A little-known metal used in steelmaking could emerge as a game-changer for battery technology, raising the prospect of an investment boom like the one that lifted rare earths out of obscurity last year.

Those aren’t my words. They’re Reuters’.

The opportunity the straitlaced news organization is describing is so exciting, its description almost sounds sensationalized.

It’s not.

Another Metal to Learn

The metal in question is vanadium.

And according to Chris Berry, founder of New York-based research firm House Mountain Partners, the potential exists “to make vanadium into a multi-billion dollar metal.”

Its strengthening capabilities have been known for years…

Henry Ford added it to steel to build the Model T. It’s also used to create specialty alloys for the aerospace industry.

But those uses aren’t what’s going to turn vanadium into a multi-billion-dollar metal…

Energy is.

Wanted: Vanadium Supply

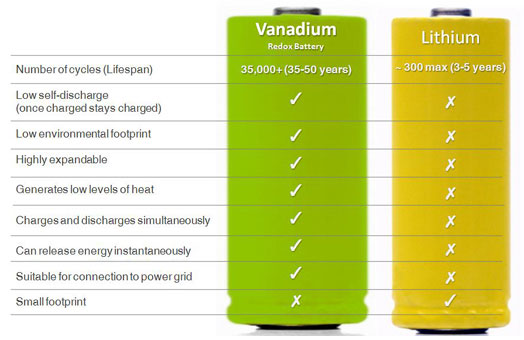

Vanadium flow batteries charge in a flash, their capacity actually expands, and they last for decades.

But until recently, vanadium’s volatile price has kept most manufacturers from working with it.

Reuters reports: “At present, vanadium prices tend to surge when steel demand is high and plummet during economic downturns. The volatility is a major deterrent for battery producers.”

A new willingness to invest in vanadium battery technology could mean a new use for the metal — and something to help stabilize prices.

China-based Prudent Energy recently raised $30 million in an effort to reduce the costs of its vanadium batteries.

It’s rumored that China Strategic Holding is spending $300 million to build the world’s largest vanadium battery.

German start-up DBM Energy has made a lithium-vanadium car battery it says can travel 375 miles on a six-minute charge. For comparison, the Chevy Volt can only go 50 miles on a four-hour charge.

Two major international automakers already have plans to adopt the technology.

According to Byron Capital Markets analyst Jonathan Lee, “You’re seeing dollars flow into this technology, so there is some good promise in it going forward. “In the long term, the demand will rise.”

The Next Rare Earth Scenario?

Economics tells us vanadium prices will level off if the early scramble to secure a stable supply gains traction, much like the recent rush to find rare earths.

You should know by now the companies that found rare earths surged by tens of thousands of percent.

American Vanadium (TSX-V: AVC) CEO Bill Radvak is certainly excited: “Vanadium has all that rare earth-type opportunity, yet it has a very stable base on the steel-strengthening side, It’s just about to take off in the next year or two.”

His company owns a deposit in Nevada, and is looking to partner with battery makers to sell them vanadium at a lower price while sharing profits from the value-added battery.

Largo Resources (TSX-V: LGO), Apella Resources (TSX-V: APA), and Energizer Resources (OTC: ENZR) are some other names to watch.

For my money, I like the company I just visited in Canada…

It has a proven reserve of 257 million pounds of recoverable vanadium oxide. At current prices, that’s worth over $2.1 billion dollars.

That’s impressive — because the metal in the ground is worth several hundred times the company’s current market cap.

And it isn’t just vanadium this company controls…

To get complete articles and information, join our daily newsletter for FREE!

Plus receive our new free report, How to Play Rare Earth Today

Call it like you see it,

Nick Hodge

Editor, Energy and Capital