It was about 3,000 years ago, in what would become the city of Fushan in northeastern China, that the first-ever coal mine opened and produced coal.

The Chinese used the coal for their energy needs, and thus began the Age of Coal.

Indeed, Fushan was mining so much coal that the city’s nickname would become “City of Coal.”

By around the third century B.C., it began burning coal for heat, while carved coal became a trading commodity in village marketplaces.

Around 120 B.C., the expansion of the city's metallurgy industry led to mass deforestation caused by burning vast amounts of wood-derived charcoal in blast furnaces. Over the following centuries, China’s deforestation problem developed into a national environmental crisis. The solution to the loss of China’s forests was found in coal.

Coal was a vital source of energy for heat: for warmth during the winter season, to cook food, and for industrial purposes.

Again, this was during ancient times.

But guess what? Despite the nauseating bile being spewed by wealthy children gluing themselves to priceless works of art protesting the use of coal and other fossil fuels, not much has really changed.

Let me explain…

In these pages, we have expounded upon the crisis Europe faces this winter because of the war in Ukraine.

Sanctions and other restrictions have cut off European nations from lifesaving natural gas from Russia. Moreover, many European nations have gone “all-in” on green energy transitions to solar and wind, replacing the traditional energy forms of coal, gas, oil, and even nuclear.

Now they find themselves stuck with no viable alternative.

A Black Winter Is Coming

The U.K. just approved its first coal mine in three decades, but it might be too late as the country is staring into the abyss of a winter with severely constrained energy supplies.

According to The Guardian:

U.K. power prices have hit record levels as an icy cold snap and a fall in supplies of electricity generated by wind power have combined to push up wholesale costs.

The day-ahead price for power for delivery on Monday reached a record £675 a megawatt-hour on the Epex Spot SE exchange. The price for power at 5 p.m.–6 p.m., typically around the time of peak power demand each day, passed an all-time high of £2,586 a megawatt-hour.

Prices are surging as the weather forces Britons to increase their heating use, pushing up demand for energy, despite high bills.

Snow and ice have caused disruptions… with snow forecast for parts of east and southeast England, as well as Scotland.

The cold snap, which is expected to last for at least a week, comes as wind speeds reduced sharply, hitting power suppliers.

Live data from the National Grid’s Electricity System Operator showed that wind power was providing just 3% of Great Britain’s electricity generation on Sunday. Gas-fired power stations provided 59%, while nuclear power and electricity imports both accounted for about 15%.

The increase in power prices come amid jitters over energy supplies this winter. National Grid warned in October that a combination of factors such as a cold spell and a shortage of gas in Europe related to the war in Ukraine could lead to power cuts in the UK.

The anticipated surge in power demand will coincide with a planned use of the National Grid’s demand flexibility service between 5 p.m. and 7 p.m. The scheme pays businesses and households to cut their consumption at peak times to reduce the strain on the grid.

King Coal

Look, here’s the deal: Coal is reliable, and we have a ton of it.

And nations all across the globe are begging for American coal.

That’s why coal — as a commodity — is outperforming all others.

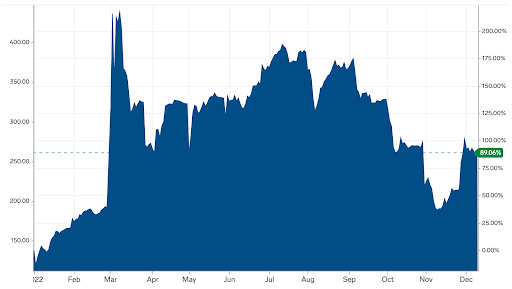

Check out these charts:

Coal, nicknamed "black diamond," is even crushing the returns on the yellow metal.

Year to date, coal is up 89% versus gold’s 0.009%.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Gold is limp compared with coal.

Even when you go back to the beginning of 2020, when a gold breakout had gold bugs wetting themselves, the yellow metal still looks limp compared with coal.

Gold is up 22% since January 2020 versus coal’s rally of 463%.

When wokesters and ESG true believers were asking me what I was investing in, I told them my No. 1 position was fossil fuel stocks (oil, natural gas, LNG) in general and Alliance Resource Partners (NASDAQ: ARLP) specifically — a coal stock.

In fact, I took my first position in ARLP in March 2020:

Today, the stock trades for $22 a share and is kicking off a sweet 9.5% dividend.

I’ve been adding more and more to my position.

And as an entire continent faces a brutal winter, energy stocks will only get better and better, including coal.

But there’s more.

You see, it’s not just Europeans who are facing a black winter.

Right here at home in the United States, the situation looks dire.

Millions of Americans will face deadly blackouts this winter…

And there’s little time left to prepare.

A quarter of all Americans are facing an energy nightmare this winter…

With power grids from the Great Lakes to Louisiana, New England, the Carolinas, and all of Texas being the most at risk for blackouts during periods of high energy demand.

Some New England residents are filling up containers of heating oil as fears of a major shortage grows. Eversource — New England’s largest utility company — is begging President Biden to use his emergency powers to ensure residents will have enough fuel to stay warm and avoid blackouts this winter.

On top of that, folks everywhere are about to see skyrocketing power bills.

The average American household is expected to pay a stunning 47% more for electricity than it did just a year ago.

Many families will be forced into a difficult decision this winter — choosing between eating or heating their homes.

We’ve put together an exclusive report just for you explaining how this disaster will unfold, what you can do about it, and the investment opportunities that will be available as this crisis grows.

It could be the opportunity of a lifetime.

To your wealth,

Brian Hicks

Brian is a founding member and President of Angel Publishing. He writes about general investment strategies for Wealth Daily and Energy and Capital. Brian is the managing editor and investment director of R.I.C.H Report (Retired Independent Carefree Healthy) and New World Assets. For more on Brian, take a look at his editor’s page.