Natural gas is a hot commodity on the market for a number of reasons.

Not too many nations have an abundant supply of oil, but many of these same nations have enough natural gas to fuel an entire economy for decades or even centuries. This includes the United States and Australia.

And governments and companies around the world are exploring natural gas as a way of finally breaking away from oil dependence.

Natural gas means two things for you as an investor and consumer. On the investment side, it is a way to hold a stake in a new source of energy for the future and make some money in the process.

On the customer side, it could mean lower prices at the pump for those with natural gas vehicles. Western markets would not be susceptible to chaotic political climates in the Middle East, a factor that drives up oil prices.

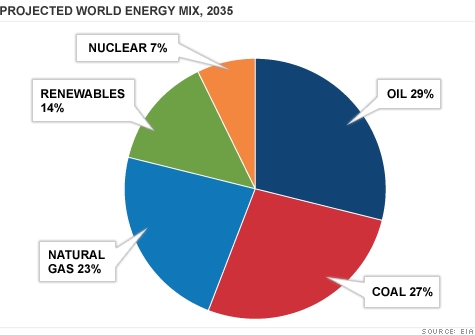

Energy analysts predict that natural gas will still be one of the top three energy sources in the 21st century. Gas shows signs of positive growth, since many governments and citizens have become weary of rising oil prices, and there are concerns about dirty coal.

Source: CNNMoney

Source: CNNMoney

But many nations, including the U.S., have as of yet barely scratched the surface of their gas resources despite heavy investment and exploration.

So when Chevron (NYSE: CVX) made a $349 million dollar offer to join Australian company Beach Energy (OTC: BCHEY) to begin shale gas exploration in central Australia, the deal heightened the interest of investors around the world.

The targeted region makes up 81,000 acres of the Australian Cooper Basin. Other partners include ConocoPhillips (NYSE: COP) and Hess Corporation (NYSE: HES).

To show how serious Chevron is about gas exploration down-under, the oil company is putting up a heavy amount of that $349 million in cash.

An article by Bloomberg states:

“Chevron will initially pay Beach $36 million in cash and cover $95 million in costs for 30 percent of the South Australia permit and $59 million in cash for 18 percent of the Queensland acreage, according to the Beach statement. The Australian company may receive as much as $349 million over two stages that span several years.”

According to government reports, there could be 400 trillion cubic feet of natural gas sitting underground.

As good as the deal may sound, the venture itself risky. Reaching the gas will require busting up the shale rocks through pressurized water, sand and other chemicals, a controversial procedure known as fracking.

Since much of the region is unpopulated, Chevron will not have to worry about endangering humans; however, fracking is a costly endeavor, and the infrastructure for extracting the gas is not in place, as the Wall Street Journal reports

Even though Australia contains plenty of natural gas, the Aussies are far behind Americas when it comes to tapping into natural gas reserves, and local demand is not strong. However, this could change if oil prices in Australia continue to rise.

Overall, the deal is a gamble since the Australian region is an unknown factor; many investors may sit on the sidelines and observe the project as it unfolds.

Chevron will also have to compete with Santos (OTC: SSLTY), a rival Australian company doing some drilling of its own in the Cooper Basin.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Shale gas could be useful in exporting to Asia, but the process of liquefying the gas may be problematic since production costs are on the rise. If Chevron and its partners are going to export to other areas of the world, a pipeline will need to be in place for faster transport.

Include the fact that Chevron chose not to invest in Queensland export terminals, as the Wall Street Journal reports, a move that would have assured a prompt transport of any natural gas abroad.

And then there is the monetary side.

Currently, the Australian dollar is a highly sought after currency according to Forbes, which may not work in the favor of overseas investors who want a piece of the action right away. Even though the gas venture in Australia is an exciting project, the number one investment rule of buying low and selling high still applies.

At this point, it would not be wise for foreign investors to deal in high valued currency, and there is no sure way of knowing when the value of the Australian dollar will lower in the future.

Chevron must also compete with other continents like East Africa and North America in the pursuit of gas exploration and new customers.

The odds may seem stacked against Chevron, but the effort could pay well if conventional gas prices continue to rise. A spike in oil-based gas translates into higher demand for natural, domestic gas.

The wind may not be shifting in Chevron’s favor, but the exploration project is an investment in the future. Chevron is in a good place since natural gas is popular enough to generate interest from investors, and it is in a market that is not over-crowded.

Australian shale gas faces stiff competition from other markets abroad, but exploration is a good way to get ahead of rival companies.

The project is a vast undertaking that could pay handsomely to all parties involved.

Until then,

Jon Carter