To pay for their governments’ skyrocketing COVID-19 bills, central banks around the world are expanding their money supplies at a historic rate, triggering fears of high inflation and prompting big expectations for gold prices.

In America, the Federal Reserve has added nearly $2.25 trillion to the U.S. money supply (as measured by M2) over the past 10 weeks alone.

The Fed has done more in response to the coronavirus in three months than it did in four years of Quantitative Easing programs in response to the 2007 to 2008 financial crisis.

$2.25 trillion in 10 weeks!

That’s almost $1.23 billion per hour –– or over $350,000 per second!

Count with me…

One Mississippi… two Mississippi… three Mississippi…

The Federal Reserve just created over a million dollars right out of thin air.

If printing money is its business, business is good.

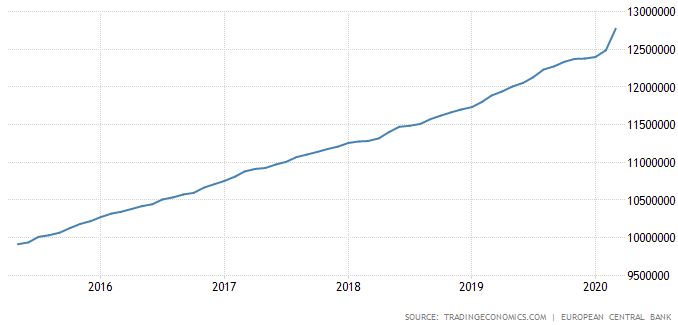

Elsewhere around the many other central banks have been forced to follow suit –– adding substantially to their own money supplies to help pay for COVID-19 relief, although not as much as the U.S.

Euro Area Money Supply |

U.K. Money Supply |

Japan Money Supply |

China Money Supply |

Canada Money Supply |

Mexico Money Supply |

Brazil Money Supply |

India Money Supply |

Why do central banks have their printing presses in overdrive?

Mandated COVID-19 lockdowns have resulted in significant declines in federal, state, and local tax revenues all over the world. But governments needed immediate money to pay for coronavirus relief via stimulus packages as demanded by their constitutes. So, they turned to the only place they could get the trillions of dollars needed to pay for bailouts: their central banks.

It’s what’s known as monetizing debt. In short, the government issues debt in the form of bonds. Then its central bank buys those bonds (giving the government a fresh supply of cash) with new money it creates.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

With trillions of dollars immediately needed to pay for COVID-19 relief, governments around the world authorized massive amounts of bonds, which their central banks threw their printing presses into fifth gear to buy.

As a result, we just witnessed the largest expansion of the global money supply in history.

So, now what?

Well, the fact is this is unprecedented. We’ve never seen central banks (in the modern era at least) add so much and so fast to their money supplies. We’re in unknown territory.

The simple answer is all this new money being filtered into the system will eventually create more inflation. Econ 101 will tell you more money chasing the same number of goods causes their prices to rise.

Many have already predicted that the recent expansion of the money supply will lead to increased levels of inflation, even hyperinflation.

Others (a minority) who say that inflationary pressures will be tempered with a full economic recovery, is still nowhere in sight. With high unemployment, lower wages, and lingering coronavirus fears, they fear a very slow recovery.

For our old friend gold, the fallout from COVID-19 seems to promise a boost in prices almost either way.

If inflation does, in fact, begin to substantially increase, gold prices will get a boost from buyers seeking a hedge.

On the other hand, if inflation is subdued by a very long and slow economic recovery, gold prices may rise on also on buyers seeking a hedge.

Right now consumer prices for many non-essential items like furniture, clothing, and electronics have fallen because of lower demand. So, we’re actually in an overall deflationary period right now. Yet gold prices have remained strong throughout. I think that’s important because it suggests any near-term reversal in consumer prices could be the fuse to send gold prices to the next level.

Even if it’s not within a month, we won’t be in a deflationary period forever. Sooner or later, consumer spending will come back. People will go back to restaurants. They will go on vacation and stay in hotels. They will fly around the world to make YouTube videos and Instagram posts. Things will go back to normal… eventually.

But here’s what we can’t go back on: the trillions of dollars in new money just introduced into the economic markets. The holders aren’t giving it back.

For the Fed’s $2,250,000,000,000 cash injection not to cause inflation, the U.S. economy would likely have to drag on as is for months. And I really don’t think many folks honestly see that happening.

As soon as businesses around the country even appear to get back to normal, consumer sentiment and spending will probably rise, likely stamping out deflation, and I believe fueling new fears of higher inflation in the coming months.

So even though gold prices have continued to break multi-year highs over the past few weeks, renewed fears of inflationary pressures may continue to drive the yellow metal much higher.

COVID-19 is only temporary. That $2.25 trillion is here to stay. Soon, the market is going to have to deal with it. Stay long gold.

Until next time,

Luke Burgess

As an editor at Energy and Capital, Luke’s analysis and market research reach hundreds of thousands of investors every day. Luke is also a contributing editor of Angel Publishing’s Bull and Bust Report newsletter. There, he helps investors in leveraging the future supply-demand imbalance that he believes could be key to a cyclical upswing in the hard asset markets. For more on Luke, go to his editor’s page.