Patience is a virtue.

I try to remind myself of this every so often.

Unless you’re planning on looking at a chart every 30 seconds, then buying and selling your position within the span of a few hours, patience is an absolute necessity.

Let’s leave the day trading for the herd.

We have better things to do with our time, don’t we?

I’m not talking about those set-it-and-forget-it, multi-decade holds, either. You know, the ones that make Warren Buffett stand at attention. Although they have their own place in your portfolio, that’s not what we’re getting into today.

If your investment horizon stretches a few years, however, you should sit up and take notice… now.

In fact, I already know you may be ahead of the curve on this one.

The question now is whether or not you see what’s about to take place with one of the best-performing commodities over the past year.

It’s a five-year test of our patience that will pay off handsomely for individual investors like us.

The Five-Year Winning Investment

Two weeks ago, we talked about how the “Apple Effect” was in full swing. What I mean by that, of course, is that major players like Apple have finally realized just how critical their supply of cobalt will be to their future success.

Come on, we both know Apple doesn’t get to ship 46 million units a year without this key material.

That’s why the world’s biggest tech and auto companies are quietly negotiating their own cobalt supply over the next few years.

Wouldn’t you?

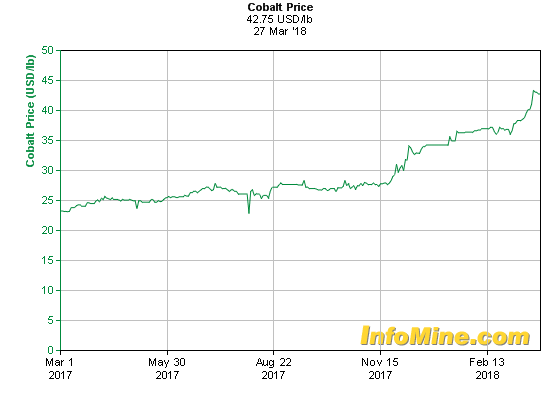

One glance at this chart of cobalt prices over the last 12 months, and you can’t blame Tim Cook for making his move now, before it’s too late:

We can’t help but ask, what’s next for the goblin metal?

According to Macquarie Bank’s latest outlook for commodities, the five-year investment horizon for vital battery metals like lithium and cobalt will be in a very profitable part of their cycle.

As you can see below, Macquarie believes the next two years could be tight — even bearish — for cobalt, as prices peak and the market starts to balance.

Again… their outlook, not mine.

Any investor who takes a look at what’s happening right now in the cobalt market can see the supply issues that are going to throw a wrench in the works.

And I think the market is sorely underestimating the supply issues at hand.

The Cobalt Crisis Ahead

The moment the Democratic Republic of the Congo, a hell on Earth where the world gets two-thirds of its cobalt, declared that cobalt was a strategic metal, I knew we were headed for trouble.

That’s more than 81,000 tons of cobalt that flows out of the Congo.

Unfortunately for Apple, they aren’t the only ones to understand the kind of supply crunch we’re going to see over the next few years as the EV revolution hits overdrive.

It turns out China is trying to corner that market — today!

The recent deal struck between Chinese battery maker GEM and Glencore for a third of the latter’s cobalt supply between now and 2020 should be a huge red flag for companies like Apple.

Now imagine the situation we’ll be in if these companies decide to simply outright buy the small, up-and-coming producers.

Apple commands a war chest of more than $77 billion.

Tesla is sitting on over $3 billion in cash… and still clings to the hope of ramping up its Model 3 production.

Samsung built up its coffers to more than $78 billion.

OR…

What do you think will happen if China continues to make its cobalt power grab to control global supply?

Look, all it takes is just one of these catalysts to trigger another price surge and throw Macquarie Bank’s forecast out the window.

And if that happens, dear reader, it’s going to send this $1.50 cobalt stock parabolic.

However, I don’t want you to take this opportunity on a whim. Inside my latest investment presentation, I’ll give you the full details behind this explosive situation (click here for free access to my presentation).

The next step is up to you.

And this will get you started.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.