Last March, oil was trading at a dismal $45/barrel. Nearly every oil stock you followed had been crushed. (Believe me, I was suffering just as much as you were.) And it’s sad to say, but that price felt infinitely better than when crude prices fell to $32 per barrel in December 2008…

Yet no matter how depressed we were watching our stocks crash alongside oil prices, I told you our day would come. At the time, I said that investors have two options: They could either play the field or sit on the sidelines.

You know how the story played out over the next twelve months… Our stocks rallied while crude prices rebounded — and here we are today, with oil comfortably trading at $70-$80 per barrel.

I’ve said before that trading last March was as easy as blindly throwing a dart against a wall. To some extent, that’s true — it’s difficult to find a stock that wouldn’t have made you money since last March.

But lately, I’ve been rethinking that position…

Devil in the Details

OPEC certainly has a stigma attached to it. Despite the fact that its members pump out one-third of the world’s oil production, I have yet to meet a reader who actually trusts the 12-country cartel.

Ask yourself what’s the first thing is that comes to mind when you come across OPEC…

I immediately think of the shady reserve increases that occurred in the 1980s. Several OPEC countries drastically raised their oil reserves.

Anyone else remember this?

It’s a regular sight to see OPEC break their quotas. "Honesty" does not seem to be in their dictionary.

So what has me thinking of OPEC’s shifty past?

Two weeks ago, ExxonMobil announced their 2009 reserves replacement. (Simply put, the reserves replacement is the amount of new reserves compared to oil produced.) In 2009, ExxonMobil added 2 billion barrels of oil equivalent to its reserves, replacing 133% of its production during that year.

ExxonMobil — one the world’s largest publicly traded oil companies — shouldn’t be so quick to gloat. These new reserves aren’t easy-to-get from conventional sources, and the reality is that Exxon’s saving grace lies in developing unconventional oil, such as oil sands.

In other words, developing those new barrels will be costly.

Investing in Crude Oil Stocks: A Year Later

My regular readers should know that I’m not much of an ExxonMobil fan. It’s not just the shenanigans with ExxonMobil’s latest reserve replacements that has made me sour; it’s the fact that this company has yet to impress me.

Don’t let the company’s size fool you. Too many people make the mistake of believing that these "supermajors" drive world oil production.

If you were to add up the oil and gas reserves of all six of the supermajors (a group which includes ExxonMobil), you would only account for approximately 5% of the world’s oil and gas reserves. About 95% of known oil and gas reserves are tightly held by state-owned oil companies like Saudi Aramco.

You see, ExxonMobil is one of those companies that would have lost you money as the oil markets bottomed out last March.

If you had told me that last year, I wouldn’t have believed it. After all, crude prices have nearly doubled since last year. So how could ExxonMobil not make you money?

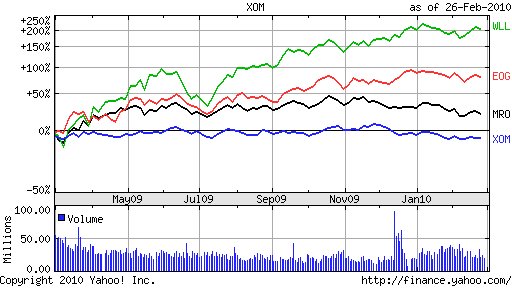

Compare ExxonMobil to the three oil and gas stocks I mentioned last March when I told you about the buying opportunity…

As you can see below, my Energy and Capital readers outperformed ExxonMobil:

Pretty depressing for anyone who bought ExxonMobil in the last twelve months, isn’t it?

Oil’s Next Buying Opportunity

There’s a reason I brought up ExxonMobil’s troubling performance. It’s not because I revel in Exxon’s failures. (Okay, I do to a certain extent.) But the fact is that I see another huge buying opportunity on the horizon.

This time it won’t be as easy as it was last March.

Our production is barely holding on to 5 million barrels per day. In 2008, production fell to 4.9 million barrels per day — a level we haven’t seen since 1946. Now that we’re headed for a recovery, demand is expected to return.

The EIA has stated that oil markets are expected to become tighter in 2010 and 2011.

This time, however, we’re going have a lot more trouble finding more oil. I’ve already laid out the crisis that Mexico is having with its oil industry. In the next few years, they’ll be relying on us for help.

We can’t look to the Saudis, either. When was the last time you heard the American public beg for more oil from the Middle East?

That leaves the U.S. with only one option left. And I’ll tell you all about it next week, including several companies that will pay back the money you lost with ExxonMobil.

Until next time,

Keith Kohl

Investor’s Note: While those three oil plays outperformed ExxonMobil, there’s one in particular that could have made you a small fortune. My readers at the $20 Trillion Report who bought this tiny company back when I called the bottom in March are holding gains over 1500%. And that’s just one play…

I’ve put together this free report for my Energy and Capital readers who are interested in sharing on our trading success. Simply click here for more information.