Housing in the United States is about to launch in price and I have all the charts to prove it.

To understand home real estate, you have to know that prices are driven by two things: interest rates and demographics.

According to the Bank of England, we are experiencing the lowest interest rates in 5,000 years!

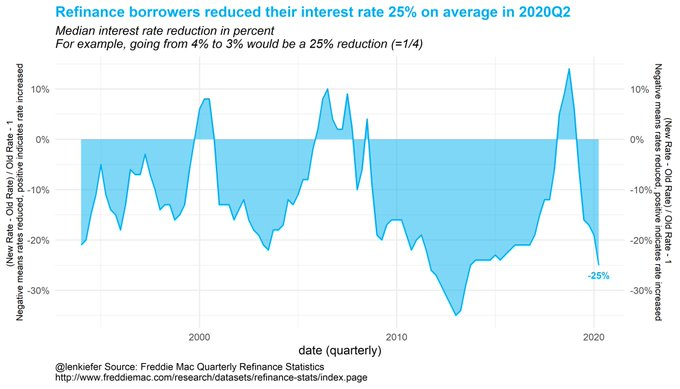

That’s a bit esoteric as we aren’t building in Rome, but I recently saw a 15-year mortgage rate tick by at 2.25%. That’s amazingly low. It also means that people can refinance, save money, and take out cash.

The last time that happened, the economy boomed.

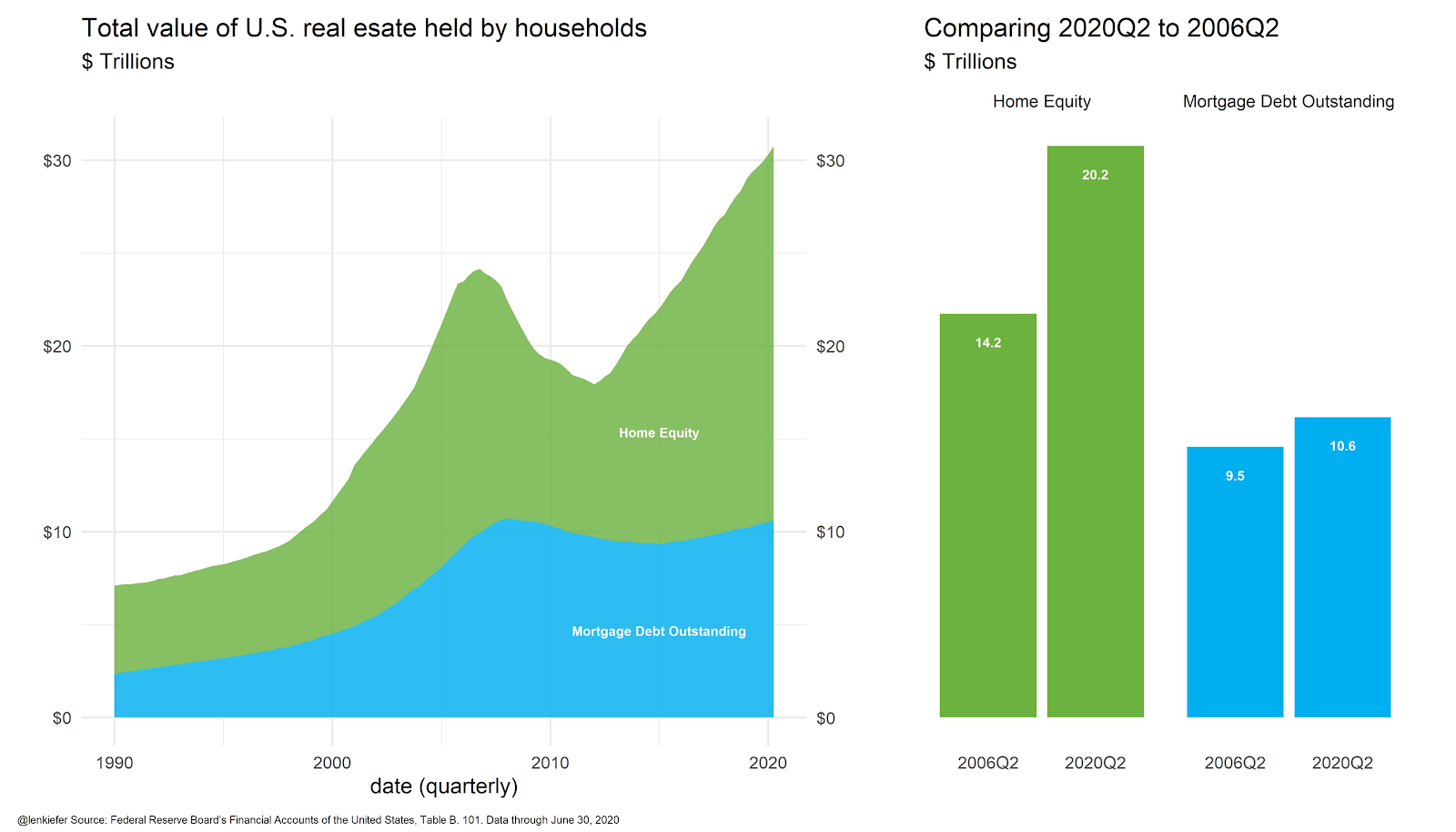

And what the scaremonger/clickbait press won’t tell you is that people own more of their houses than they have in decades. Check out the huge chunk of equity people are sitting on:

A lot of this has to do with people staying in their houses longer, and for good reason. Property tax rates get locked in. What is the benefit of selling your million-dollar house that costs $10,000 a year in property taxes only to pay $20,000 a year on an $800,000 house? If that’s downsizing, who needs it?

Furthermore, many people no longer have to move for a job. And houses are huge now. Who wants to move all that junk?

More equity means there is a lot of money to spend on remodeling, buying new cars, boats, and RVs. I mean, as long as you are refinancing, you might as well take out some cash… Am I right?

In addition, credit scores are awesome:

It’s been over a decade since the Great Recession. Those bankruptcies are off the books. Furthermore, the personal savings rate is at historic highs. The personal savings rate spiked 33% in April alone, though it came down to a 10% increase in July.

Back in the mid-2000s, the savings rate was negative.

Demographic Is Destiny

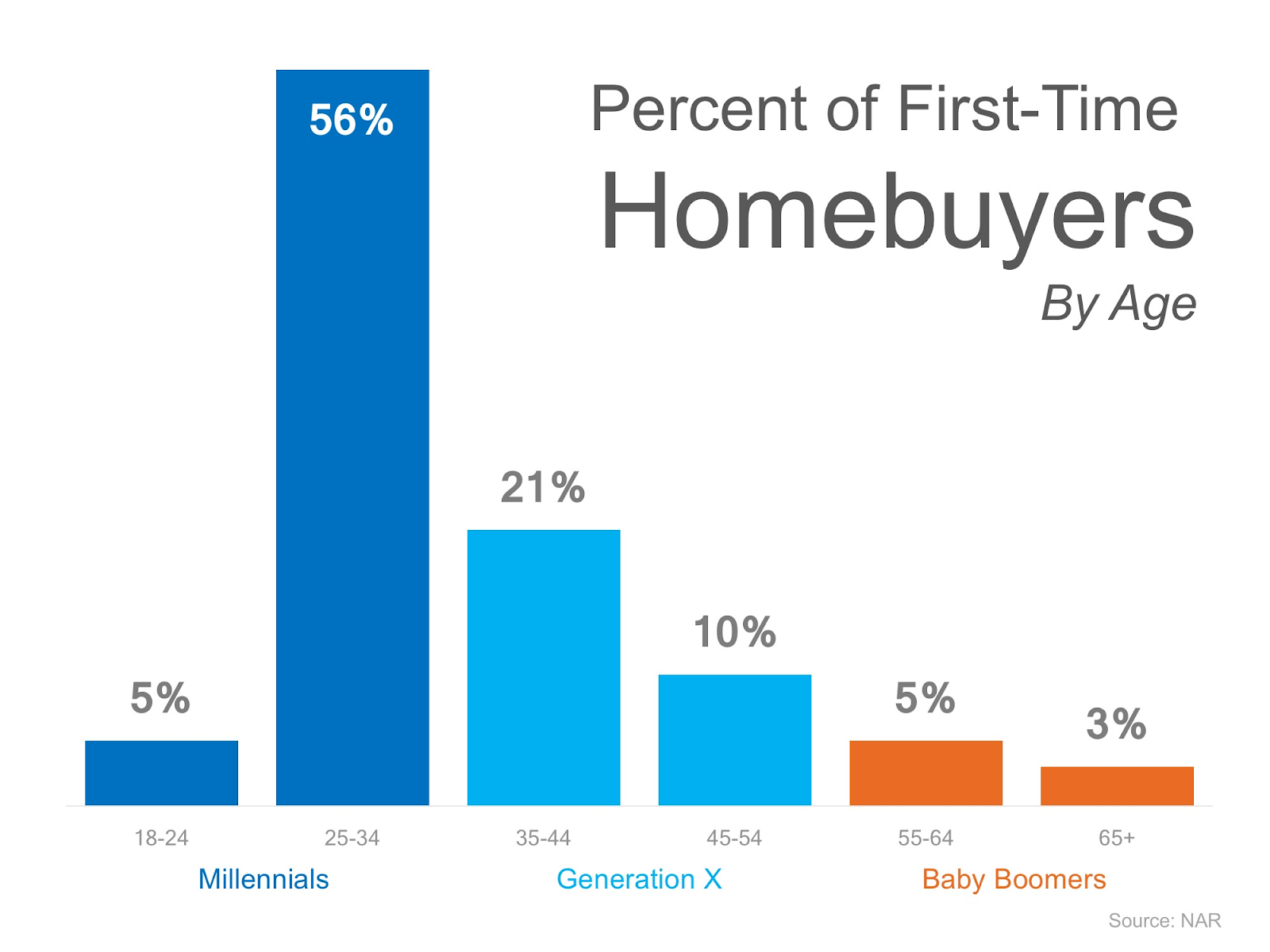

The other half of the 2020s housing boom will be demographics. People in their late 20s and early 30s buy houses. We call these people “millennials” because we are creatively bankrupt as a society.

Millennials make up the largest 10-year segment of the population in the United States. Their bulge bracket is right now between the ages of 24 and 34. When humans are in their late 20s, they get married and start having babies.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

As a single man, I could have lived in my two-room apartment for the rest of my life. I didn’t care; I had everything I needed. However, once I got married and had children, it was time to pack up and move to the country for more room, a fenced-in yard, and better schools.

It’s built into our DNA. But the problem is the inventory of houses for sale is low.

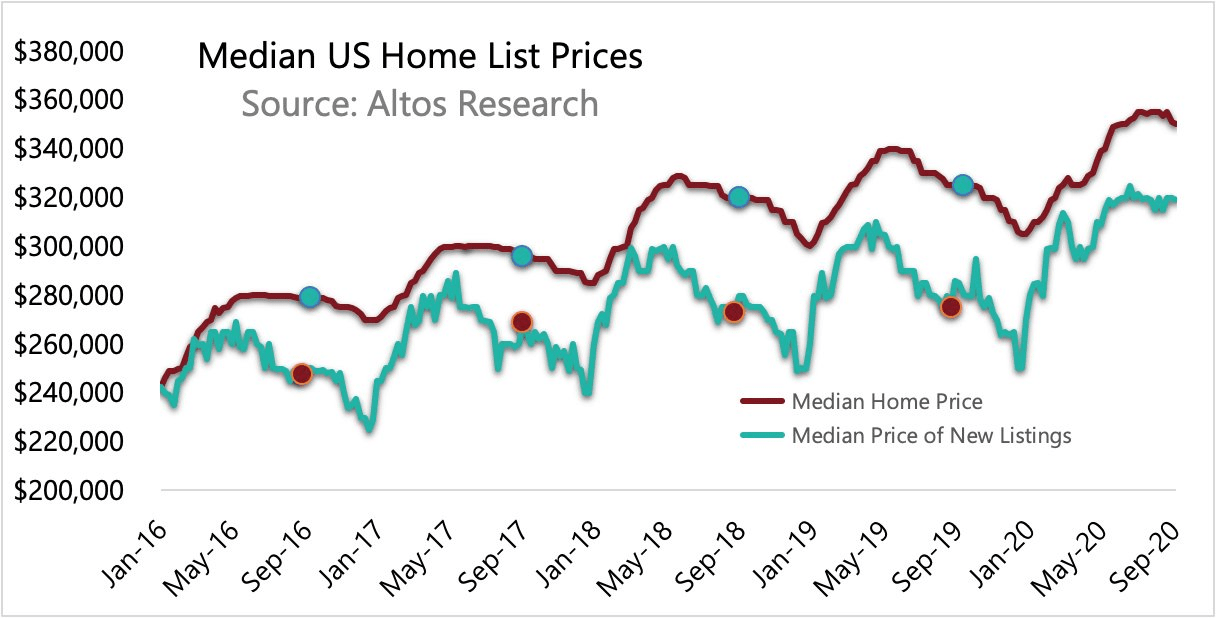

And given the laws of supply and demand, housing prices are climbing higher:

As a result, home construction and sales have rebounded quickly from the March sell-off.

Housing starts were up for three months before taking a breather in August due to a 5% drop in multifamily units.

Single-family starts were still up 4.1% in August to 1.021 million. Existing home sales — the cheaper ones younger people buy — were up by 24.7% in July. That was a second-straight record month.

But wait, it gets better for housing bulls.

Inventory won’t pick up. After the Great Recession, builders simply didn’t build enough houses. There are 5 million–6 million houses not built compared with the growth of new households formed.

And as I said before, homebuilders must deal with the high cost of land, record lumber prices, and a dearth of labor.

There you have it. Interest rates are at 5,000-year lows. Our biggest population cohort is entering homebuying/family formation years, and there is a massive shortage of housing.

Don’t buy the builders. Other companies that supply the needs to new homeowners will do better. Companies like Sherwin-Williams (NYSE: SHW) are up 80% in the past six months. Home Depot (NYSE: HD) is up 35%. Wayfair (NYSE: W) is up a whopping 518%.

In my next issue of Bull and Bust Report, I will tell you my favorite stock to own for the next real estate megatrend.

All the best,

Christian DeHaemer

Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.