. Whether by way of a candle, oil lamp, gas lamp, or fireplace, people used combustion for light. But then Edison’s bulb replaced combustion light with electric light.

Today the main type of vehicle engine is also combustion-based. In most engines today, a fuel (usually gasoline) and air mixture is compressed by a piston, then sparked, causing combustion and creating power stroke. But soon fully electric motors will replace the combustion engine the same way the electric light bulb replaced the fire.

The electric vehicle revolution is happening right in front of our eyes. Soon, everyone is going to have one.

And today’s investors will be the beneficiaries of major gains.

But there’s one side sector to the electric vehicle market that’s set to grow even faster than car sales from here…

Twice as fast, in fact…

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

This Obscure EV Market Is Set to Grow 2x Faster Than Auto Sales

Just like cars with combustion engines, electric vehicles need to be refilled… or rather recharged. So, charging stations are needed to supply power to recharge the batteries.

Right now, EV charging stations are nowhere near as common as traditional gas stations. But with the electric motor set to replace gas engines, the electric vehicle charger market is positioned to absolutely explode.

According to two recent reports, the global electric vehicle charger market is set to grow at a CAGR of about 45% over the next few years.

- Research and Markets of Dublin, Ireland, says the world EV charging market will grow at a 43.7% CAGR between 2017 and 2021.

- Grand View Research, Inc. of San Francisco, CA, believes the global EV charger market will grow at a CAGR of 46.8% from 2017 to 2025.

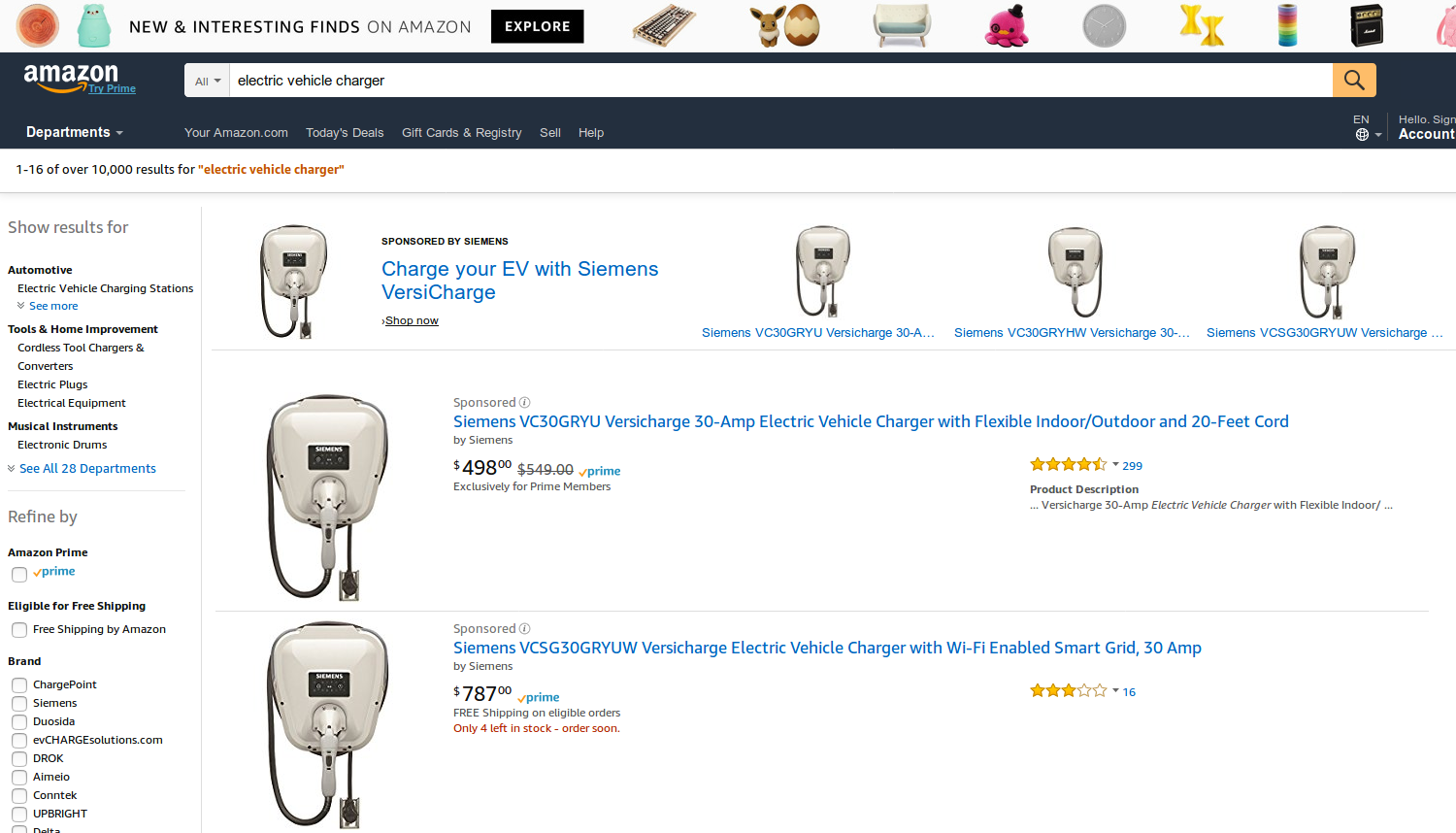

Right now, Siemens (OTC: SIEGY) seems to have the EV home charging market on lockdown. Just take a look at this screenshot from Amazon when searching for “electric vehicle charger.” Every single unit on the first page is produced by Siemens:

Other big-name companies are fighting for market share, including ABB, Ltd. (NYSE: ABB) and even the company founded by Thomas Edison himself: General Electric (NYSE: GE).

Manufacturers are constantly upgrading the capacity of batteries and the technology of EV charging outlets. And the next trend of EV charging technology is wireless.

Mercedes-Benz has already begun offering wireless charging on the Mercedes-Benz S500e.

Imagine: In the future you won’t even need to plug in for a recharge. Just pull up and get out.

But that’s tomorrow. Today you can position yourself ahead of the crowd with an easy investment in the electric vehicle market.

I like how Energy Investor editor Keith Kohl put it to me. He said, “Luke, the electric vehicle market is going to produce two kinds of investors: those who become wealthy, and those who become jealous.”

Keith recently put together an entire presentation on this explosive market, which you can check out here. In the report, he explains in much fuller detail the opportunities in an under-the-radar material that’s even more crucial to electric vehicle batteries than lithium.

I highly urge you to view this presentation as soon as possible and act today.

Again, this is an opportunity you’re not going to want to miss out on. We’re sitting at the dawn of a major paradigm shift. The revolution is happening now. And it won’t wait for you.

Don’t get left behind.

Until next time,

Luke Burgess

As an editor at Energy and Capital, Luke’s analysis and market research reach hundreds of thousands of investors every day. Luke is also a contributing editor of Angel Publishing’s Bull and Bust Report newsletter. There, he helps investors in leveraging the future supply-demand imbalance that he believes could be key to a cyclical upswing in the hard asset markets. For more on Luke, go to his editor’s page.