Last May, I wrote an article called "The Oil Market in Seven Charts." I laid out my thesis as to why oil stocks would be a great investment in 2022. I wrote about two companies: ExxonMobil (NYSE: XOM), which was up 22% from May until now, and Chevron (NYSE: CVX), which was up about 5%. Both paid a nice dividend and beat the S&P 500, which lost more than 18% on the year.

There is still a lack of investment in new oil fields. The war in Ukraine is settling down for the winter and gearing up for a bloody spring. Russian oil production will continue to drop as more workers leave for the front line, and maintenance is ignored now that Western contractors have gone home.

The Biden administration has pulled almost all of the oil it can out of the Strategic Petroleum Reserve (SPR) and now must fill it back up. The SPR release for 2023 is mandated by Congress to be 26 million barrels, which is the lowest amount since 2021. There is to be no release in 2024.

The Saudis have said that they will cut production if oil falls under $70 a barrel, which is also the price at which Biden said he will refill the SPR. This effectively puts a floor on the price of oil, which was up about 2% yesterday. WTI is at $74.90, while Brent is at $79.70.

Recession

The counter fear is that the global economy will fall into a deep recession and there will be demand destruction. It hasn’t happened yet, but perhaps the bears will be right this year.

That said, the big dog itself, China, has just increased its oil quota by 21%, or 170 million barrels. The Middle Kingdom has said it will import 970 million barrels of oil in 2023. To put this in perspective, it imported 800 million barrels in 2022.

Meanwhile, Biden dumped 180 million barrels of oil out of the SPR last year. In other words, the market will have to come up with 350 million barrels of extra oil. That’s a lot.

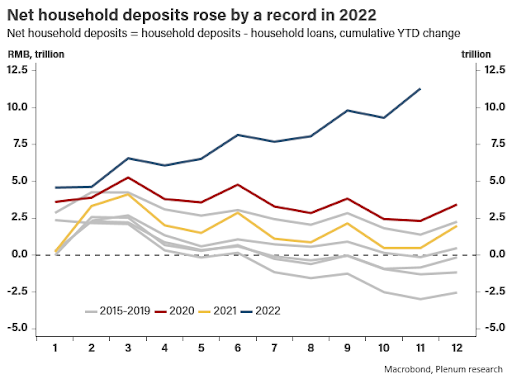

Furthermore, due to several years of lockdowns, the Chinese are sitting on trillions of dollars. Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.The Best Free Investment You’ll Ever Make

Pent-up demand should boost the economy and demand for oil.

If you like oil as an investment — and you should — you might want to check out my research report regarding a small South American country that found a record amount of oil just offshore. ExxonMobil is leading the exploration and production, and just said it's adding a seventh production platform to produce and export the needed crude to Europe.

But you don’t want to own XOM. Instead, I’ve found a handful of small companies that have the most upside on this fantastic new development. Find out more here.

All the best,

Christian DeHaemer Christian is the founder of Bull and Bust Report and an editor at Energy and Capital. For more on Christian, see his editor’s page.