Bitcoin is without a doubt one of the most volatile investments currently on the market. But through all of Bitcoin’s ups and downs, there has been at least one dependable consistency: The conversation about Bitcoin has always included gold.

The conversation about Bitcoin still includes gold. This is evident in the number of times Bitcoin and digital currency appear on gold news aggregate websites like Kitco and in countless editorial, tweets, and comments linking gold to BTC in some way.

So what’s the deal? Are Bitcoin buyers interested in gold? Or are gold buyers interested in Bitcoin?

Well, the truth is Bitcoin actually has its roots in gold.

Bitcoin was invented by an unknown programmer and released as open-source software in 2009. But the architecture for Bitcoin was actually conceptualized more than a decade before. And the guy who got the ball rolling was a gold bug.

In 1998, a computer scientist named Nick Szabo designed a mechanism for a decentralized digital currency he called “bit gold.”

Under Szabo’s plan, a bit gold miner would dedicate energy in the form of computer power to solving cryptographic puzzles. When a puzzle was solved, it would then become part of the next challenge. This created a growing chain of new property.

Bit gold was never implemented. But Szabo’s system was the precursor to distributed ledger technology like Bitcoin’s blockchain. He said:

I was trying to mimic as closely as possible in cyberspace the security and trust characteristics of gold, and chief among those is that it doesn’t depend on a trusted central authority.

And that’s exactly how Bitcoin and gold are irrevocably connected: We can consider both Bitcoin and gold forms of decentralized money.

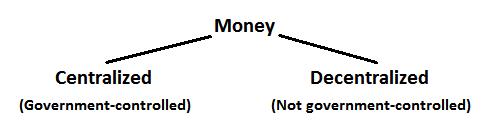

There are hundreds of forms of money. The United Nations officially recognizes 180 different currencies in the world. There are international and regional monetary reserve currencies (like SDR and SUCRE) and now over 700 different digital currencies (mostly “alt-coin”). But all of these forms of money can generally be divided into two categories: centralized and decentralized.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Now, the theoretical roots of decentralized money go back to the 1970s, mainly being defined in Friedrich Hayek’s Denationalisation of Money (1976).

According to Hayek, instead of the national government, private businesses should be allowed to issue their own forms of money. But it wasn’t until the further development of computing power and rise of the internet that Hayek’s dream was able to exist as Bitcoin and other digital currencies.

Gold isn’t exactly controlled by private or government enterprises, in that its supply is naturally finite — it can’t be created out of thin air. But the large majority of gold mining and gold ownership is privately owned. So in a very general way, we can categorize gold as a “non-government” money. And here’s how we can visualize the world’s main forms of money:

Many gold bugs are interested in the metal in part because they don’t trust government. Like Szabo, they don’t want to “depend on a trusted central authority.” So all gold bugs must love Bitcoin, right?

Not really. There are some gold bugs, like myself, who see the value in Bitcoin and blockchain technologies. But many are still extremely skeptical of Bitcoin. Some downright hate it.

I would wager that some (maybe a lot) of the criticism coming from gold bugs about Bitcoin is rooted in envy. Some gold bugs are just jealous that Bitcoin is acting the way gold should be. Perhaps it’s a situation where “the lady doth protest too much,” and some gold bugs secretly love Bitcoin.

Either way, Bitcoin and gold appear to be irrevocably connected. The conversation about Bitcoin has, currently does, and always will include gold.

Until next time,

Luke Burgess

As an editor at Energy and Capital, Luke’s analysis and market research reach hundreds of thousands of investors every day. Luke is also a contributing editor of Angel Publishing’s Bull and Bust Report newsletter. There, he helps investors in leveraging the future supply-demand imbalance that he believes could be key to a cyclical upswing in the hard asset markets. For more on Luke, go to his editor’s page.