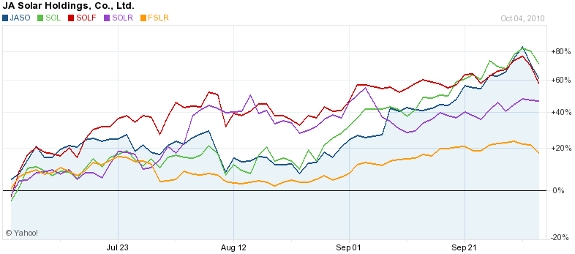

If you haven’t looked at the solar sector in the past few months, here’s what you missed:

As colleague Jeff Siegel and I said would happen, Chinese solar companies have emerged as global leaders.

They’ll supply about 50% of the world’s solar energy products this year.

For the most part, though, Chinese companies are focusing on traditional solar panels — the ones made of polysilicon and mounted on roofs.

But a new generation of solar technology is about to take root. And the Chinese don’t have a stranglehold on it… yet.

It’s called thin film solar

For several years now, thin film solar has been on the verge of commercialization. And now it’s ready for prime time.

Thin film is made by putting one or more photovoltaic materials on a substrate like glass, plastic, or cloth. These materials are usually about 1 micron thick (a human hair ranges from 40 to 120 microns), so they are more easily managed than heavy panels and can be placed on a variety of surfaces.

From solar shingles to solar backpacks… the possibilities for this new technology are limitless.

And some very powerful companies are taking notice.

Save money. Live better.

Companies like Walmart (NYSE: WMT), for example, which in 2005 set a goal to get 100% of its power from renewable resources.

A few weeks ago Walmart announced it would begin installing two different types of thin film solar on its stores: cadmium telluride and copper indium gallium selenide (CIGS).

The company likes the technology because:

-

it can be installed on flat roofs, even in snow-prone areas

-

it’s more efficient in fog and smog-prone locations

-

it can actually be incorporated into the building

-

it can provide 20%-30% of each store’s electricity needs

The project will be one of the largest business installations of thin film solar, will help Walmart save money and reach its sustainability goals, and will help to quickly commercialize this still-young technology.

Something old, something new…

Walmart will work with two companies for the installations.

The cadmium telluride panels will come from First Solar (NASDAQ: FSLR). This technology has been available for years and is starting to gain high favor with utilities.

In fact First Solar just flipped the switch on the world’s largest solar energy facility this week. The 80 MW Sarnia project will power nearly 13,000 homes.

(For all you solar detractors out there, it’s located in Ontario — not exactly the warmest or sunniest of climates.)

The company is currently working on three other large plants in North America, and will install about 145 MW this year.

That’ll be nothing compared to the 290 MW Agua Caliente plant it’s starting to plan for California…

The plant will be as big as a natural gas-fired plant and require more than 5 million thin film modules.

By 2012, First Solar will ramp up its factories to be able to produce 2,200 MW of thin film per year. That’s the equivalent of a large nuclear plant.

That stock is currently trading around $140, but a recent report by investment bank Piper Jaffray has assigned it a $200 price target.

But there’s an up-and-comer trying to steal some of First Solar’s thunder — an upstart named MiaSole.

MiaSole will be providing the CIGS panels for the Walmart project.

MiaSole is backed by $350 million in cash — most of which is from Kleiner Perkins — and is manufacturing thin film modules on a flexible stainless steel substrate.

It’s trying to catch up to First Solar’s production cost of $0.85 per watt and steal some market share from a sector that’s expected to double by 2013.

New applications

New applications

More than 160 companies are hard at work trying to perfect thin film technology and applications for its use.

First Solar is by far the biggest, but some other established companies are entering the space: Sharp, Mitsubishi, Q-Cells, Bosch, and Shell are all in the hunt.

And it’s not going to be just flexible panels for roofs…

Developments in dye-sensitized and other organic solar cells are showing just what this technology can offer.

From solar shingles to self-charging electronics (even indoors) to windows that produce electricity… This market is expected to eclipse $7 billion in annual sales by 2015.

So be sure to keep an eye out for recommendations as we sift through the 160 competitors to find the best profit opportunities.

Call it like you see it,

![]()

Nick