Producing electricity is one thing.

But storing that electricity is another.

Human beings have been trying to perfect the battery for centuries… maybe even longer.

Artifacts such as the Baghdad Battery may prove that man’s quest to store electricity dates back millennia.

But the term “battery” itself (as we’re using it here) actually dates back to Benjamin Franklin. In 1748, Franklin described multiple Leyden jars (a device that stores static electricity) by comparing them to a battery of cannons, referring to the weapons functioning together.

Since Franklin, many different minerals have been used as battery anodes and cathodes: lead, zinc, nickel, iron, copper… the list goes on.

But there is one very special mineral that’s considered “the Holy Grail” for battery engineers.

And that’s lithium.

The #1 Battery Metal

You see, lithium has the lowest density of all metals, which gives it the greatest electrochemical potential and energy-to-weight ratio.

And that makes lithium the absolute best material for batteries.

Experimentation with lithium batteries actually began in the 1910s. But it wasn’t until the 1970s that the first lithium batteries were sold. And it wasn’t until the technology developed further that large-scale commercial use became feasible in the late 1990s.

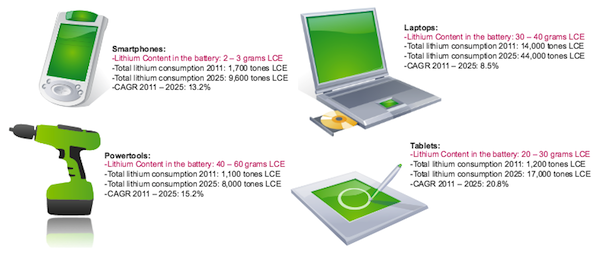

Today, lithium batteries are used and produced more than ever. There are no doubt several around your house right now… in your cell phone, laptop, power tools, tablet, handheld gaming device — basically any consumer product with a battery that needs to be recharged has a lithium-ion battery.

But the demand for lithium-ion batteries is bigger than just consumer electronics.

The boom will continue thanks to electric cars and lithium-ion energy storage systems, like Tesla’s huge Gigafactory lithium-ion battery facility, which by itself could soak up as much as 17% of existing lithium supply.

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Last year, the demand for lithium-ion energy storage systems gained significant momentum, with records broken for deployed and newly announced projects around the world.

According to a new report from Navigant Research, lithium-ion batteries accounted for more than half of newly announced energy storage systems and more than 85% of deployed ESS power capacity in 2015.

Navigant Research reports:

Li-ion batteries are the most popular technology for the growing distributed energy storage system (DESS) and behind-the-meter (BTM) market segments. These systems accounted for an estimated 12.0% of new system capacity announced in 2015, the highest percentage of any year on record. While market activity picked up in a number of regions during 2015, North America remains the largest market for newly announced ESSs. An estimated 1,653.5 MW of new ESSs were announced worldwide in 2015, with around 33.8% of this new capacity coming from North America.

As a result, global lithium consumption has skyrocketed.

Global lithium consumption doubled between 2005 and 2015 and is only expected to continue rising.

Global demand is expect to double again by 2022.

Truth is, the world needs energy more than anything else. Everything we use is powered by some form of it.

We just can’t do without batteries. And there are massive opportunities in the lithium sector.

We’ve seen opportunities in the energy industry, like solar and geothermal, yield countless millionaires. And now we’re seeing another revolution in stored energy with lithium.

Lithium is the new metal that will drive our power needs. And we’ll be there to profit.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.