Sometimes I think we all feel like Ron Wayne.

We all feel like we’ve lost out on the one investment that could have made us rich.

But most of us probably haven’t made a mistake that cost us $72 billion…

Ron Wayne sold his 10% share in Apple (NASDAQ: AAPL) for $500 in 1976. That share would now be worth about $72 billion.

Of course, it’s very possible that all of us would have sold out then, because 41 years ago Apple was nothing more than two guys with beards and long hair tinkering in a garage.

Today, Apple is the most valuable publicly-traded company in the world.

When was the last time you went somewhere without your smartphone? I can’t remember. It’s the first thing I pick up in the morning and the last thing I put down before bed.

Technology has changed our world completely. In just the past 15 years, we’ve jumped ahead light years.

And a few specific technologies are set to revolutionize the world again over the next decade…

Edge Computing

Remember how difficult it was to move files between computers just 10 years ago, before the advent of cloud computing?

Back in the 2000s, meetings frequently ground to a halt because someone forgot the flash drive containing their presentation, or because the file was too big to send via email, or because the office’s finicky network drive wasn’t working.

About a decade ago, cloud file storage services like Google Drive and Apple’s iCloud emerged to solve this problem by creating online “drives” where users could upload, download or edit their files from any computer with an internet connection.

In the years that followed, cloud file storage evolved into cloud computing – and next-generation cloud services like Amazon Web Services (AWS) and Microsoft Azure allowed programmers to build entire applications which ran entirely “in the cloud” (i.e. over the internet without a physical home machine).

Cloud computing is a miraculous technology which is largely responsible for the proliferation of online mobile apps. When you call an Uber, your phone isn’t actually contacting drivers; it’s simply pinging Uber’s server with your location. Uber’s cloud-based ride-hailing software then orders a car to your location, and simply provides you periodic updates through your phone.

The problem with this paradigm is that it’s rather slow and inefficient. In the Uber example above, data has to travel from your phone to an Uber server which may be located thousands of miles away, and then back. It’s no wonder cloud-based applications like Uber have a reputation for lagginess.

The next evolution in cloud computing, however, solves this problem. It’s called edge computing, and it combines the convenience and omnipresence of the cloud with the speed and reliability of localized computing.

Edge computing applications crunch any numbers which are derived from a user’s local data – their GPS coordinates, timestamp, file uploads, etc. – on their machine. They only do the computational tasks on the cloud which the user’s local machine is incapable of.

Uber has recently updated its algorithm from a cloud computing paradigm to an edge computing paradigm – in which some of the computational work of ordering a ride, such as calculating the best route, is done on the user’s phone where such data is readily available – but the more nuanced process of matching a user to a driver is still delegated to a cloud-based application running on an Uber server.

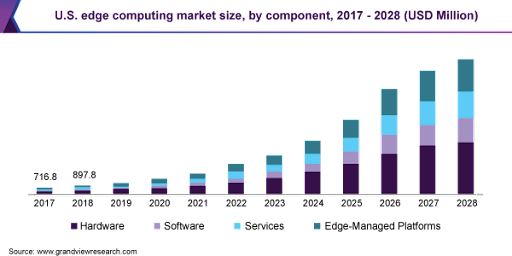

Uber isn’t the only company replacing cloud applications with edge applications. Grand View Research expects edge computing to grow at a compound annual growth rate (CAGR) of 38.4% from 2021 to 2028. And one celebrated computing stock is currently in the process of spinning off several divisions to focus on edge computing.

More on that in a moment.

Artificial Intelligence (AI)

You might remember Watson from Jeopardy. He beat out two of the biggest winners of Jeopardy ever: Ken Jennings and Brad Rutter.

Watson wasn’t a person but an AI — an incredibly complicated computer system that is made to act in ways similar to a human.

Without a doubt, AI is a revolutionary part of our future. Grand View Research expects the market for AI technology to grow at a CAGR of 40.2% through 2028.

Watson has already been tapped to work with Under Armour for health and fitness, General Motors for its communication systems, and, perhaps most importantly, Apple. iOS users will be able to use Watson in-app, and app developers will be able to use it with the creation of their apps.

The technology can be awe-inspiring… but some say it could eventually be deadly. Both Elon Musk and Stephen Hawking warn about the danger the technology could eventually pose for humanity, and we’ve seen some recent inklings of it outsmarting its human counterparts.

In fact, Alphabet recently had to shut down part of its Google Translate R&D program because two of its translator AIs started talking to each other… in a language only they understood. Apparently the AI decided English wasn’t efficient enough, so they developed their own shorthand. While Alphabet wasn’t worried about the AI talking to each other and plotting to destroy the human race as we see in movies, there’s no doubt the technology is one that should be used with caution.

The next big thing in tech is a little less scary than AI but has similar world-changing potential.

Augmented Reality

Today, Apple, Google parent Alphabet and Microsoft, among other companies, are all working on something new…

Something that could revolutionize the world we live in… again.

Augmented reality is different from virtual reality in that while virtual reality completely immerses users in a virtual world, augmented reality adds computer-generated images to users’ daily lives.

Apple CEO Tim Cook thinks it will eventually become part of our day to day, as ingrained as eating three meals a day. And Microsoft is confident enough in an AR future that it feels comfortable charging more than $3,000 for each of its HoloLens AR headsets.

Apple and Microsoft are both certainly major players in AR, but as we’ll discuss in a moment, they’re not necessarily the most dynamic AR stock available to investors today.

In fact, one of their more software-focused Silicon Valley rivals has recently completed a burst of high-profile AR-related hires under a newly-organized AR division…

Now a quick look back at the top three tech companies in these industries…

1. Alphabet (NASDAQ: GOOG) — AI & AR

Founded in 1998 (as Google) and based in Mountain View, California, Alphabet is best-known as the operator of the world’s largest search engine – but its myriad divisions are involved in far more interesting technologies than that.

In fact, its AI subsidiary, DeepMind, is behind some of the most famous achievements in AI history. Its AlphaGo program became the subject of an acclaimed documentary film when it beat world champion Lee Sedol in a five-game match of Go (a Japanese strategy game with several orders of magnitude more complexity than chess).

Google has also leveraged its AI expertise to give it an edge in AR development. Its Google Lens product, which was launched in 2017 and is now part of the standard camera app on Android phones, uses AI to help visually identify objects around a user (such as a restaurant) and serve users relevant online information (such as said restaurant’s menu).

In the most recent quarter, Alphabet grew earnings per share (EPS) by 166.2% year-over-year on a 61.6% increase in revenue. It’s no wonder shares have shot up in the last year – but now is as good a time as any to buy in.

2. International Business Machines Corporation (NYSE: IBM) — Edge Computing & AI

Founded in 1911 and based in Armonk, New York, IBM is one of the oldest and most storied computing companies in the world.

Since losing the PC wars to Apple and Microsoft in the 1980s it has focused on developing high-end enterprise computing services – one of which, Watson, is one of the world’s most famous AIs, as we’ve discussed previously.

It’s also in the process of making a big bet on edge computing. IBM recently announced that it would spin off its yet-to-be-named managed infrastructure/IoT segment by the end of 2021 to focus its core business on edge and cloud computing.

IBM has a low price-to-earnings (P/E) ratio compared to other big tech companies, and pays a 4.65% dividend. Shares have pulled back slightly in the last month, giving investors a great opportunity to buy in for cheap.

3. Facebook (NASDAQ: FB) — AR

Founded in 2004 and based in Menlo Park, California, Facebook is best-known as the operator of the world’s largest social media service – but like IBM, it’s in the midst of a major pivot in its business model.

Facebook had already owned virtual-reality gaming headset maker Oculus since 2014 – and in 2021, it took a major step into the world of AR when it reassigned a slew of high-profile executives, including Instagram product head Vishal Shah, into a new AR-focused division called Metaverse.

Metaverse’s early product offerings are simple yet functional. They include an AR work chat room in which remote coworkers can converse “face to face” and various social and gaming apps. But CEO Mark Zuckerberg has explicitly said that he envisions the division as the company’s flagship. “Our overarching goal across all of these initiatives is to help bring the metaverse to life,” he told The Verge in a 2021 interview.

In its most recent quarter, Facebook grew EPS by 100.70% on a 55.60% increase in revenue. Shares have popped this year – but if the company’s AR bet plays out, they’ll only move higher in the future.

Energy and Capital’s Future Tech Watchlist: Alphabet (NASDAQ: GOOG), IBM (NYSE: IBM), Facebook (NASDAQ: FB)

There is still plenty of money to be made in the fields of edge computing, AI and AR in the years ahead.

But in truth, the biggest profits in emerging technological markets like these go to the earliest adopters – the investors who buy into these trends before they become mainstream.

Technology and Opportunity editor Keith Kohl is one such investor. That’s why his subscribers are currently sitting on an average gain of more than 40% per trade. Click here to learn more.