“We’re going to make sure everyone knows Exxon’s profits. Exxon made more money than God last year.”

Biden’s recent claims were clearly meant to be taken negatively, in defense of his own impotence, but all I’m hearing is praise for Exxon’s strong financials.

If you’ve been following the energy sector recently, you’d know that nearly everyone is making more money than God. The market is currently experiencing a very healthy bull run.

Meanwhile, our fellow tech investors are waking up to sights like this each morning:

Take the S&P 500, for example. The latest in a dizzying sequence of sell-offs means the world’s largest equity index is down about 25% since the start of the year.

Meanwhile, the S&P 500 Energy index has returned a positive 40% in the same time frame. Few other sectors have been able to keep up with inflation, let alone beat it by more than 30%.

It’s better to let sleeping bears lie. The time to invest in energy is right now.

Curiously enough, the overall S&P 500 index consists of only 5% energy firms. WTI crude is hovering around $120 per barrel, and inflation is creeping dangerously close to 9%, yet the index’s allocation to energy is the same as it was in 2019.

To put that in perspective, in 2019, WTI crude was trading for around $60 a barrel. Inflation was below 2% — practically nonexistent compared with today.

So what gives? Why hasn’t the index caught on yet? Have we cracked some kind of secret code that the rest of the world is missing?

The graph shows that in recent years, the S&P 500’s energy allocation has failed to keep pace with the swings in oil prices. If you think about it, the discrepancy between those blue lines essentially represents millions of wasted dollars.

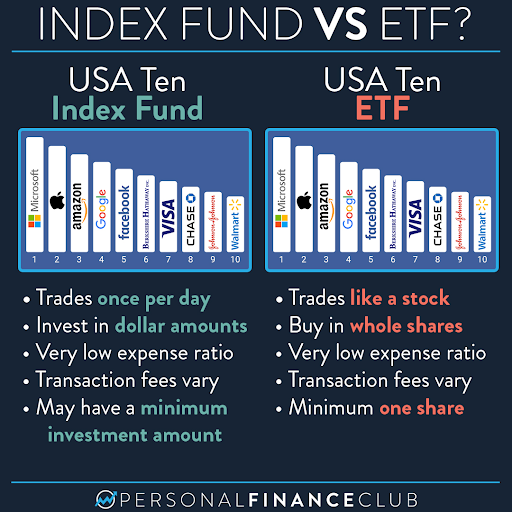

But in the case of passive investing (i.e., buying shares of an index/ETF), this is the system working as intended. And it exposes a fatal flaw that can cost less diligent shareholders thousands if not millions of dollars over their investing career.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.The Best Free Investment You’ll Ever Make

The First Step: Do Your Due Diligence

In fact, your first, second, AND third steps should all involve due diligence. I can’t overstate the importance of gathering as much trusted information as possible before making a decision.

In many ways, dumping money into indexes like the S&P 500 avoids most of this legwork. You’re spared the endless company press releases and dry financial reports. You simply park your money in a sector you believe in and call it a day.

Don’t get me wrong — indexes and ETFs aren’t all bad. They're specialized tools for a specific purpose. Plenty of investors have made excellent returns over time with these safe plays.

But they have one critical design flaw that can severely limit gains for most investors: They're too slow — too slow to respond to changing market conditions and too slow for investors to cash out at just the right time.

In simpler terms, you can’t exactly make income from investing in these slow burns. In most cases, they play better as a retirement nest egg.

Passive investors often operate with a “hindsight is 20/20” mindset. In the case of the S&P 500’s allocation to energy firms, the index only increased its stake after oil prices began to stabilize at their new price point.

That’s not my strategy for investing, and it shouldn't be yours either.

In the case of the energy market, we wouldn’t be able to predict future market changes based on recurring patterns.

In the United States, summer driving season has begun — almost a guarantee for a rise in oil prices. If we were investing passively, it would be impossible to buy low and sell high. The index itself would never react quickly enough.

To truly take advantage of this incredible energy bull market, investors need to be more flexible. Timing is critical during these periods of volatility.

There’s usually only a small window of time between a breaking news story and its effect on stock prices.

Take the recent discovery of the world’s largest oil field, located right in America’s backyard, for example. It’s enough oil to give the U.S. an advantage over every member of OPEC combined.

By the time the S&P 500 catches on, those gains will already be gone.

We are expecting the surge to continue until the end of the summer at the very least, so the best time to invest would have been a month ago. The next best time is right now.

To your wealth, Luke Sweeney Luke’s technical know-how combined with an insatiable scientific curiosity has helped uncover some of our most promising leads in the tech sector. He has a knack for breaking down complicated scientific concepts into an easy-to-digest format, while still keeping a sharp focus on the core information. His role at Angel is simple: transform piles of obscure data into profitable investment leads. When following our recommendations, rest assured that a truly exhaustive amount of research goes on behind the scenes..

Contributor, Energy and Capital