Everyone has an opinion about Bitcoin and cryptocurrency these days. You still can’t go anywhere without hearing about it from someone.

Some say Bitcoin and blockchain technology are a cutting-edge system destined to redefine the way we use money. Others say cryptocurrency is only a fad and is doomed to fail.

But from my perspective, there’s a much more important aspect to Bitcoin and cryptocurrency that’s being almost completely ignored:

Bitcoin is the ultimate expression of capitalism.

Let’s clear this up…

Capitalism is not greed. Nor is it the self-serving pursuit of power.

Capitalism is simply an economic system under which a country’s means of production and trade are owned by private citizens. This is opposed to a country’s means of production and trade being owned by the government — that’s communism.

Bitcoin gives private citizens ownership over the means of producing something that’s almost completely controlled by governments around the world today: money.

Any private citizen with the hardware, knowhow, and will can produce Bitcoin. And that’s pretty revolutionary, if you ask me.

Private currency is an idea that’s actually over 100 years old. In the 19th and 20th centuries, private companies would sometimes pay their employees in what they called “scrip.”

Company scrip was mainly used in areas where national currency was hard to come by, such as coal mining and logging camps. Employees were paid in company scrip, which was exchanged for goods at the company store.

You’re probably familiar with the Merle Travis song that talks about company scrip and stores:

You load sixteen tons, what do you get?

Another day older and deeper in debt

Saint Peter don’t you call me ’cause I can’t go

I owe my soul to the company store

In his 1976 book, The Denationalization of Money, Austrian economist Friedrich Hayek helped refine the argument for privately issued currency. Hayek argued that private entities should be allowed to issue their own forms of money, instead of a national government issuing a specific currency, and that competition will favor currencies with the greatest stability.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

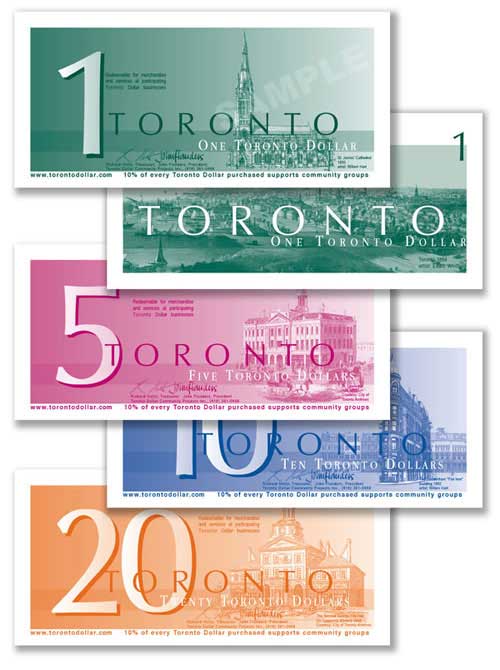

Believe it or not, estimates suggest that there are over 4,000 different privately issued currencies being used in more than 35 countries today. These include local and regional currencies such as the German Chiemgauer and the Canadian Toronto dollar.

Local currencies act as complementary currencies to a national currency and often aim to encourage spending within a local community. But private and local currencies aren’t legal tender. That means they can’t be used to pay national taxes. And in the big picture, local and regional currencies only represent a very small fraction of global wealth.

In the U.S., the most common form of legal tender is the U.S. dollar. (American Gold and Silver Eagle bullion is also legal tender.) And it’s often argued that a private entity actually does control the means of producing the U.S. dollar.

The U.S. dollar is technically a Federal Reserve Note. It’s a product that is produced, maintained, and distributed by the Federal Reserve. And the Fed is essentially a privately owned business with shareholders.

However, the Fed’s monetary policies are largely regulated by Congress. It can’t do whatever it wants.

Members of the Federal Open Market Committee (FOMC) are actually required to appear before congressional hearings at least twice per year regarding “the efforts, activities, objectives and plans of the Board and the Federal Open Market Committee with respect to the conduct of monetary policy.”

Bitcoin represents an entirely new spin on private currencies. Where previous private currencies were meant to be used regionally, Bitcoin is an international private currency that’s produced, maintained, and distributed all over the world.

Until next time,

Luke Burgess

As an editor at Energy and Capital, Luke’s analysis and market research reach hundreds of thousands of investors every day. Luke is also a contributing editor of Angel Publishing’s Bull and Bust Report newsletter. There, he helps investors in leveraging the future supply-demand imbalance that he believes could be key to a cyclical upswing in the hard asset markets. For more on Luke, go to his editor’s page.