The end of crude is nigh.

At least, that’s what we’ve been told over and over again, isn’t it?

Ever since we took the plunge into the new COVID era, the death of oil has been quite a popular sentiment in the headlines.

We can’t blame anyone for thinking that way, either.

Ten months ago, we watched as oil prices utterly collapse, plunging into negative territory for the first time in history.

Personally, that moment was one of the most bullish signals I’ve ever seen.

The fact that we got to the point where companies were actually paying customers to take oil off their hands means there’s really only one direction prices can go — up!

Whether or not crude would rally from there wasn’t a question rooted in reality. It wasn’t a matter of if oil would rally but rather when.

Fortunately, it didn’t take long to get the answer.

Recently, WTI prices broke into new 52-week high territory, and oil has officially rebounded back to where it was just before the COVID lockdowns took effect.

So is the end of oil upon us?

Not even close.

President Biden Just Dropped the C-Word

We talked a little bit last month about how crude oil will fare during a Biden administration.

In fact, the president has been rather busy going after the crude market during the first few weeks of his term.

There’s been a lot of concern that his policies will absolutely crush the industry, leaving in his wake nothing but clean energy rainbows and a massive fleet of electric vehicles.

That sentiment is saturated throughout the media and plastered across headlines, isn’t it? It seems not a day passes that I don’t see a headline portending the imminent collapse of the oil industry.

At first glance, it’s hard to disagree.

With a snap of his fingers, President Biden brought dreams of the Keystone XL pipeline expansion to a grinding halt.

If that wasn’t enough to make you pessimistic over oil’s future in the U.S., then his order to place a 60-day arrest on oil-and-gas drilling on federal lands — on his very first day in office — certainly did the trick.

Perhaps just bearish enough to consider buying Tesla, huh?

We respectfully disagree.

Oil is set for one helluva comeback this year.

Here’s why…

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.The Best Free Investment You’ll Ever Make

The Most Unexpected Rally in 2021 Will Be Oil

Forget the fact that crude prices have run up to nearly $60 per barrel recently.

COVID didn’t kill the oil market, and we’re already seeing signs of life.

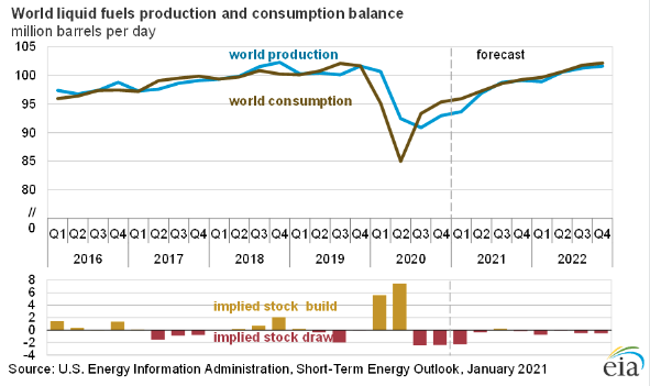

According to the Energy Information Administration’s (EIA) projections, the supply/demand fundamentals — which have been thrown out of whack during the pandemic — will tighten through 2022.

It’s only a matter of time until global demand climbs back over 100 million barrels per day.

Except there’s one serious concern to keep in mind as demand rises.

If there’s one lesson good drillers learned over the last few years, it’s fiscal discipline. Companies that failed to put their financial houses in order were quickly snuffed out or swallowed up by the bigger fish in the pond.

Yet the cold, bitter truth is that a lot of drillers weren’t profitable at that level to begin with!

Couple the low oil price environment with President Biden’s aggressive oil policies, and we have a recipe for lower output here in the United States.

The latest Baker Hughes rig count showed that as of January 29, 2021, there were just 295 rigs in the U.S. drilling for crude oil — more than 400 fewer rigs than were active a year ago!

Drilling budgets have been slashed dramatically over the last year, with companies turning to their drilled-but-uncompleted (DUC) wells to keep production steady. These wells comprised more than one-third of new production in the Bakken.

However, the DUCs won’t save us in the long run.

Goldman Sachs is already clamoring for oil to top $65 per barrel by the end of this summer.

We’re in a perfect storm for higher oil prices, and the only question left is where to find those beaten-down, hidden investment gems inside the oil sector.

We’ll answer that question next time.

Until next time, Keith Kohl A true insider in the technology and energy

markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new

technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the

Managing Editor of Energy & Capital, as well as the

investment director of Angel Publishing’s

Energy Investor and Technology and

Opportunity. For nearly two decades, Keith has been providing in-depth coverage of the hottest

investment trends before

they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution

currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on

key advancements in robotics and AI technology. Keith’s keen trading acumen and investment research also extend all the way into

the complex biotech sector,

where he and his readers take advantage of the newest and most groundbreaking medical therapies being

developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s

to lab scientists grinding out the latest medical technology and treatments. You can join his vast

investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.