The shale gas boom has a hold over the energy industry.

The low-priced fuel is beginning to take over every aspect of North American energy: it’s catching up to coal in power plant fueling, it’s working in conjunction with alternative power to increase efficiency, and it’s even starting to gain steam as a vehicle fuel.

Few might imagine natural gas could infiltrate the nuclear power industry; yet it’s starting to push even nuclear aside.

Yesterday, Duke Energy (NYSE: DUK), the largest utility owner in the country, announced it would be shutting down its Crystal River Nuclear Plant in Florida after years of attempted and failed repairs.

The plant was originally owned by Progress Energy, Inc., which merged with Duke in July 2012. It was 36 years old, but it had been offline since 2009 after cracks were found.

Two years and millions later, the cracks had been repaired, but it was not enough; new cracks were discovered in 2011. Through 2012, the company had spend $338 million on repairs, but the new damage would cost between $1.49 billion and $3.43 billion more.

During the time the reactor had been offline, customers were forced to pay higher costs for alternative power – costs they hadn’t expected. Through an insurance settlement, Duke will repay over $835 million to its customers. But this might not be enough to create good terms.

Because while it will reimburse its customers, Duke is also hoping to take back $1.65 billion from its customers to recover its investment in the plant.

A number of analysts believe the decision to close the plant is a good one, including Nathan Judge, an analyst at Atlantic Equities LLP. He told Bloomberg it was a “prudent decision,” though he also expressed concerns:

“Having said that, it leaves ratepayers with about a $1.6 billion bill and that’s going to increase scrutiny on Duke’s operations in Florida and its rates.”

The company’s decision doesn’t yet have the all-clear. Florida’s Public Service Commission must first determine that the plant’s closure is the best decision for the company and its customers. The company will also not be able to recoup its $1.65 billion investment without approval from Florida regulators.

Still, Duke does not believe it is worth keeping the plant alive. The cost of repairs won’t be able to be balanced by the low price of nuclear. And there may be a lower-cost fuel readily available, anyway.

From Businessweek:

“The fuel du jour is natural gas,” Florida Public Counsel J.R. Kelly, the state’s official advocate for utility customers, said yesterday in a telephone interview. “I personally believe in fuel diversity. I’m just afraid the costs of new nuclear are going to be prohibitive.”

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Duke, it seems, shares these sentiments. Its top consideration for replacement power is, as USA Today reports, a natural gas-fueled power plant.

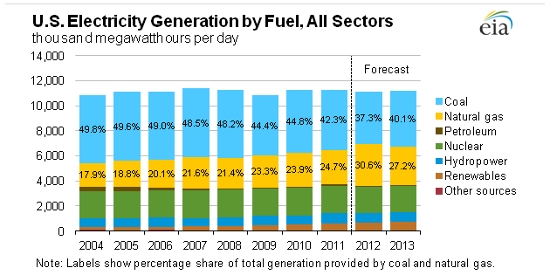

Natural gas-fired electricity plants are starting to overtake coal-fired plants to become the norm in the United States. Last year, the EIA estimates, electricity generated by natural gas rose to 30.6% from 24.7% a year earlier. Meanwhile, coal-fired generation fell to 37.3% from 42.3%.

The EIA expects this major shift to correct a bit this year, as you can see in the chart, but over the long term it is quite possible that natural gas could become the main generator of electricity, particularly as climate change concerns continue the move away from coal use.

That’s not to say coal use will disappear globally; China and India are major coal consumers, and this will grow in the years to come. That’s good news for U.S. coal miners that export to these locations.

But the shale gas boom has brought forth a cleaner burning, abundant energy source that companies are scrambling to use. The risk is much lower than with nuclear plants, where cracks are the warning signs for major problems.

And when it comes to building a whole new plant, companies are likely to skip the expense and safety measures that come with new nuclear plants. Instead, natural gas looks much more attractive.

As for price, it’s one of the cheapest sources available. Duke’s customers may be a little more forgiving.

That’s all for now,

Brianna Panzica

Energy & Capital’s modern energy guru, Brianna digs deep into the industry with accurate and insightful updates into the biggest energy companies and events. She stays up to date with the latest market moves and industry finds, bringing readers a unique view of current energy trends.

@brianna_panzica on Twitter

@brianna_panzica on Twitter