The big story of the week was April’s red-hot Consumer Price Index (CPI) report, which came out Wednesday morning.

The print came in at 8.3% over the past 12-year period, keeping inflation rate right at 40-year highs!

This was even higher than the experts' expectations and all but confirms more hawkish rate hikes are coming.

This means a heck of a lot more volatility and uncertainty ahead for market participants.

But unlike most folks who are running for the hills as the selling intensified this week, I’m salivating at the juicy, under-the-radar opportunities emerging from this uncertainty.

Here’s why.

Uncertainty Is the Mother of Volatility — but There's a System to Beat It

When it comes to trading stocks and options, volatility is exactly what we want to see.

Market volatility is an increase in the rate of price changes in stocks. We need these changes to make money off our trades. The more volatility (or change) in the market, the more price changes we see. That means we have more opportunities to make money as we trade around these changes. This is why traders like myself, unlike investors, can thrive in frothy sideways and bear markets in addition to bull markets.

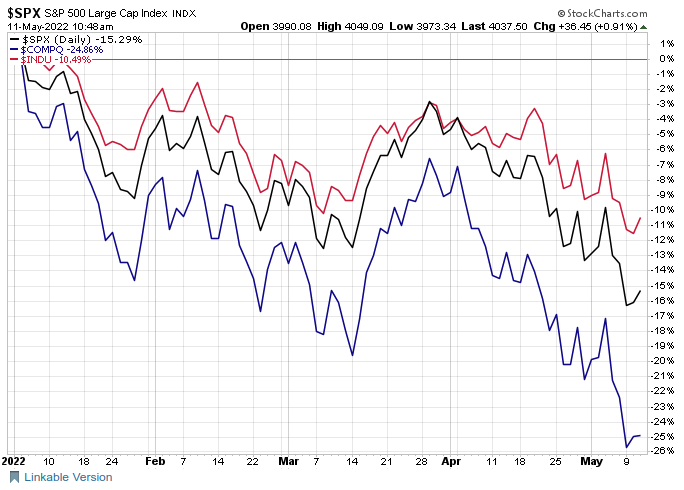

For example, the overall market since January has been terrible.

The Nasdaq is down a whopping 27%, the S&P 500 is down 17%, and the Dow is down 12%!

But while this market carnage bleeds Wall Street dry, my fellow traders and I are using a simple yet powerful system to rack up double- and triple-digit returns week after week after week!

No BS.

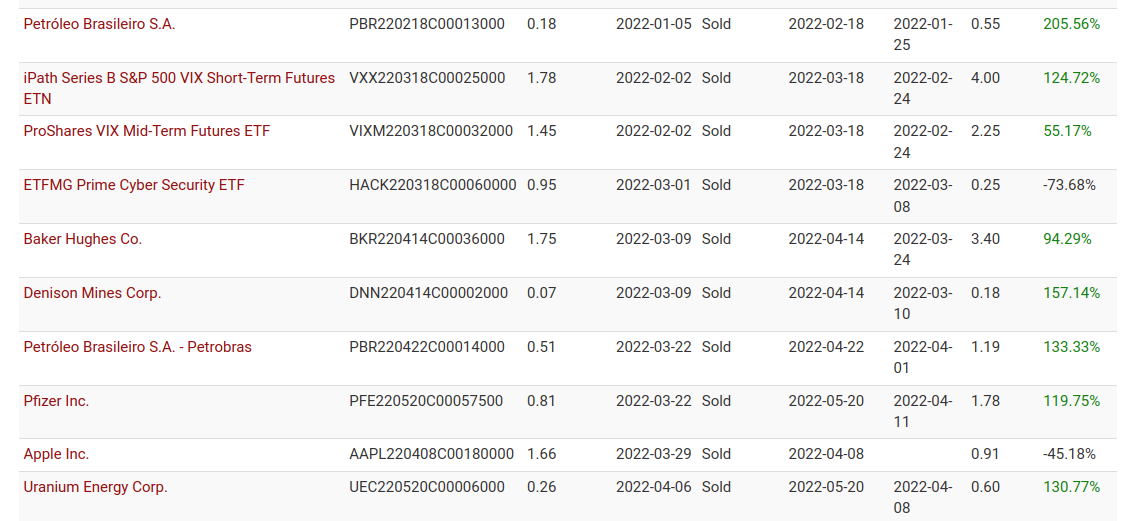

Using my unique proprietary system, members of my Naked Trades community have locked in some incredible gains since the beginning of 2022, including:

- 51% on Walmart

- 205% on Petrobras

- 124% on the VIX

- 84% on Baker Hughes

- 157% on Denison Mines

- 133% again on Petrobras

- 119% on Pfizer

- 130% on Uranium Energy Corp.

And that's all in the past few months! Here’s a screenshot of my very real and up-to-date portfolio of all our trades made so far in 2022. I’m on pace to have my best trading year ever, despite headwind after headwind!

And you could join me on this journey today to have your own best trading year ever.

But before you do that, I do have a confession to make.

I Didn’t Come From Money, and I’m Not a Wall Street “Elite”

But I will put my trade recommendations and track record up against any one of those top money managers or analysts.

The story of my success all started with a belief that I, a blue-collar guy from a blue-collar background, could do it.

I personally take this belief very seriously because I watched my dad empower himself to seize all the opportunities in front of him when I was kid — opportunities that helped my dad go from painting benches as a simple park employee in Beacon, New York, to becoming the director of security for North, South, and Central America at IBM and buying a beautiful house on the beach!

As for me?

Well, my journey is far from over, but simply by believing in myself and my ability to be a great trader, I went from flat broke with a crap bartending job to a cushy office, money in the bank for whatever curveballs life throws at me, and a career I love analyzing and advising on the markets so folks like me can write their own great success stories too!

And soon I’m going to show you every last detail on how you could have your best trading year ever!

All I ask is that you believe in yourself that you can do it. I’m nothing special — I just work harder than the next analyst does, and I believe in myself and my trading system. That’s why I know you could have your best trading year ever this year too!

If you’re the kind of person who’s ready to recognize and seize incredible opportunities, here’s your invitation to join me at my Your Best Trading Year Ever special event.

I’ll be sending more details over the coming days, but most importantly, Your Best Trading Year Ever starts on May 17 at 3:00 p.m. ET.

Reserve your spot here. I sincerely hope to see you at this momentous event.

To your wealth,

Sean McCloskey

Editor, Energy and Capital

After spending 10 years in the consumer tech reporting and educational publishing industries, Sean has since redevoted himself to one of his original passions: identifying and cashing in on the most lucrative opportunities the market has to offer. As the former managing editor of multiple investment newsletters, he's covered virtually every sector of the market, ranging from energy and tech to gold and cannabis. Over the years, Sean has offered his followers the chance to score numerous triple-digit gains, and today he continues his mission to deliver followers the best chance to score big wins on Wall Street and beyond as an editor for Energy and Capital.

@TheRL_McCloskey on Twitter

@TheRL_McCloskey on Twitter