The Old Guard has some new tricks…

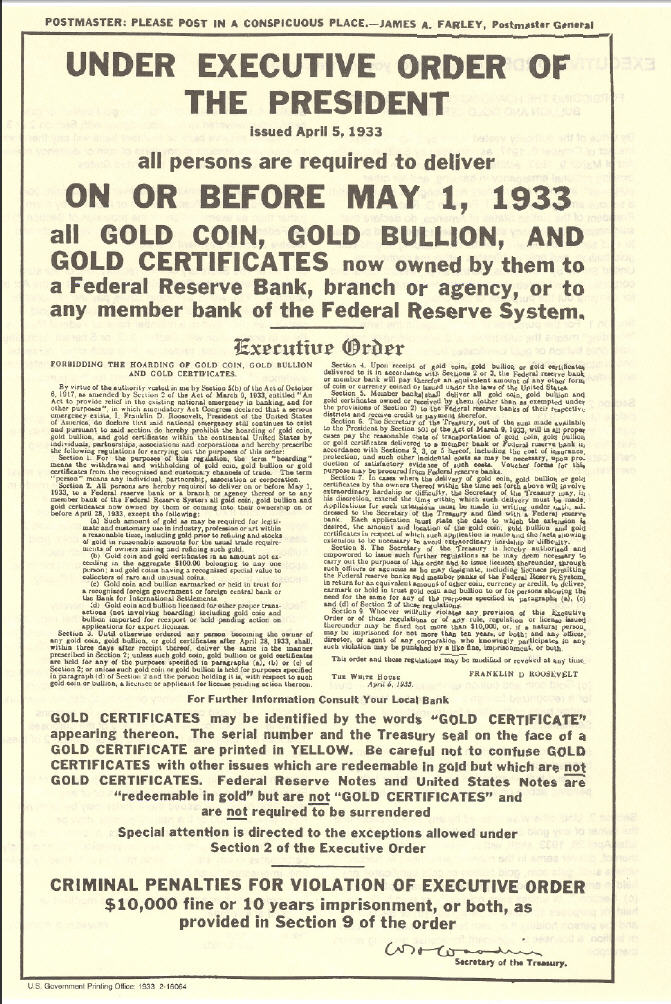

At the very bottom of the Great Depression in 1933, the U.S. made it illegal for Americans to own gold bullion. All individuals, partnerships, associations, corporations, etc. were forced to hand over their gold to the U.S. government at a discount price.

Violation of the order was punishable by fine up to $10,000 (about $185,000 today), up to 10 years in prison, or both. Pretty harsh for owning a piece of metal.

The government told the public that the ownership of private gold stalled economic growth. But the truth is, the initiative was intended to help the Federal Reserve increase liquidity to its member banks and protect its product (the U.S. dollar), which was, and still is, in direct competition with gold.

At the end of the day, the American government essentially took the public’s gold and gave it to the U.S. banks. And there are many who have speculated that the U.S. government will again confiscate the public’s gold. However, I personally don’t believe that a direct confiscation of the American public’s gold would fly today — especially considering our political environment.

But the big banks have figured out a new way to stop you from owning gold without direct confiscation…

They can simply restrict your ownership of gold, or even stop you from ever buying it.

And a major Swedish bank might have just tried to play that card…

Last week, with the European markets flooding in gold and precious metals, a member of the global banking cartel made a move that showed us exactly how the big banks can keep gold out of the hands of the public. It’s all been swept under the rug at this point, with the news disappearing from the web. But fortunately, I’ve got screenshots.

Last Thursday, the largest gold and precious metal dealer in Sweden, Tavex Guld & Valuta, sent a letter to its customers saying:

Best customer,

We hereby announce that as of 15:30, Thursday, June 30, 2016, we can no longer accept bank transfers or bank deposits for gold and silver to our Swedish SEB account.

The reason for this is that SEB – at very short notice – informed us that they will close down our bank account. This decision has, unfortunately, been made without first consulting us, and in addition to state in its notification letter that the decision to close our account due to “a general business decisions,” they have not yet given us any concrete reason why they decided to take this measure.

The banking system in Sweden is operated however vigorously towards a cashless society, as you probably are aware of, and Tavex has, as one of the largest wholesale suppliers of physical notes and investment metals in Sweden, as we see it become a target for the major commercial banks.

This letter has since disappeared from Tavex’s website. But here’s the screenshot:

And this is exactly what’s going on here…

SEB (Skandinaviska Enskilda Banken) is the largest bank in Sweden. Tavex, the largest gold and silver bullion dealer in Sweden, has merchant accounts set up with SEB.

In the wake of the rush to gold last week, SEB decided (without giving a clear reason) that it wouldn’t provide certain banking services for Tavex. This effectively strained Tavex’s business and put a direct limitation on Swedish consumer ownership of gold and silver as well — particularly since Tavex is a major gold and silver dealer in Sweden.

Of course, there’s no way to prove that SEB specifically intended to put any kind of restriction on the public ownership of gold in Sweden. But as a major bank and a dealer of fiat currency, SEB and gold are essentially competitors.

Here in the United States, gold’s competitors are also the major banks — J.P. Morgan, Wells Fargo, Bank of America, etc. And it turns out that the big U.S. banks not only have the ability to also make things difficult for U.S. gold bullion dealers, but they’re already working with the Justice Department to disrupt the business operations of those they deem fraudulent.

In 2013, the U.S. Justice Department and FDIC initiated Operation Choke Point, which targeted businesses in broad merchant categories that were deemed to have a high risk of fraud. They include:

- Payday loans and direct lenders

- Telemarketing

- Online gambling

- Firearm and ammunition sales

- Credit repair services

- Multi-level marketing operations

- Online pharmaceutical sales

- Coin and bullion dealers

At any point, any U.S. coin or bullion dealer could be targeted, and its sales disrupted. And if enough large wholesale and retail bullion dealers were targeted all at once, it could potentially limit the American public’s access to gold.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

The banks providing merchant services, like payment processing, to gold and silver bullion dealers could cut them off at any time without giving a clear reason. And that would be well within their rights. The banks are private businesses. They have every right to make decisions in the interest of sustainability and profit.

Cutting off payment processing services would seem like the best option for the banks. Most gold bullion sales are done electronically. However, there are other options such as buying with cash from a local dealer or other private individual. And consumers can always purchase bullion from offshore dealers.

But moreover, a conspiracy by the big banks to intentionally restrict the public’s access to gold would probably backfire.

First, if the big banks were to collaborate on something like this, they’d potentially have an anti-trust case on their hands. They don’t want that. But also, they could never completely stop the American public from buying gold. And as soon as the U.S. public saw that the big banks were trying to restrict their access to it, they’d buy gold like never before.

So I ultimately don’t think the U.S. banks are going to try to intentionally restrict the American public’s access to gold anytime soon. For such an initiative to be successful, it would have to work in tandem with legal restrictions on gold imports, which would be a severe uphill battle in and of itself.

Moreover, it’s a card that can only be played once. It’s the nuclear option for only the direst of economic situations. A desperate measure for a desperate time…

Like the bottom of the Great Depression, 1933.

Until next time,

Luke Burgess

Energy and Capital